by Brad Sorensen, Charles Schwab and Company

Key Points

- It doesn’t appear that the U.S. economy is on the cusp of a recession, but a global slowdown and trade disputes have heightened risks.

- We think it’s time to use market rallies to add modestly to defensive positions.

- We aren’t changing our official recommendations … yet. There remain potential upsides, but those are slowly being overcome and we may not be far away from an official change.

Recession threat rising?

It doesn’t appear that the U.S. has entered a recession yet, or even that one is imminent—although start dates to recessions typically aren’t known until we’re looking in the rear-view mirror. However, it does appear to us that risks to the U.S. economy have grown, and that the trade dispute with China has dragged on and escalated to the point of potentially having a longer-term impact on economic growth.

We’re also concerned that the Federal Reserve cutting interest rates, as they have done and seem likely to continue to do, will have a limited impact on what is really ailing the economy—corporate uncertainty due to the ongoing trade dispute with China.

As a result of our growing concern, we are suggesting investors use market rallies to add modestly to defensive equity positions, such as the utilities, consumer staples, health care and real estate sectors. We don’t think it’s time yet to load the boat in these areas, as there still remains a possibility of a renewed sustained move higher (which would likely benefit the more-cyclical sectors), but we think it’s prudent to begin slowly adding some defense to your portfolio.

Uncertainty

As I have written before, I would love to be able to make a more definitive call, and we’re getting closer to that point. However, history shows us that markets could turn either way, even after the Federal Reserve cuts interest rates. According to BCA Research, in the year following a rate cut, staples, utilities and health care historically have been the best performers—as you might expect, as the Fed typically cuts when a recession or sharp economic slowdown is feared. However, there have been six instances of what BCA calls a mid-cycle adjustment, where rates were cut, but a recession did not follow. In those instances, the leading sectors were much different: Tech and consumer discretionary were among the leaders, while utilities was the worst performer. Also, while we don’t think a trade deal is imminent, recent history shows us things can change quickly, and if a deal were to occur, we would likely see at least a short-term rally led by more-cyclical areas.

I am also hesitant to go to outperform on the staples and utilities groups, due to some valuation concerns. These areas, along with real estate, have rallied as investors search for yield, resulting in forward price-to-earnings (P/E) ratios of 19.3 for utilities and 19.6 for consumer staples (FactSet). The historical averages for both sectors are 14.8 and 16.9, respectively, according to Strategas Securities. This modest overvaluation compared with historical average causes some concern, but we also believe valuations aren’t to the point of being extreme, and that these groups can go higher if economic concerns rise. I’d also note that health care hasn’t had the run of these other groups, and its forward P/E of 14.8 is right in line with its historical average.

The concerns

Schwab Chief Investment Strategist Liz Ann Sonders does an excellent job, as usual, in discussing the possibility of a recession in her recent article “Recession Watch (or Distant Early Warning?),” which I urge you to take a look at and won’t rehash here. But there is one more global chart that has had a pretty good track record of anticipating sector performance, and that is global manufacturing.

Global manufacturing trending lower

We see that the utilities, staples and health care sectors are inversely correlated with the global PMI reading (meaning they have moved in the opposite direction), thanks to a study by Cornerstone Macro. As always, past performance is no guarantee of future results, but it can give us some insight.

Additionally, with concerns surrounding the trade dispute with China, these groups appear attractive as utilities has zero revenue from China, while consumer staples has 3.9% and health care 4.6% revenue exposure to China, both below the average of the S&P 500 of 5.8% (Strategas). Finally, there’s the interest rate picture. According to The Wall Street Journal, there is now roughly $17 trillion in negative-yielding fixed income securities across the globe—and while we’re not there in the U.S., rates have fallen precipitously over the past few months.

Yield have plummeted lately

I again want to emphasize that investors shouldn’t move fixed income money into the equity markets in search of better yields—the risk profile is much different and your portfolio could be taking on more risk than you realize. However, for yield within the equity-designated portion of your portfolio, these defensive groups look fairly attractive. With yields of 3.3% for utilities, 2.9% for consumer staples, and 3.2% for real estate—all are above the S&P yield of 2.1%, according to FactSet. Remember that dividends are never assured and these yields may change as prices and payouts change, but the general characteristics are useful.

Call to action

After asking investors to be patient for longer than I would like—I believe it’s time for most tactical investors to start to take some action, slowly. During periods when you see the overall market rallying, and defensive sectors lagging, start to look at slowly adding to the consumer staples, utilities and health care sectors, especially if you happen to be underweight in these categories. We aren’t making a call on a recession at this point, or making an official change in our recommendations, but given the risks we see building, digging the umbrella out of the closet so it’s ready in case of a storm seems prudent to us.

