by Invesco Canada, Invesco Canada

Bonds serve a crucial role in helping investors reach their investment goals. They generate income, provide a measure of principal protection and can mitigate volatility.

While bonds can help stabilize a portfolio, they are not without risks.

Bond investors may worry about rising rates weighing on bond returns, while falling rates may bring lower returns in the future as maturing assets are reinvested.

Only a few months are, the assumption was that policy rates from the Federal Reserve would rise. More recently, the Fed has sounded a dovish note, and rate cuts may follow.

Whether the Bank of Canada will follow suit remains unclear.

For bond investors, 2018’s uptick in rates was a reminder that their fixed-income portfolios remain vulnerable to interest-rate risk, reinvestment risk and default risk.

Fortunately, there are time-tested strategies that can help mitigate these risks.

Bond laddering in a volatile rate environment

A laddered bond strategy can help income investors by bringing a rules-based discipline to their fixed income portfolio, and removing the temptation to attempt timing interest-rate changes.

Interest payments from bonds in a laddered strategy can provide a scheduled cash flow.

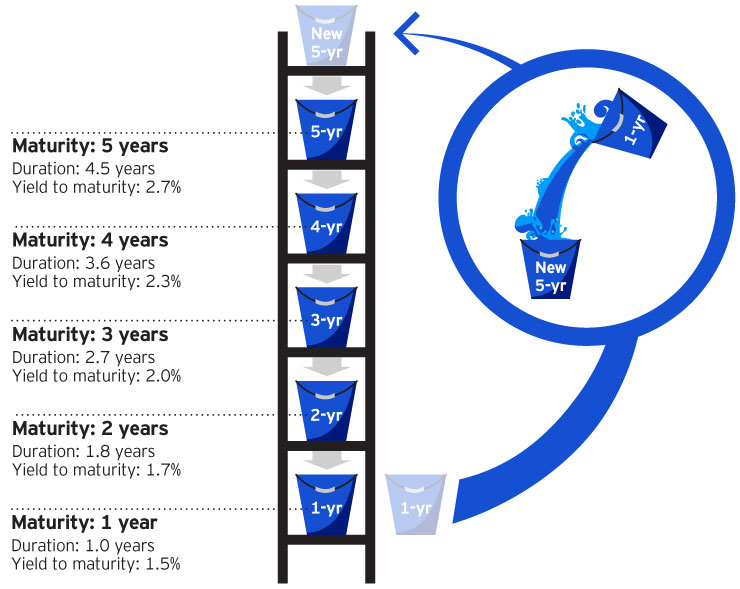

Diversifying bond exposure with a laddered strategy may help cushion a portfolio from the impact of changing interest rates. Bond laddering involves diversifying your portfolio into buckets of bonds that span the maturity spectrum. As bonds in the shortest maturity bucket mature, the proceeds are reinvested in the longest maturity bucket at the prevailing interest rate.

How laddering works

Keeping up with rates

In addition, the ladder can help manage reinvestment risk – the risk to an income stream regardless of the direction of interest rate movements.

When interest rates fall, there is a risk that the proceeds from maturing bonds may only be reinvested at the lower interest rate. This risk becomes a larger concern in cases where a large portion of a bond portfolio matures during a period of falling interest rates.

In a rising interest rate environment, investors face the risk of having their bonds locked into a longer maturity, and may miss out on higher prevailing interest rates. A bond ladder regularly frees up a slice of the fixed-income portfolio to take advantage of potentially rising rates.

Bond laddering provides a framework in which to balance the reinvestment opportunities of short-term bonds with the potentially higher yields that longer-term bonds typically offer. Having a well-diversified bond ladder does not provide a guarantee against loss, but it can provide some measure of protection by managing the reinvestment process with a rules-based approach.

Enhanced stability

While bonds are often used to stabilize a portfolio, changing interest rates can have a dramatic effect on the value of fixed-income holdings.

Interest-rate risk is the potential for rising rates to cause bond prices to fall. While many investors view interest-rate risk as a necessary cost for the benefits bonds can provide, rate uncertainty can be unnerving, especially for investors seeking an income stream.

A bond ladder may help to manage these concerns by creating a predictable stream of income while diversifying maturities over a pre-determined range.

Whether interest rates rise or fall, a portion of the portfolio is reinvested at prevailing interest rates, which helps stabilize the annualized return and partially offset the initial price impact of the shifting rates.

Default risk

Because the purpose of a bond ladder is to provide predictable income over an extended period, taking excessive risk may not make sense. Income investors may want to consider focusing on higher-quality bonds.

Investment-grade corporate bonds are high-quality bonds that have historically had a low default rate, while providing a higher yield potential than government bonds.

Balancing act

Shorter duration bonds tend to be less sensitive to interest rate movements than long duration bonds. Because they are less risky in this regard, they also tend to offer lower yields than similarly rated long duration bonds.

Fixed-income portfolios that seek stability by overweighting either short-term bonds or government issues may not provide sufficient income to meet an investor’s goals and are sensitive to changing interest rates. Investment-grade corporate bonds have the potential to offer attractive yields compared to a traditional fixed-income portfolio made up of government bonds while a laddered approach may help lower sensitivity to interest rates.

Strategy in action

With more Canadians entering retirement, there is a growing need for quality income investments that can serve as a complement to equities. Having a fixed-income strategy that can help navigate changing interest rate environments, while managing the risk, is vital.

Invesco laddered bond strategies can serve as core positions in a fixed-income portfolio. By combining a laddering strategy with investment-grade corporate bonds, these ETFs help manage reinvestment risk, interest-rate risk and default risk, while providing an attractive yield compared to the broad Canadian bond universe.

With a shorter time horizon, Invesco 1-5 Year Laddered Investment Grade Corporate Bond Index ETF (PSB), may provide protection against interest-rate sensitivity and greater capital preservation.

This post was first published at the official blog of Invesco Canada.