by Avi Hooper, Invesco Canada

Investors frequently focus on the yield to maturity that bonds pay, rather than recognizing the potential total returns that are available to global fixed income investors.

When people allocate their portfolios to equity markets, they rarely think about the dividend yield or whether the equity even pays a dividend. Yet, when it comes to investing in bonds today, the first comment is always that bond yields are so low.

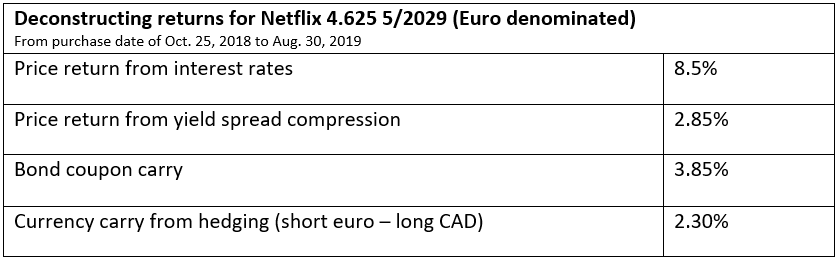

Bonds may seem more complex to the casual observer, but only because the sources of returns are more diverse and less well understood. The three main contributors of total return include: price sensitivity to interest rates, price sensitivity to credit spreads and coupon carry.

For Canadian investors, there has been additional return contributions from currency carry. For example, we added 2.75% in extra annualized return (as at August 30, 2019) by buying bonds denominated in euros, and hedging euro currency risk back into Canadian dollars.

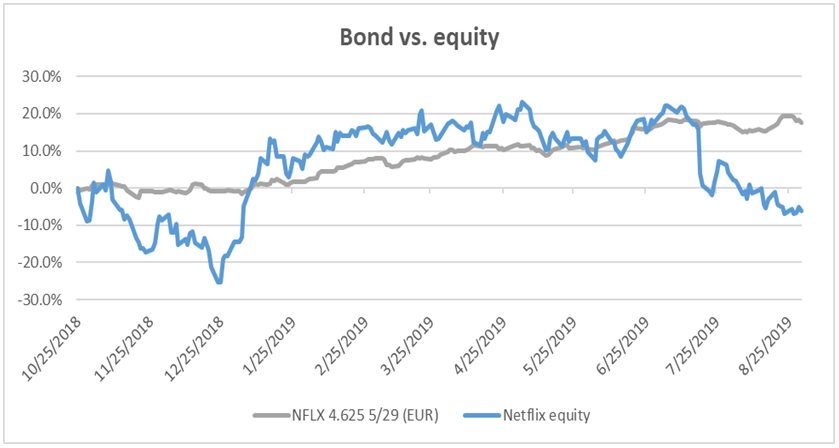

An example of comparative asset returns of a global growth company are shown here from Netflix (this particular bond is held in both Invesco Global Bond Fund and Invesco Canadian Core Plus Bond Fund). The company’s equity performed well over the years of subscriber growth. As competition in the sector continues to rise, however, expectations for the company’s growth are deteriorating.

Bond investors are concerned about cash flow generation, rather than earnings growth. At this stage of the life cycle, investment returns from debt are more likely to be rewarded.

The biggest concern among retirees is whether they will outlive their retirement nest egg. To preserve their capital, increasing exposure to lower volatility assets often becomes the largest anchor of their overall portfolio.Source: Bloomberg, as at Aug 30, 2019. All returns are in CAD.

Global bond markets are very diverse across countries and companies, different sectors of the economy and various capital structures that provide idiosyncratic return opportunities. Bond prices typically have between 20% and 30% of the price volatility compared to the company’s equity price volatility. Increasing the allocation to global bonds can help preserve capital while maximizing potential returns.

Performance

Inception date for Invesco Canadian Core Plus Bond Fund is February 11, 2000. Inception date for Invesco Global Bond Fund is May 26, 2016.

This post was first published at the official blog of Invesco Canada.