by John Levy, CFA, Franklin Templeton Investments

Social infrastructure assets are the physical buildings that are essential to deliver social services, such as hospital, schools, courts and affordable housing. As such, social infrastructure plays a crucial role in the health and vibrancy of communities and the surrounding environment. Despite its important civic and environmental role, however, social infrastructure has suffered from underinvestment in the past decade. The High-Level Task Force on Investing in Social Infrastructure in Europe has estimated the minimum size of the annual investment gap to be €142 billion.1

We think social infrastructure is a natural fit for most impact investors. It can deliver a positive impact together with the potential for financial benefits such as predictable, steady returns as well as a lower exposure to market and systemic risks.

We examine how investors can maximise the potential for dual returns in social infrastructure—an attractive risk-adjusted financial return as well as the social and environmental benefits—by actively managing for impact.

Impact Management Approach

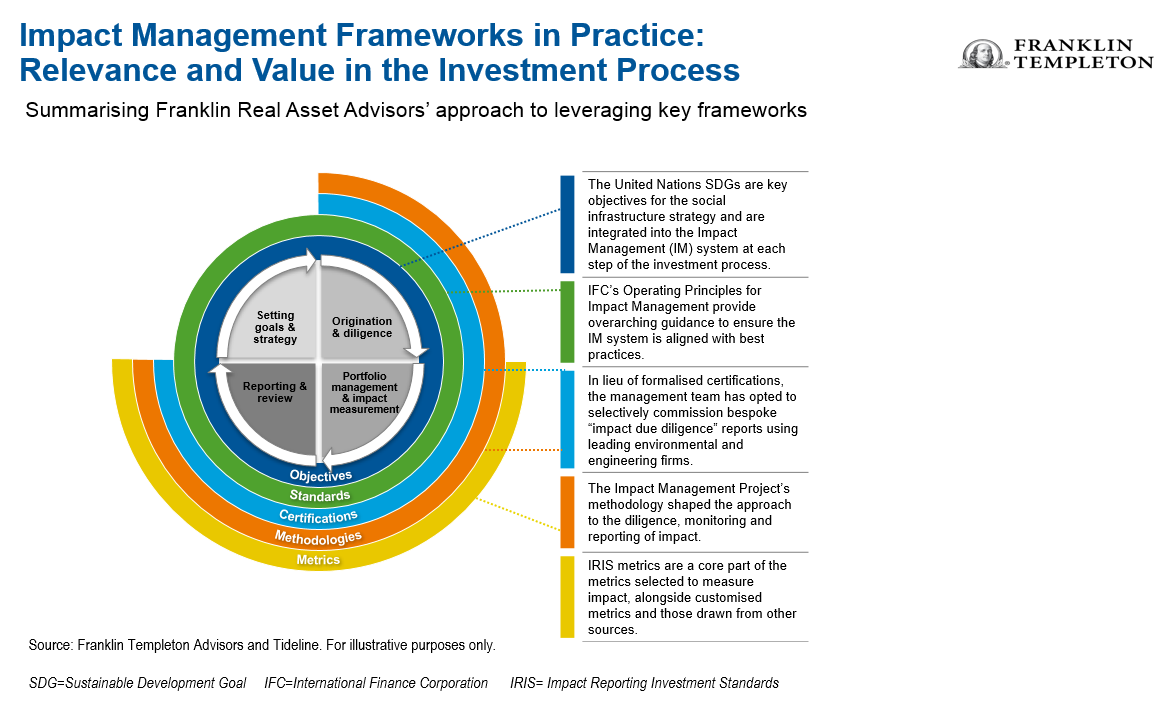

Franklin Templeton Real Asset Advisors and Tideline developed an impact management approach based on industry best practices and aligned with a commitment to transparency and authenticity. A crucial aspect of the design is the integration of impact management throughout the investment process.

This approach integrates impact from the early stages of the investment process—for example, the sourcing and management of social infrastructure assets—informs investment decisions and allows for proper impact measurement at the reporting stage. And as we expect most of the desired impact outcomes will be achieved over the long term, this approach should support better tracking over time.

What follows is a discussion of how we selected the key frameworks for our impact strategy; how they could be used throughout the investment process; their limitations; how they interact and complement one another; and how they can be appropriately tailored to an investment strategy.

Objectives

This social infrastructure strategy targets six Sustainable Development Goals (SDGs) as key objectives:

- Good Health and Wellbeing

Quality Education

Peace, Justice, and Strong Institutions

Sustainable Cities and Communities

Affordable and Clean Energy

Clean Water and Sanitation

The SDGs inform the entire impact management system and process. For example, in screening and due diligence, the alignment of an asset’s impact with the targeted SDGs is specifically evaluated. In impact measurement, metrics were identified that would demonstrate the degree of progress against the SDGs, which are also used later in reporting. Finally, where possible, we prioritise opportunities to manage the assets in ways that will enhance this impact in line with the SDGs.

Standards

We consider the International Finance Corporation’s (IFC’s) Operating Principles for Impact Management because the principles help clarify the contribution the investor can make from the very start. This concept is important for identifying the additive value an investor brings to the impact of an investment. However, IFC principles do not prescribe specific contributions and a taxonomy is not available; hence, customisation is required at this stage in the process.

