by Tony DeSpirito, Blackrock

Can equity markets continue to deliver in the third quarter? Tony DeSpirito sees reason to believe stocks can grind higher and reflects on three wildcards to watch.

Proceed with caution, but by all means … proceed. This was the overarching message in our third quarter equity market outlook.

We believe U.S. stocks can grind higher in the new quarter, underpinned by strong fundamentals and an economy that is still growing ― albeit nearing the final legs of its multi-year expansion.

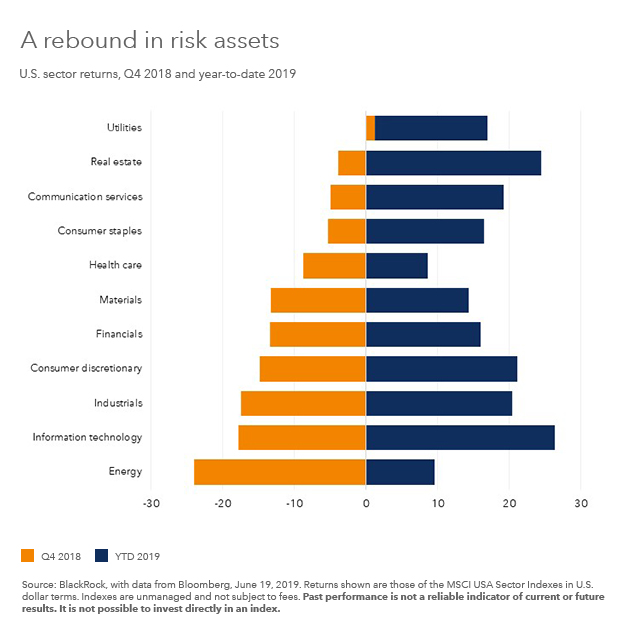

The rebound from late 2018 losses was robust in the first half and evident across sectors, as shown below.

The second half is unlikely to be a repeat. Yet we are not ready to shift to risk-off. Our stance at the midyear point: risk-on and risk-aware. Slowing growth, combined with earnings uncertainty and higher (but not prohibitive) valuations, argue for a strategy aimed at upping portfolio resilience. To us, this amounts to a stock-by-stock approach to portfolio construction that emphasizes quality companies with strong balance sheets and solid free cash flow. It’s a strategy we’re employing in BlackRock Equity Dividend Fund.

Such a tack is particularly relevant given three wildcards that we believe have the potential to guide stocks moderately in either direction in the months ahead:

1. U.S.-China relations

A resumption of talks after the June G20 summit is a favorable sign, and we believe both nations have incentive to arrive at an agreement on trade. Yet the battle for global technology dominance is an even thornier issue that is likely to rage on. The upshot: A trade deal, however modest, would be a positive for stocks in the near term, but expect a protracted cold period to generate headlines and market gyrations through time.

2. Monetary policy

Stocks have cheered the Fed’s dovish tone and potential for a rate cut in the second half. The medium-term question that market participants will begin to ponder is whether a rate-cutting cycle would be an insurance policy to keep the economy buoyant or, more worrisome, a defensive front to forestall a recession. The upshot: Look for a rate cut to boost stocks, but the subtext will be important to monitor for signs that late-cycle may be approaching recession.

3. D.C. politics

2020 election campaigning has kicked off with the first Democratic debates and rallies by incumbent Republican Donald Trump. The agenda and rhetoric of the various candidates (with more than 20 hopefuls seeking the Democratic nomination) is sure to include proposals affecting the health care and technology sectors, where both public interest and regulatory scrutiny are high. The upshot: We like both sectors but believe a stock-by-stock approach is increasingly important.

Risk on and risk aware

Across our fundamental active equity platform, a growing share of risk-taking budgets has been dedicated to stock-specific variables. This type of focus on company-level risks is one way to seek insulation from macro uncertainty. We also advocate a quality bent in pursuit of portfolio resilience as the market and economic cycles wear on.

Still, investors can take some solace in the idea that neither of these cycles is known to die purely of old age. And one thing I really like about this particular bull market: It has not been based on irrational exuberance. It has climbed a wall of worry to reach current levels. The low conviction has limited any build-up of dangerous excesses―and that could imply there is room to go.

Tony DeSpirito is Director of Investments for U.S. Fundamental Active Equity and a regular contributor to The Blog.

Investing involves risk, including possible loss of principal.

BlackRock Equity Dividend Fund is actively managed and its characteristics will vary. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. International investing involves special risks including, but not limited to, political risks, currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. The fund may use derivatives to hedge its investments or to seek to enhance returns. Derivatives entail risks relating to liquidity, leverage and credit that may reduce returns and increase volatility.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of July 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

You should consider the investment objectives, risks, charges and expenses of any BlackRock mutual fund carefully before investing. The prospectus and, if available, the summary prospectus contain this and other information about the fund and are available, along with information on other BlackRock funds, by calling 800-882-0052 or from your financial professional. The prospectus should be read carefully before investing.

Prepared by BlackRock Investments, LLC, member FINRA.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc. All other marks are the property of their respective owners.

USRMH0719U-891585-1/1