So far, this has been a week of consolidation for world markets, which isn’t a surprise since late August has historically been one of the quieter times of the year for trading with many market participants taking vacations before school starts up again.

On the trade front, the US and China have adopted a more conciliatory tone toward trade talks which suggests despite the bluster, neither side wants the situation to really spiral out of control. On the other hand, the risk of a no-deal Brexit appears to have increased with UK PM Johnson shutting down Parliament until just ahead of the October 31st deadline.

Uncertainty surrounding Brexit and its potential impact on European economies has kept the Euro, British Pound and indices like the FTSE and the Dax under pressure this week. In contrast, US markets have stabilized, with the Dow, S&P and the NASDAQ attracting support above their 200-day averages. In terms of sector action, US health care stocks have weakened along with banks/insurance and energy, while real estate related groups continue to rally/outperform.

With earnings season over, investor focus appears set to shift fully back toward the world economic outlook and its impact on interest rate trends. Next week brings a new round of monthly manufacturing and employment indicators that could influence sentiment heading into the latter part of the year.

In this week’s issue of Equity Leaders Weekly, we take a look at the impact of Brexit in German stocks and at the reasons for recent changes in the relative performance between the US homebuilding and global infrastructure sectors.

iShares MSCI Germany ETF (EWG)

Despite all of the stonewalling and opportunistic talk that has come out of the EU since the UK voted to leave back in 2016, stock market action indicates that the Eurozone, as represented by Germany, its largest component, is unlikely to come through Brexit unscathed. Germany’s economy has already been struggling this year and with the British Pound sinking to offset the growing risk of a No-Deal Brexit this fall, combined with political instability in Italy, the risk of Brexit and other crises tipping the Eurozone into a recession has grown significantly.

After staging a major retreat in 2018, German stocks had been recovering through the first half of 2019. EWG peaked at a lower high earlier this summer and since then, their primary downtrend appears to have resumed. A recent Triple Bottom breakdown confirmed the start of a new downtrend while a bearish SMAX score of 1 indicates EWG is showing near-term weakness relative to the asset classes.

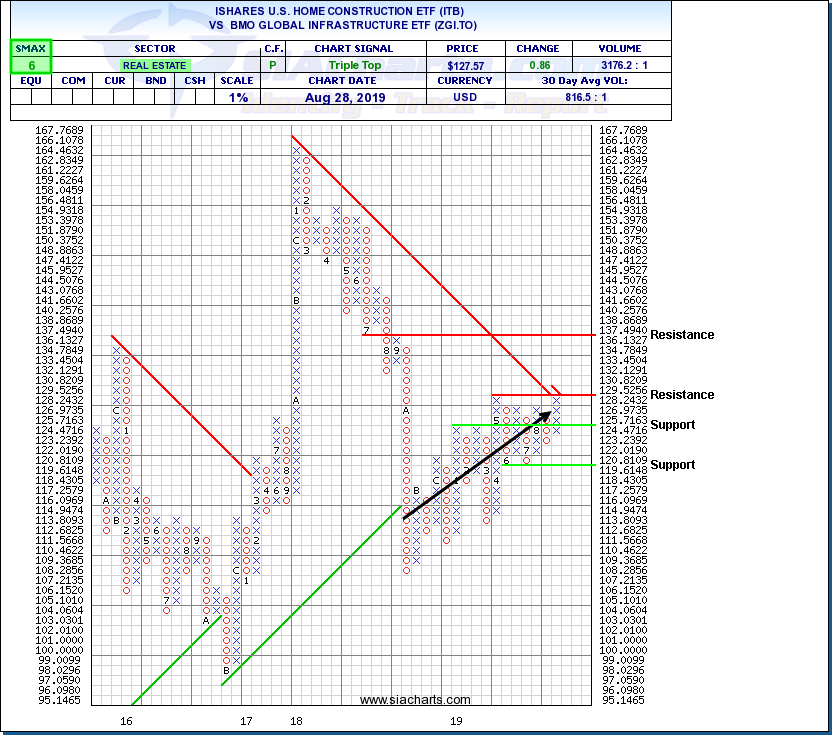

iShares US Home Construction ETF (ITB) vs BMO Global Infrastructure ETF (ZGI.TO)

This chart reflects some of the themes and divergences which have emerged in the global economy and global trading over the summer. Although both US homebuilders (ITB) and global infrastructure stocks (ZGI.TO) have been trending upward over the summer, on a relative basis, US homebuilders have been accelerating upward at a faster pace, a reversal from last year when ITB underperformed.

This change in relative performance reflects changes in economic performance and monetary policy. So far, it appears that the negative impact of US-China and UK-Europe trade tensions have hit overseas economies harder than North America, causing stocks and sectors more focused on North America to outperform relative to global multinationals, a trend that was clearly seen in the last US earnings season.

This shift in interest toward US homebuilders may also be a function of changing monetary policy. Last year, when ITB severely underperformed, the US Federal Reserve Board was raising interest rates putting interest-sensitive stocks and sectors under pressure. This year, as the Fed stopped raising rates and started cutting them while treasury yields have plunges, homebuilders have recovered, suggesting that perhaps the US homebuilding sector could be seen as a high-octane group particularly sensitive to US interest rate swings.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.