by Craig Basinger, Chris Kerlow, Derek Benedet, Alexander Tjiang, RichardsonGMP

We spend our lives making decisions. Some are rather innocuous, like which TV show to watch during your evening down time or deciding between fish or chicken on a flight. The impact of the decision on your life pretty much ends once the show is over or the meal is done. Other decisions can have a bigger impact on your life. Say you are late for an important appointment and decide to speed to make up time. You could make it on time, and since it was important that is a good thing. Or given you have increased the probability of an accident this could happen as well. These kinds of decisions are pretty straight forward mainly because the repercussion or decision feedback is relatively quick. Suppose your speeding resulted in an accident, clearly not a good decision or outcome, but the impact of that decision was quick.

Unfortunately, many of the more important decisions we make have very uncertain probabilities of outcome and the timeline of the repercussions, as to whether the decision was correct or not, can vary considerably. Some times in years. Take for instance the current escalating trade tensions between China and the U.S. Currently, the repercussions include slower economic growth and increased uncertainty in the markets – clearly not positive. Fast forward five years and the repercussions may be much different, perhaps even a more balanced and fair global trade environment, which would be viewed by most as positive.

Another complication in decision making is that you only get to play the game of life once. You may make a decision and it may work out, but it is very difficult to know with certainty how alternate decisions would have played out – perhaps better, perhaps worse.

Let us get out of the philosophical and back into the practical, as it pertains to investing. So, making decisions is hard, with uncertain outcomes that often change over time. The best tools to help us make better decisions, for the more important questions, is PROCESS. This won’t help you decide between fish or chicken, but it can be useful in making investment decisions pertaining to asset allocation, manager selection, investment options or even business decisions. It can also help you learn from both mistakes and wins, hopefully to evolve your process and increase the chances of more wins and fewer losses in the future.

Tools to help make better decisions

When it comes to asset management, our team devotes considerable effort to improving our process to help make better decisions. This doesn’t guarantee success, but we believe it improves your probability of making the right decisions over time. And it is not overly complex; much more often than not keeping things simple helps with making the correct choice (see one of our favourite Einstein references to the right).

