by Collin Martin, CFA, Fixed Income Strategist, Schwab Center for Financial Research

Key Points

- The Federal Reserve cut interest rates for the first time in more than a decade, reducing the federal funds rate target by 25 basis points, to a range of 2% to 2.25%.

- Fed Chair Jerome Powell suggested that the cut had an “insurance” aspect to it, suggesting the next rate cut may not come as soon as markets initially expected.

- The Fed also announced an early end to its balance sheet reduction process, which was originally slated to continue through September 2019.

The Federal Open Market Committee (FOMC)—the Federal Reserve’s policymaking arm—reduced the federal funds rate target by 25 basis points, to a range of 2% to 2.25%. This marks the first rate cut since December 2008.

The rate cut was widely expected by the markets, but the magnitude of the cut was less certain. Prior to the release of the statement, there was still roughly a 16% implied probability of a 0.50%, or 50 basis point cut.1

The Fed also announced an early end to its balance sheet reduction process, initially slated to continue through September 2019.

For the second meeting in a row, the decision was not unanimous. Voting against the decision were Esther George, president of the Federal Reserve Bank of Kansas City, and Eric Rosengren, president of the Federal Reserve Bank of Boston, who both preferred the rate be held steady.

Markets whipsawed after the release of the statement and then following comments made during Fed Chair Jerome Powell’s press conference. Short-term yields rose, long-term yields fell, and stock markets generally dropped. Market expectations had been for multiple rate cuts going forward, but the guidance provided by Powell pointed to the contrary. (This FOMC meeting only included the statement and Powell’s press conference—the quarterly Summary of Economic Projections were not updated at this meeting.)

The opening paragraph of the statement, which generally provides an overview of economic conditions, was mostly unchanged from last month’s statement. While the statement highlighted that business fixed investment has been soft, it also noted that job gains have been solid, household spending has picked up, and economic activity has been rising at a moderate rate.

So why the rate cut? Despite the relatively positive view of the domestic economy, the cut appears to be due to global growth concerns and muted inflation pressures. After all, the Fed’s preferred gauge of inflation, the core personal consumption expenditures (PCE) index, remains below the Fed’s 2% target, and has been below that target for most of the past decade.

What’s next?

The door for more easing is still open, but not as wide as the market had hoped. Going into the meeting, markets were expecting two to three more cuts, but the tone of the statement and comments from Powell indicated that’s not likely, at least in the near term.

The text of the statement shifted ever so slightly from the June FOMC meeting—the committee will now “contemplate” the future path of rates, hinting to a more data-dependent approach. According to Bloomberg, the implied probability of a rate cut at the September meeting is now 62%.

In line with the relatively positive domestic outlook, Powell stated that the rate cut has an “insurance” aspect to it, and that this isn’t necessarily the start of a rate-cut cycle. While this points to a patient approach, the statement says that the Fed will “act as appropriate to sustain the expansion.”

While this meeting did not include updated economic projections, the rate cut itself can serve as a sign that investors shouldn’t read too much into them. Just six weeks ago at the June 18-19 meeting, the median projection for year-end 2019 pointed to zero rate cuts. Now, six weeks later, the Fed has cut rates.

The end of “QT”

Originally expected to continue through September, the Fed cut short its balance sheet normalization process, commonly referred to as quantitative tightening (QT). This decision simply puts their balance sheet process in line with their interest rate policy. If a rate cut is an easing decision, it makes sense to end any policies that have a tightening bias. While this decision made headlines, we view it as relatively insignificant given the size of the Fed’s balance sheet.

As originally planned, through September, the Fed would allow a maximum of $15 billion in Treasury securities per month to mature from its balance sheet; anything above that would be reinvested back into Treasuries. With the updated plan, all maturing Treasury securities will be reinvested accordingly, beginning August 1.

Meanwhile, beginning August 1, any maturing agency debt or agency mortgage-backed securities (MBS) will be reinvested into Treasury securities, with a cap of $20 billion per month.

In short, while the Fed will now be maintaining the size of its aggregate balance sheet, it will be shifting the makeup of its holdings, reducing its agency debt and MBS holdings while boosting its Treasury holdings. This is just one more reason why Treasury yields are unlikely to rise much from current levels, as the Fed will actually increase its Treasury purchases down the road.

Market reaction

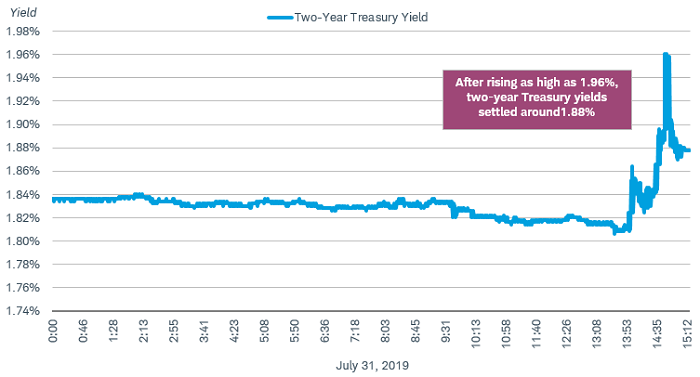

After the release of the statement, both short- and long-term Treasury yields rose modestly, likely due to the lack of indication that a second cut was imminent. However, yields then surged after Powell commented that the cut had an “insurance” aspect and that this wasn’t necessarily the start of a rate-cut cycle. After much volatility, 10-year Treasury yields ultimately dropped to roughly 2.01%, while two-year Treasury yields were up to about 1.88%.

Two-year Treasury yields surged, then dropped

Source: Bloomberg. US Generic Govt 2 Year Yield (USGG2YR Index). Tick data from midnight through 3:16 pm EDT on 7/31/2019.

Meanwhile, stocks dropped sharply. After little movement for most of the day, the S&P 500 dropped more than 50 points, or almost 2%, after the release of the statement and Powell’s comments that followed. By the conclusion of the press conference stock prices had rebounded and pared roughly half of their losses.

Takeaways for investors

The Fed cut rates, but the prospect of future cuts is less certain. While global growth concerns and low inflation support the policy move, the U.S. economy is still in relatively good shape, and this cut doesn’t not necessarily mean it’s the start of a rate-cut cycle.

1 Source: Bloomberg, World Interest rate Probability (WIRO) as of 7/31/2019.

Copyright © Schwab Center for Financial Research