by Alan Young, Franklin Templeton Investments

Four Findings from Franklin Templeton’s 2019 RISE Survey:

- More than half of the RISE survey respondents of pre-retirement age in Hong Kong (57%) and mainland China (61%) haven’t started saving for retirement. Most of those that are taking steps to prepare expect personal savings to be their main source of retirement income.

- Concern about running out of money in retirement is high, but even those already saving may not have enough to generate the returns they need. Most respondents recognise their expenses will change in retirement. Over half (52%) of RISE survey respondents in Hong Kong are worried about running out of money during this period.

- Savers’ narrow approach to retirement investing means many could potentially miss out on opportunities to maximise their savings.

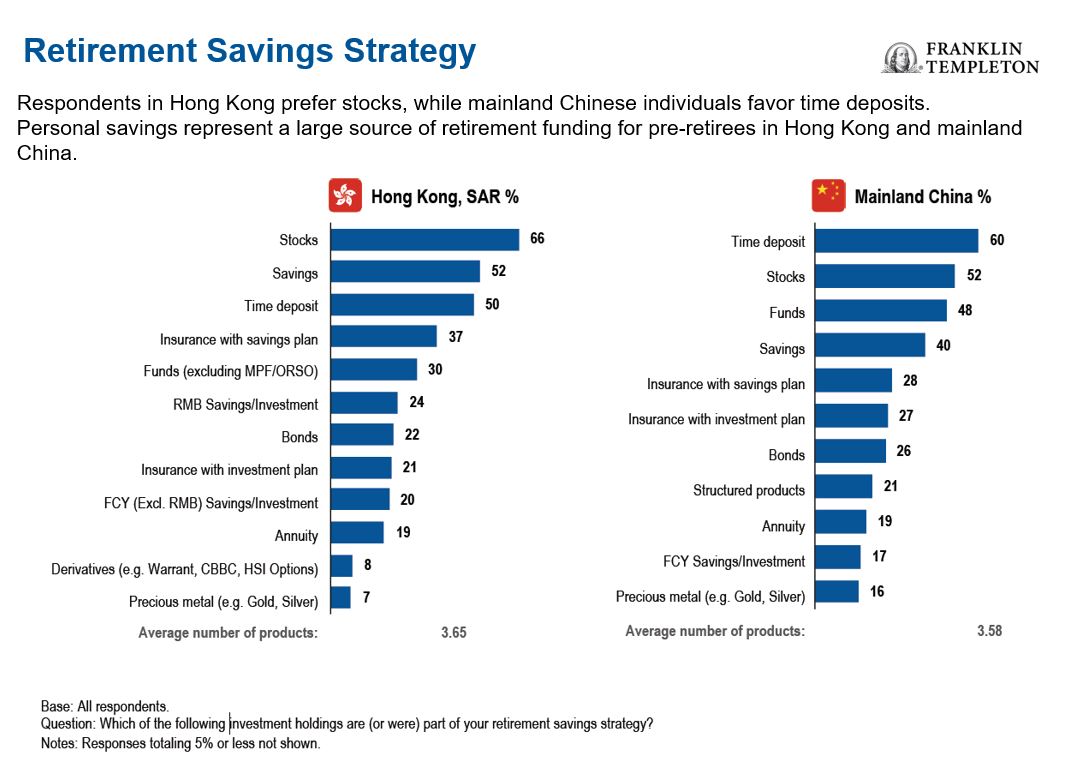

- Preferred retirement saving strategies vary between Hong Kong and mainland China—those in Hong Kong predominantly prefer to hold stocks or cash, while those in mainland China prefer time deposits.1

Hong Kong and Mainland China Aren’t Retirement-Ready

Years of economic growth in Hong Kong and China have brought social, economic and demographic changes, including the challenges an aging population poses. Our latest research suggests that public attitudes towards saving aren’t keeping pace with the likely needs of the future.

The Franklin Templeton 2019 Retirement Income Strategies and Expectations (RISE) survey reveals that 57% of respondents living in Hong Kong have not started planning or saving for retirement. While numbers of non-savers are highest among younger people, the survey shows significant numbers of people over 50—those closest to retirement—haven’t started saving. In Hong Kong, 40% of respondents aged 50 and above haven’t begun retirement preparations, while for those in mainland China the number is even higher at 54%.

Among the younger generations, the numbers are even more stark. Well over two-thirds of RISE survey respondents aged 25– 34 haven’t started saving for retirement: 72% for Hong Kong and 70% for mainland China. Among respondents in Hong Kong and mainland China aged 35–49, 60% haven’t started a retirement plan.

Rising Savings Gap Awareness

In many parts of the world, a comfortable retirement requires a sufficient level of retirement savings and investments. Respondents in Hong Kong (77%) and mainland China (68%) are stressed when they think about saving for the golden years.