1) Pre-mortem

1) Pre-mortem

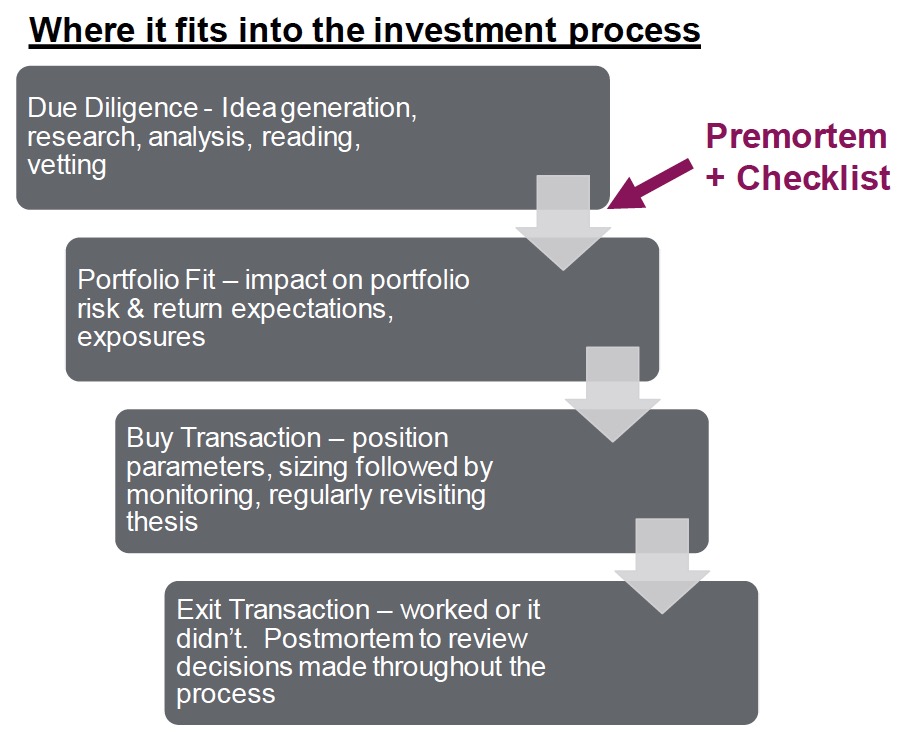

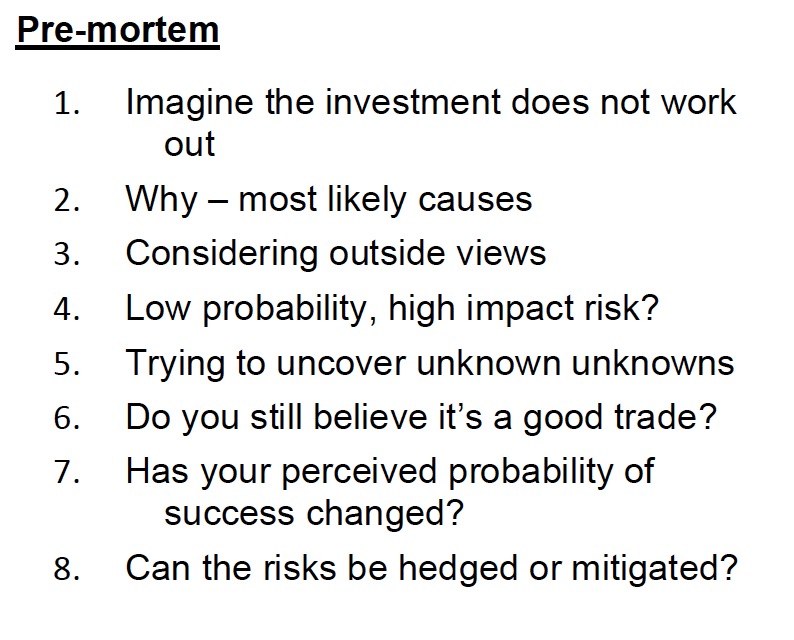

We covered the use of a pre-mortem in an earlier edition of Market Ethos (Click HERE), so I will keep this brief. A pre-mortem is a mental exercise that occurs before a trade/position is added or that is applied to an existing position. This can apply to an individual equity, bond, fund or strategy. Essentially, you force yourself or your team to hypothesize why the investment could fail or not work out as planned. The process helps reduce the impact of confirmation and overconfidence biases, two of the more prominent behavioural mistakes made when investing.

We covered the use of a pre-mortem in an earlier edition of Market Ethos (Click HERE), so I will keep this brief. A pre-mortem is a mental exercise that occurs before a trade/position is added or that is applied to an existing position. This can apply to an individual equity, bond, fund or strategy. Essentially, you force yourself or your team to hypothesize why the investment could fail or not work out as planned. The process helps reduce the impact of confirmation and overconfidence biases, two of the more prominent behavioural mistakes made when investing.

The markets will always surprise you. A pre-mortem can at least help you postulate some of the negative surprises and this makes it easier to develop potential contingencies. If something does go awry, you will be better prepared to handle it, reducing the risk of a bad decision becoming a bigger mistake.

In the words of Daniel Kahneman – “The main virtue of the premortem is that it legitimizes doubt”

2) Checklists

2) Checklists

A checklist – essentially a list of things you must do during the investment- making process – is critical for not just making good decisions but improving your process over time. If your process changes during each investment decision, it makes it very difficult to isolate whether good decisions were made and why, or if it was just luck. Mistakes will always be made, but using checklists and documenting your decisions helps lay the foundation to learn from your mistakes.

Documenting the rationale behind decisions can help you understand both good and bad choices. A year or two after a decision, we can often see if the decision was good or bad. Revisiting your rationale is akin to a time machine enabling you to reflect upon what you were thinking and why you made the decision.

3) Don’t make excuses or attach blame

Something always goes wrong at some point in time. Trying to blame others, whether another team member, an analyst, a portfolio manager, is perhaps one of the most counterproductive activities. Mistakes are learning/teaching opportunities even for those not involved. Squandering these will keep you from improving your decision-making process.

Investment takeaways – Incorporating some of these relatively straight forward components into your investment decision process can help. While we have kept things very high level, in future editions we will dive deeper, specifically into how our process/due diligence fits into the checklist/documentation component.

*****

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness. The opinions estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor. Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trademark of James Richardson & Sons, Limited. GMP is a registered trademark of GMP Securities L.P. Both used under license by Richardson GMP Limited. ©Copyright September 30, 2019. All rights reserved.

Copyright © RichardsonGMP