In this specific case, the illustration below shows the key contributions investors could potentially achieve through a social infrastructure strategy. These were brought together to create a tracking tool that documents the current versus projected (or realised) impact of each asset. This tracking tool is based on a 10-factor scoring system—five related to community aspects and five to environmental ones. Current and projected impact scores rank from 1 to 5 and are grounded on different metrics, for example, the Global Impact Investing Network’s (GIIN’s) Impact Reporting Investment Standards (IRIS), and due diligence reports.

Certifications

Though Franklin Real Asset Advisors does not pursue third-party certifications for the assets in its social infrastructure strategy, it does leverage the Building Research Establishment Environmental Assessment Method (BREEAM) and Leadership in Energy and Environmental Design (LEED) for discrete purposes in its impact management system.

In lieu of formal certifications, the management team has opted to selectively commission bespoke “impact due diligence” reports using leading environmental and engineering firms. These reports provide valuable data on the current state of each asset and identify potential environmental improvements. The reports provide benchmarking information versus the BREEAM and LEED certifications, allowing the scoring system to stay grounded in best practices and to obtain useful environmental data.

Methodologies

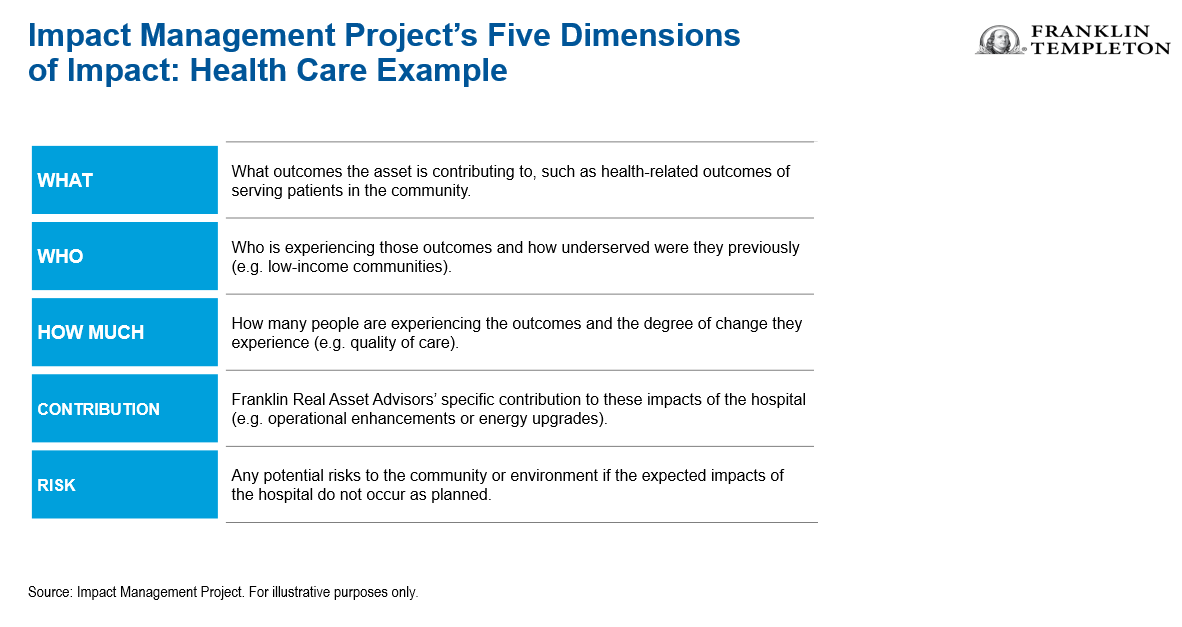

The due diligence tools and impact reporting for the case study are influenced by the Impact Management Project (IMP) and its five dimensions of impact: what, who, how much, contribution and risk.

In practice, this means that an annual impact assessment for each asset in the portfolio is designed to address these five dimensions. It does so through a documentation of SDG-alignment, specific contributions achieved or planned, and through the 10-factor scoring system designed to assess the current and future state of community value and environmental performance.

An impact assessment report for a health care asset would examine the following questions in alignment with the five dimensions. Changes in these five dimensions are calculated on an annual basis, to monitor continuously and manage the impact of the social infrastructure investments.

Metrics

The impact management system for the social infrastructure strategy draws heavily from the GIIN’s IRIS catalogue of metrics. Because IRIS is the most widely used metrics framework in impact investing, aligning with IRIS is an important way of making impact outputs more comparable and readily understood. The ultimate benefit of doing so is increased accountability and transparency in impact performance and reporting.

However, the team also wanted to track key metrics that were not in the IRIS catalogue and found value in creating custom metrics and asset class specific metric standards, like those used for real estate ESG reporting by the Global Real Estate Sustainability Benchmark (GRESB).

The combination of standard and custom metrics aims to be both practical and comprehensive. In practice, key performance metrics are identified for each asset and are designed to be aggregated to the portfolio level. Also, to stay aligned with the stated objectives for the strategy, each metric is mapped back to an SDG.

Furthermore, while metrics are a key building block for any impact management system, we also acknowledge the value of asset-specific case studies to illustrate positive outcomes. Together, quantitative metrics and qualitative case studies can present a fuller and more robust report for investors.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager(s) and the comments, opinions and analyses are rendered as at March 2019 and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered outside the United States by other FTI affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investing in real estate securities involves special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. Actively managed strategies could experience losses if the investment manager’s judgement about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

______________________________

1. Source: European Commission: Boosting Investment in Social Infrastructure in Europe, January 2018.

This post was first published at the official blog of Franklin Templeton Investments.