There are mixed signals about the extent to which respondents appreciate the implications of the retirement savings gap. This mindset is predominant among the youngest respondents in Hong Kong, who said they’d aim to save the same amount for retirement as other age groups, despite acknowledging that in around 30 years’ time, inflation could increase living costs.

The survey suggests many people are aware of their unrealistic expectations, both in underestimating the size of their post-retirement needs and in underestimating the amount of money they might need to save pre-retirement to service those needs.

Potential health issues and related pharmaceutical expenses top the list of concerns during retirement, according to around half the respondents. This is clearly a global issue for pre-retirees—our US RISE respondents also revealed that health expenses in retirement were a top concern.2

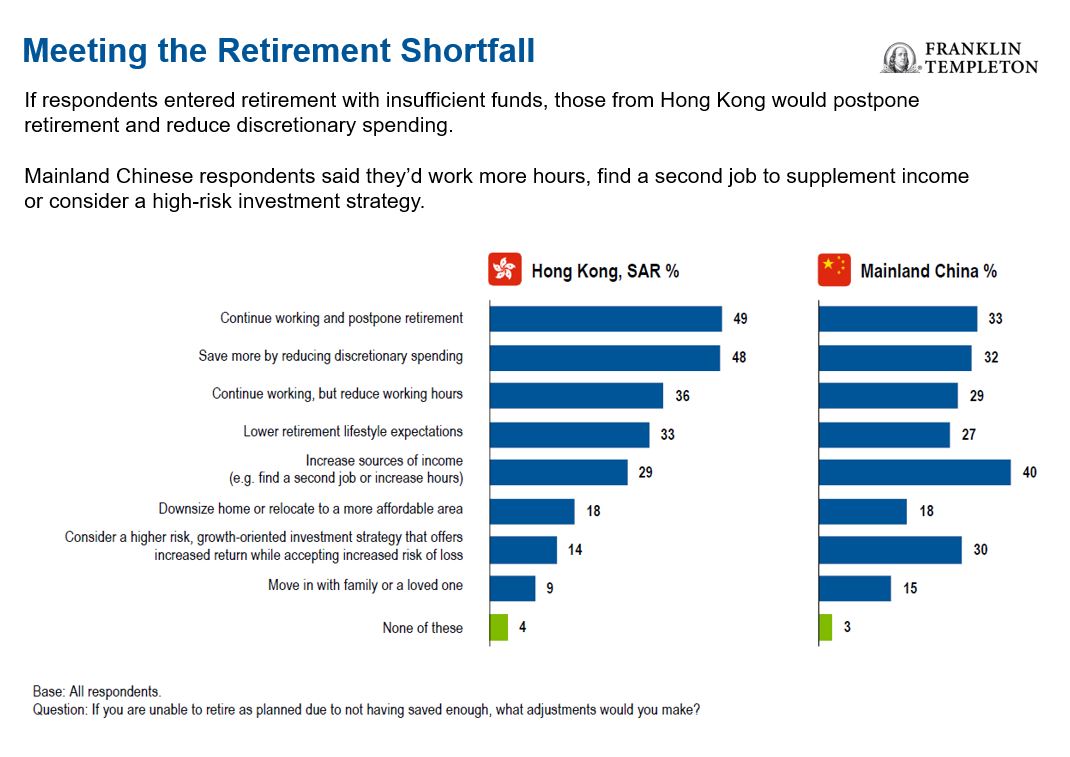

In case funds saved are not enough for retirement, nearly half of Hong Kong respondents (49%) said they’d continue working and postpone retirement. Those in mainland China said they would consider finding a second job to supplement income (40%) or continue working and postpone retirement (33%).

The Hong Kong government raised the annual pensions tax break to HK$60,000 in December 2018, in a bid to encourage more retirement saving through its Mandatory Provident Fund (MPF) scheme.3 And with that, nearly half (44%) of respondents in Hong Kong said they’d consider topping up their MPF to benefit from tax concessions.