*****

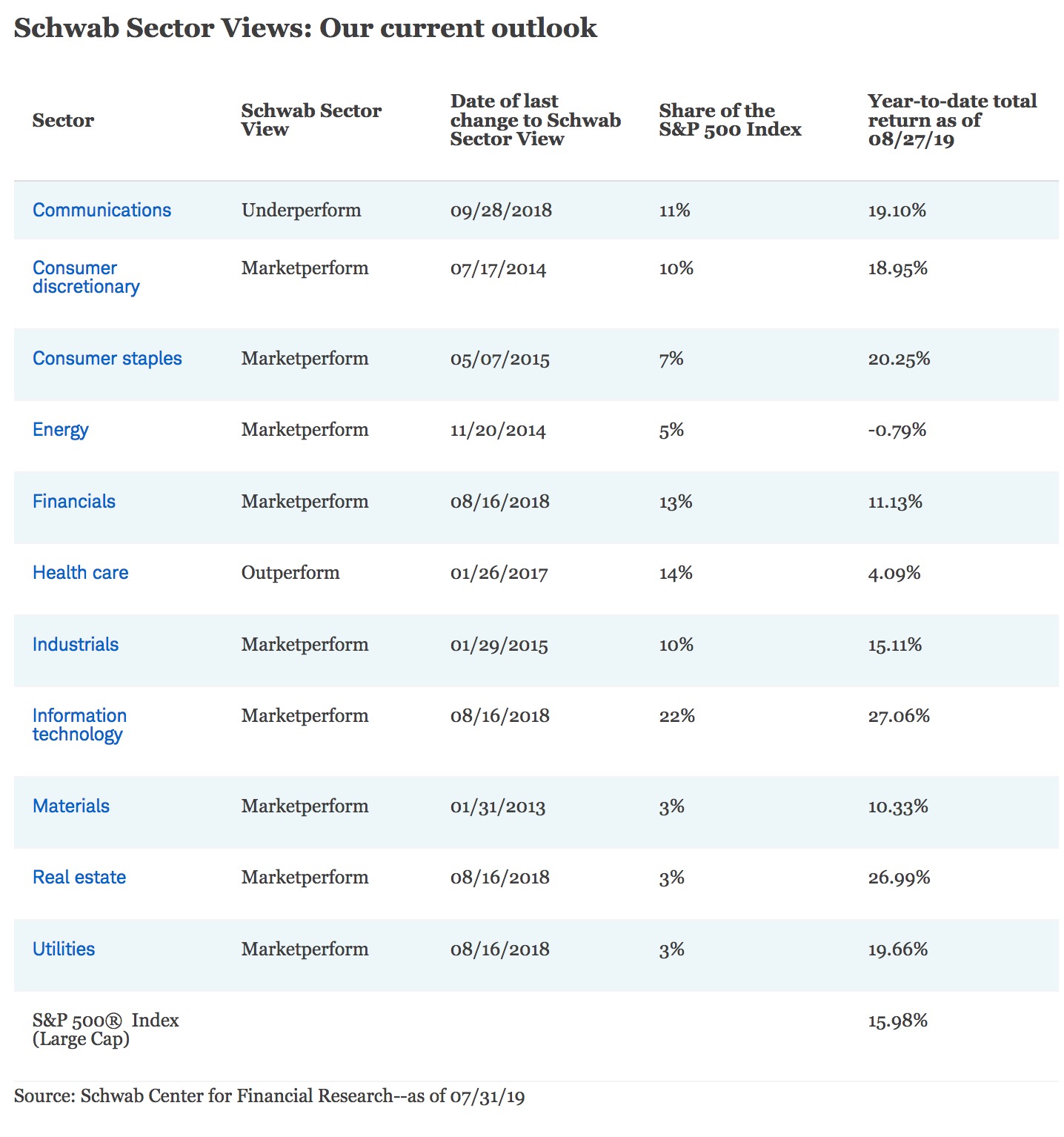

What is Schwab Sector Views?

Schwab Sector Views is our three- to six-month outlook for 11 stock market sectors, which are based on the 11 broad sectors of the economy.

The sectors we analyze are from the widely recognized Global Industry Classification Standard (GICS) groupings. After a review of risks and opportunities, we give each stock sector one of the following ratings:

-

Outperform: Likely to perform better than the rest of the market.

-

Underperform: Likely to perform worse than the rest of the market.

-

Marketperform: Likely to track the broad market.