The rebound in North American equity indices which started in the second half of August has continued into early September trading. Although the course of US-China trade negotiations remains uncertain, a key concession by China to Hong Kong dropping an extradition bill and UK MPs fighting to avert a No-Deal Brexit has suggested to investors that the political risks and dilemmas vexing markets lately are potentially solvable and that apocalyptic scenarios for the world economy can still be averted.

Central bankers don’t appear to be in panic mode at the moment either. So far this week, the Bank of Canada and the Reserve Bank of Australia have declined to cut interest rates when given the opportunity, and the Bank of England has suggested the impact of a No-Deal Brexit may not be has bad as previously feared changing its forecast to a 5% decline in GDP from an 8% decline.

These developments, along with economic data like Friday’s US nonfarm payrolls and Canada employment reports suggest that outside of political chatter, the Fed may not be under as much pressure to cut rates again at its meeting later this month as previously thought. Monetary policy outlooks have been influencing investor sentiment lately with investors viewing rate cuts as signs of a weakening economy and corporate earnings outlook, while positive economic comments from central bankers have helped to shore up investor confidence.

With earnings season over, economic and political developments may continue to drive market action in the coming weeks. While there has been some cause of optimism, nothing is settled yet and things can still turn on a dime so there also remains reason for caution among investors.

In this week’s issue of Equity Leaders Weekly, we take a look at what weakness in the NASDAQ Biotech Index is telling us about investor sentiment, and the seasonal relationship between natural gas and gasoline.

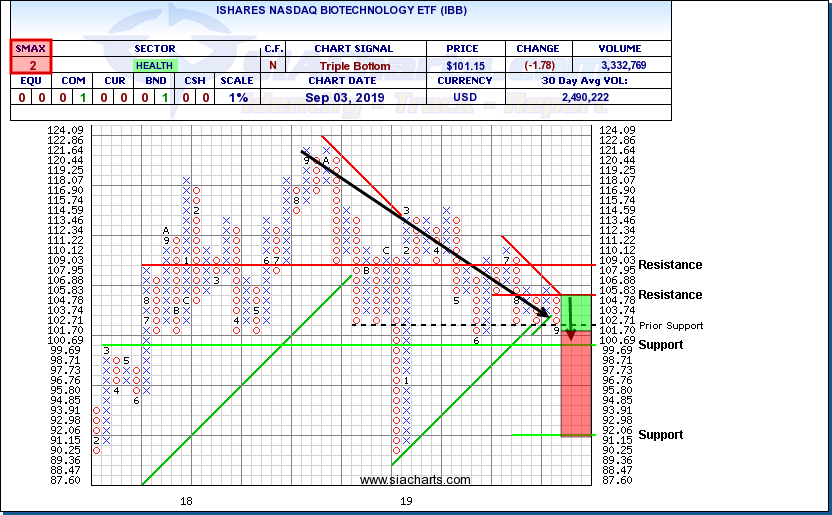

iShares NASDAQ Biotechnology ETF (IBB)

Although health care is generally viewed as a defensive industry overall, as with other industries, some sectors with the group are more defensive than others. Historically, Biotech has been seen as a growth/development area within health care and has been a 'bellwether' group for determining how aggressive or conservative investors are feeling at a point in time.

After trending upward through most of 2017 and 2018, the first big crack in the armor of the iShares NASDAQ Biotechnology ETF (IBB) appeared about a year ago as the sector finished 2018 with a big selloff. 2019 started off with a big bounce for the group but after peaking at a lower high, IBB has been backsliding in recent months.

This week, IBB broke down below $100.70 to complete a bearish Triple Bottom pattern and signal the start of a new downleg that would be confirmed by a breakdown below the $100.00 round number. Next potential support tests for IBB appear near $99.70, then $91.15 based on a horizontal count. Initial resistance appears near $105.85 based on a 3-box reversal. With a bearish SMAX score of 2, IBB is exhibiting near-term weakness relative to the asset classes.

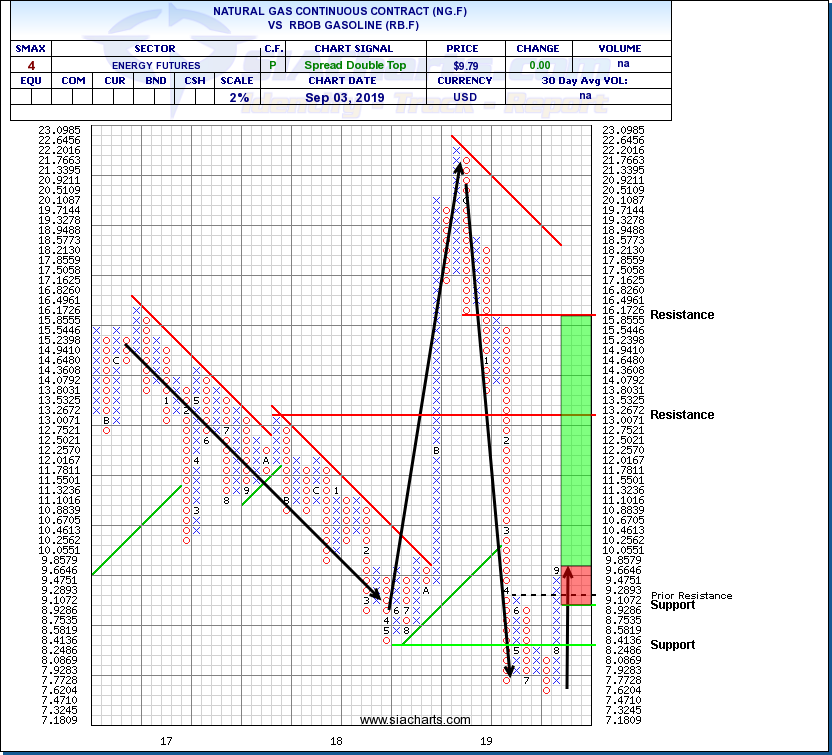

Natural Gas Continuous Contract (NG.F) vs RBOB Gasoline Continuous Contract (RB.F)

Over the years, one of the more consistent seasonal relationships between commodities has been that of Natural Gas and Gasoline. The peak demand seasons for these two commodities are opposite with demand for gasoline strongest during summer driving season and demand for natural gas strongest during winter home heating season.

As with stock markets, these two energy commodities tend to move on anticipation of seasonal changes in demand. Gasoline tends to be stronger in the early part of the year as winter winds down and investors look ahead to summer demand. Natural gas tends to be stronger later in the year as summer winds down and investors look ahead to winter demand.

The comparison chart at right shows that although the magnitude can vary, there have been significant seasonal differences in the performance of natural gas and gasoline over the last few years. So far in 2019, this relationship has followed the typical seasonal pattern with natural gas underperforming in the early months of the year, stabilizing through the summer and starting to outperform against gasoline in recent weeks culminating in the recent bullish Spread Double Top breakout.