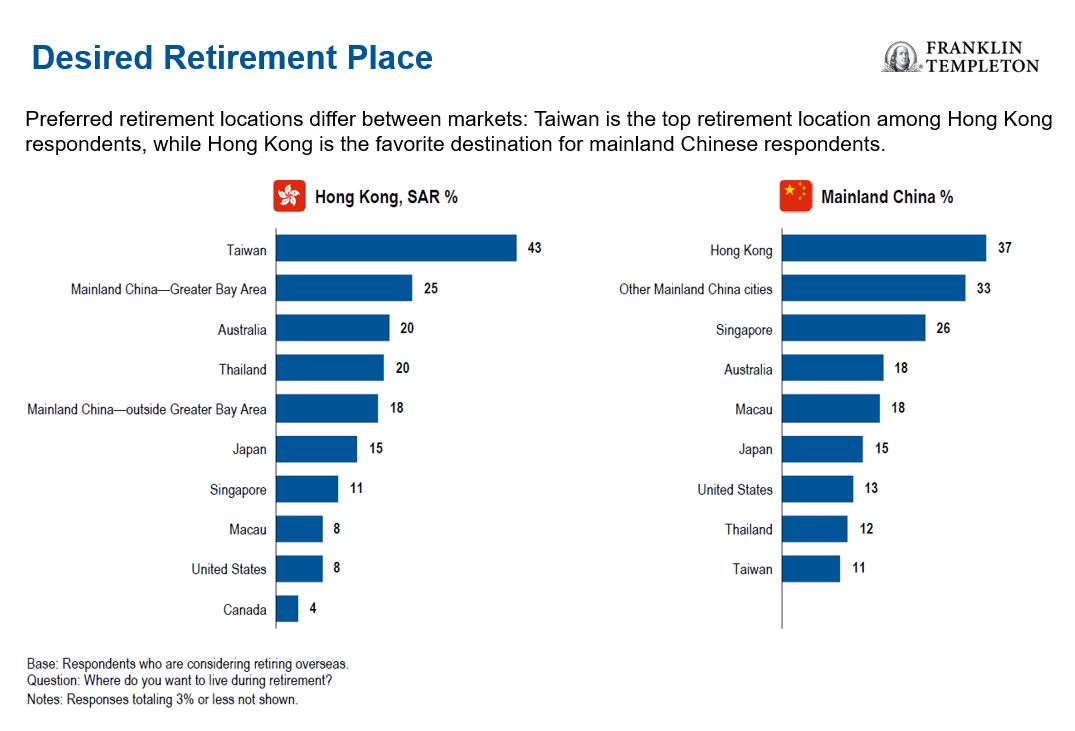

Interestingly, around a third of Hong Kong and mainland Chinese respondents would consider changing location in retirement as a cost-saving measure. Hong Kong pre-retirees opted for Taiwan as the top retirement destination, while Hong Kong was the top destination for mainland Chinese.

Widening from a Narrow Focus

Our experience tells us that savers may need to take a more sophisticated approach to bolster their nest eggs.

The current retirement investment universe in Hong Kong and mainland China is mainly comprised of equities, bonds or multi-asset funds. Outside of this space, we think there’s growing demand for non-traditional types of investments, such as illiquid assets, real estate or gold. This demand could bring innovative products to market and spark interest among those not saving enough for retirement. If such products were more widely available, we think they could offer some much-needed diversification to current investment portfolios.4

The sentiment for creative products was strong among mainland Chinese respondents, where 83% expressed an interest in reverse mortgages. The scheme could help address the post-retirement funding gap, while providing a monthly income in exchange for ownership of their property.

We still think a lack of professional financial planning advice is likely one of the reasons why some investors don’t have a diversified investment strategy for retirement. The survey also shows that respondents in Hong Kong preferred traditional investment products, such as stocks, savings and time deposits. The survey shows that diversification in retirement strategy generally increases with age, a natural approach to balance returns with manageable risk as people near the age of retirement. It differed in mainland China, where time deposits, stocks and funds were the most popular investment products. Personal savings are also expected to be a large source of retirement funding for individuals in Hong Kong (77%) and mainland China (67%).

Conclusion

The survey clearly suggests people in Hong Kong and mainland China generally aren’t saving enough for retirement. However, the evidence also shows they’re becoming more aware of the savings gap. We believe shrinking the gap should be the main priority, but that needs more than one response—there needs to be greater use of retirement advice to understand what can be achieved while managing reasonable expectations in the retirement years.

In our view, the industry also has a responsibility to step up and provide new and innovative solutions in line with the rest of the financial world—suggesting ways that could spark new avenues to funding ambitious retirement plans.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

About the Survey

The Franklin Templeton Retirement Income Strategies and Expectations (RISE) survey was conducted online with a sample of 1,037 adults in Hong Kong, comprising 514 men and 523 women, and 1,114 adults in China with 583 men and 531 women. The target respondents were employed, aged 25 or above with a personal monthly income of HKD12,000 or above in Hong Kong and RMB5,000 or above in China. The survey was administered between April 16, 2019 to May 2, 2019 by the Nielsen Company (Hong Kong) Limited, which is not affiliated with Franklin Templeton.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

1. A time deposit is a deposit with a bank that cannot be withdrawn before a set date.

2. The US Retirement Income Strategies and Expectations (RISE) survey was administered between January 17 to 28, 2019 by Engine’s Online CARAVAN®, which is not affiliated with Franklin Templeton.

3. Employees and employers are required to make monthly payments to the Mandatory Provident Fund (MPF), a compulsory pension fund for Hong Kong residents.

4. Diversification does not guarantee profit or protect against risk of loss.

This post was first published at the official blog of Franklin Templeton Investments.