by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

- Hopeful the US & Major Trading Partners Will ‘Come Together’

- Here Comes Seasonality to Help Equity Market Be ‘All Right’

- US Consumer to ‘Move’ the US Economic Expansion Further

Yesterday marked the fiftieth anniversary of the release of ‘Abbey Road,’ The Beatles’ eleventh studio album. Although it was not their final album, it did contain the last recording sessions in which all four members participated. ‘Abbey Road’ rocked the charts, surging to the coveted ‘#1 spot’ in both the UK and US. From the record-setting songs to the iconic cover art, ‘Abbey Road’ has me feeling nostalgic, but of course, I couldn’t help but notice several correlations to the economy and financial markets too.

- Album Artwork | For the first time on a Beatles’ album, the cover design contained neither the title nor the group’s name. It was simply the ‘Fab Four’—John Lennon, Paul McCartney, George Harrison, and Ringo Starr—striding along a zebra crossing on Abbey Road, just outside their London recording studio. The synchronized walk quickly became one of the most iconic album covers, and to this day, fans flock to the block just to follow in the band’s footsteps. Today there is another historic synchronized movement taking place as central banks across the globe adopt a more accommodative stance amid slowing economic momentum, heightened recessionary fears, and trade tensions. The Federal Reserve (Fed), European Central Bank, the Reserve Bank of India, and the People’s Bank of China, among others, have each cut interest rates this year. We anticipate that weak global growth and muted inflation will lead to more cuts, led by the Fed taking at least one more insurance cut (likely in December) by year end.

- Something in the Way the US Moves | We believe the US economy will continue to expand and be a pillar of strength for the global economy. The reason - the ongoing strength of the US consumer and its ability to drive growth going forward. In the second quarter, personal consumption was strong and posted its highest contribution to gross domestic product (GDP) in five years. US consumer spending currently accounts for ~70% of US GDP and ~15% of global GDP (roughly in line with the size of China!). With the holiday shopping season approaching, we expect that the US consumer will ‘move’ the economic expansion further. According to the National Retail Federation, consumers spent a record $701 billion during the 2018 holiday season. Healthy confidence, solid job creation, and increasing wages should propel holiday shopping to another record high this year.

- Impeachment Road | On Tuesday, Speaker Pelosi announced a formal impeachment inquiry against President Trump, accusing him of jeopardizing the integrity of US elections during his phone conversation with Ukrainian President Volodymyr Zelensky. This will intensify the ongoing investigations by the various House committees that could eventually lead to a vote on the articles of impeachment. If approved by a simple House majority, a public trial will be held on the Senate floor, presided over by Chief Justice Roberts. A final conviction must be supported by two thirds of the Senate, in which the Republicans currently hold a narrow majority (53 seats versus 47 seats). The market is currently pricing in a 61% probability that the House will pass impeachment articles against the president, a 18% probability that the Senate will convict and an 74% probability that he will complete his first term. The relatively low probability of the president being removed from office is the reason we have not seen a major disruption and downside volatility in the equity markets.

- Come Together | One of the most notable uncertainties causing incessant volatility for the equity market has been the ongoing trade tensions between the US and its major trading partners, namely China, Japan, Mexico, Canada, and the European Union. Fortunately for investors, President Trump and Japan’s Prime Minister Abe were able to ‘come together’ this week, and agree on a limited trade pact, and the agreement opened markets to ~$7 billion in US agricultural products and ~$40 billion of digital trade. With the October 15 tariffs approaching, the US and China continued mid-level talks, some of which resulted in an expanding list of exempted products for both countries. If the high-level negotiations set to take place on October 10 were to yield some indication of both sides ‘coming together,’ equity markets would cheer the progress.

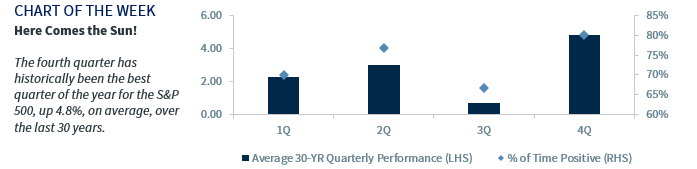

- Here Comes the Sun | As the end of what is historically the worst quarter of the year for the S&P 500 approaches, there is a ‘sun on the horizon’ for equities. Positive seasonality should help the equity market be ‘all right,’ as the fourth quarter has historically been the best quarter of the year. Over the last 30 years, the S&P 500 has been up 4.8%, on average, in the final quarter, and has been positive 80% of the time. On a longer-term basis, seasonality within the presidential cycle should also be supportive of the equity market. Since 1929, the S&P 500 has had an average return of ~11% in a president’s fourth year, and is positive 91% of the time. Supportive seasonality should help propel the S&P 500 to 3,122 over the next 12 months.

Read Larry Adam's Full Weekly Headings as PDF

Copyright © Raymond James