by Jeffrey D, Saut , Saut Strategy LLC

A week or so ago we wrote:

Turning to short-term “trading positions,” our models targeted the late-July trading top in the S&P 500 at ~3020. Subsequently, they called the “selling climax” low of August 5th at ~2822 that we said was THE low. That low was retested three time and was never violated. We further wrote the SPX is likely to trade out to new all-time highs. The jury is still out on that call, but after three attempts to do so the senior index is probably going to have to regroup before new highs can be achieved. Moreover, the D-J Industrial Average has rallied eight sessions in a row and history shows that markets rarely go more than 10 consecutive session in any one direction. So, we will say it again, “The senior index is probably going to have to regroup before new highs can be achieved.” Longer-term, however, we remain in a secular bull market that has years left to run.

Since writing that the S&P 500 has done exactly that; regrouped, bobbing between ~3020 and ~2978 while rebuilding its internal energy. Of course, such “trading nuances” have nothing to do with secular bull markets.

Speaking to the secular bull market, after nearly 49 years in this business, we have seen a number of cycles and developed a long-term perspective. We have often spoken about the difference between a “secular bull market” and what many consider to be a bull market because it is up 20%+. The reciprocal is that a 20%+ decline represents a bear market. While those may be “tactical” bull and bear markets, they are certainly

NOT secular bull markets. Secular bull markets tend to last 15+ years. Are there declines within a secular bull market? You bet! But even the number of ~30% declines in the 1949-1966 or 1982-2000 secular bull markets (including the 1987 Crash) did not deter the secular bull market. It is much like the story of Mr. Partridge (Old Turkey) in Edwin LeFevre’s book Reminiscences of a Stock Operator. Because he was such a shrewd investor, folks would come up to Old Turkey and ask what they should do in the markets. He would cock his head to one side and say, “It’s a bull market you know!”

That has been our mantra since most stocks bottomed in October 2008. Have we raised cash from time to time? Yep. Have we rebalanced portfolios? Yes. Have we hedged to the downside on occasion? Sure.

However, it has always been within the construct of, “It’s a secular bull market you know!” With the indices at, or approaching, new all-time highs, we thought it would be a good idea to repost one of our letters about secular bull markets and how smart/wealthy investors operate in them. In said report, we published a letter from our friend Richard Russell (Dow Theory Letters) titled "Rich Man, Poor Man." I like this story:

In the investment world, wealthy investors have one major advantage over the little guy, the stock market amateur, and the neophyte speculator. The advantage wealthy investors possess is they DON’T NEED THE MARKETS. I can’t begin to tell you what a huge difference that makes, both in one’s mental attitude and in the actual handling of one’s account. The wealthy investor doesn’t need the market, because he already has all the income he needs. He has money coming in via bonds, T-bills, money market funds, real estate, and stocks. In other words, the wealthy investor never feels pressured to ‘make money’ in the market.

The wealthy investor tends to be an expert on values. When bonds are cheap, and bond yields are irresistibly high, he buys bonds. When stocks are on the bargain table and stock yields are attractive, he buys stocks. When real estate is a great value, he buys real estate. When great art or fine jewelry is on the ‘giveaway table,’ he buys them. In other words, the wealthy investor puts his money where the values are. And if there are no outstanding values, the wealthy investor waits. He can afford to wait. He has money coming in daily, weekly, monthly. In other words, he doesn’t need the market. He knows what he is looking for, and he doesn’t mind waiting weeks, months or years (they call it patience).

What about the little guy? This fellow always feels pressured to ‘make money,’ to ‘force the market to do something for him.’ When this fellow isn’t buying stocks at 3% yields, he’s off to Vegas or Atlantic City trying to win at craps or he’s spending ten bucks a week on lottery tickets or he’s ‘investing’ in some crackpot real estate scheme with an outfit that his bowling buddy told him about. And because the little guy is forcing the market to do something for him, he’s a consistent and constant loser. The little guy doesn’t understand values, so he always overpays. He loves to gamble, so he always has the odds against him. He doesn’t understand compounding and he doesn’t understand money. He’s the typical American, and he’s perpetually in debt.

The little guy is in hock, and he’s always sweating, sweating to make payments on his house, his refrigerator, his car or his lawnmower. He’s impatient, and he constantly feels pressured. He tells himself he has to make money fast. And he dreams of ‘big bucks’. In the end, the little guy wastes his money on the market, he loses his money on gambling, and he dribbles it away on senseless schemes. In brief, this ‘money-nerd’ spends his life running up the down-escalator. Now here’s the ironic part of it. If, from the beginning, the little guy had adopted a strict policy of never spending more than his income, if he had taken that extra income and compounded it in safe, income-producing securities – in due time he’d have money coming in daily, weekly, and monthly – just like the rich guy. Then in due time, he’d start acting and thinking like the rich guy. In short, the little guy would become a financial winner instead of a loser.

I lost my friend Richard Russell a few years ago in a recurring nightmare where I continue to lose my mentors as they either pass away or retire (In the past few weeks I have lost T. Boone Pickens and Cokie Roberts).

After more than 50 years of writing "Dow Theory Letters," Richard Russell said the most popular piece he ever published is his "Rich Man, Poor Man" essay. In this day and age of constant advertisements, infomercials, junk mail, harassing cold calls haranguing all about how to make a killing in the stock market, real estate, commodities, etc . . . it's refreshing to read some advice from an honest old pro that makes sense.

Moreover, most stock-centric magazines you see tell you what mutual fund you should buy, how to invest to retire, how you can make it big in whatever. I would bet that those writers, advisors, and testimonial seers who concoct those pieces make more money selling their "pitch" than following their own advice. Putting that pitch on paper or through the TV, radio, or phone is a lot easier than putting up their own money.

I know many stock brokers, advisors, writers, etc. who never invest themselves. Yet they make their money telling others how to do it. A case in point is a story in a widely read financial magazine. It chronicles a now successful promoter who, earlier, tried the get-rich-quick schemes, which didn't work for him. So that led him to "why not trade commodities and get rich," which again did not work for him. That, in turn, led to "why not write a book about how to trade commodities and get rich." To make a long story short, he made mucho moola selling the book and NOT investing his own money!

STOP HERE and go back and read “Rich Man, Poor Man” again!

In the world we live in, few look at risk. Most only look at reward. The few who do look at risk (the educated, the Street savvy seers, etc.) make their money at the expense of the great unwashed majority who swallow the noisy nonsense about getting rich quick. Investing is a get rich slowly process. You must put your money at risk in the face of uncertainty. Emotions run rampant before the uncertainty of floating, fluctuating, often violent and volatile markets. Constantly discounting prices are fickle and full of surprises. Disorder is usually the norm.

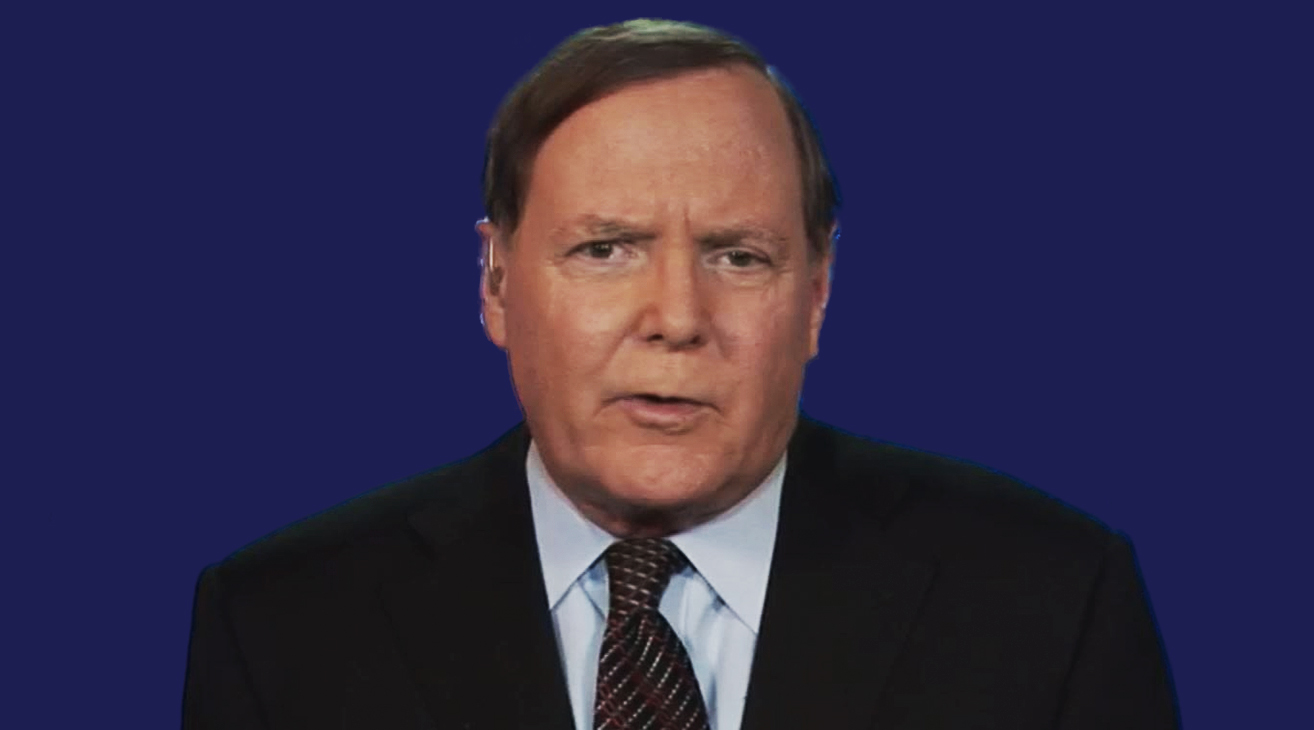

The call for this week: Our work suggests there is still a chance for the S&P 500 (SPX/2992.07) to trade out to new all-time highs (ATHs). However, the first part of October is showing up as problematic on a trading basis and potentially before then. Accordingly, the SPX needs to get noticeably above 3035 to stand-up to what our models have in store for the beginning of October. That said, in the longer-term the Advance – Decline Line continues to point the way higher (see chart). Indeed, as Paul Ho, Managing Partner, Chairman and CEO of Zygus Capital, writes, “Regardless of whether you think the S&P 500 finds resistance (here) or blows to new highs, you can't deny that advance-decline lines are WAY above their previous highs already; ATHs ahead!”

Reinforcing our long-term bullish view was this quip from the smartest guy in the room, namely Jason Goepfert, captain of the must have SentimenTrader:

Economic surprises are turning up, which is mostly a good thing for stocks. Among those surprises, the best are in “hard” economic reports as opposed to “soft” ones like consumer surveys. When hard economic data surprises to the degree it has recently, it has been a good sign for stocks.

This morning the preopening ESUs are flat with the Chinese trade talks on a slight uptick versus negative economic data. The Fed executed its 4th consecutive huge repo operation that reduced the Overnight General Collateral rate to 1.95%. Yet, the two-week repo rate traded around 2.5% to 2.7%. This implies that there could be a problem with this week’s quarterly refunding. Importantly, the Fed’s first three repo announcements were made after the NYSE close. The 4th was made during the final hour. Does that mean there is more urgency in the repo market?

Chart 1

Source: Stockcharts.com