by Tony Zhang, Option Matters

Options can be used to provide an additional income stream for just about any portfolio.

Whether you are interested in acquiring an equity position, already own equities, or simply do not wish to own any equities, there are option strategies that are suitable to generate income. In this post, we will explore the top 3 income generating strategies and how to add yield to various portfolios. To learn more about option income strategies, please view our recent webinar: LINK TO WEBINAR RECORDING

Time Decay (Theta) – Expiration Dates

Before exploring income generating strategies, it is important to understand the concept of time-decay (theta) and how it affects options pricing and the income received.

Time Decay – Theta refers to the change in the option price with respect to time when other factors remain constant. As options have an expiration date, option’s price will decay as it approaches expiration. Theta defines the rate at which an options price will decay with time and is expressed as follows:

Theta = Change in Option Price/ Change in Time

(when other factors such as underlying price are held constant)

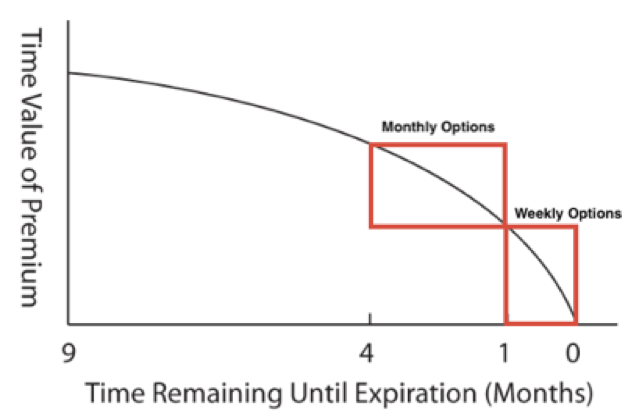

All income generating strategies requires selling or writing of an option contract to receive the income as a credit. Time decay works in favor of the option seller as income is collected at the beginning of the trade and the option decreases in value throughout the duration of the trade. Furthermore, the speed at which the option price decays with respect to time is not linear. Assuming all else as constant, shorter dated options will decay at a faster rate than longer dated options. This is shown in the graph below where the speed of time decay accelerates closer to expiration. Option sellers may benefit more from time decay by selling shorter dated (weekly) options.

Chart 1: Options Time Decay Curve

Source: OptionsPlay

Strategy 1: Selling Covered Calls

A covered call is the most popular strategy to generate income with options. There are two steps required for an investor to utilize this strategy – owning at least 100 shares of a stock and selling an “out-of-the-money” (OTM) call option. This income strategy is most effective with a neutral or bearish outlook on the stock. Selling the call option obligates the investor to sell the stock at the strike price of the call option upon expiration when it is favourable to the holder of the call (i.e. the buyer). The goal of this strategy is for the option to expire worthless when the stock is trading below the strike price at expiration, keeping the income from the call option. The seller can then repeat selling covered calls to generate a stream of income until the stock is above the strike price upon expiration. When this occurs, the stock is sold to the buyer of the call option at the strike price.

For example, if BMO stock is trading at $100 and an investor sold 1 BMO $105 call for $1 per share, the investor would be obligated to sell the stock in the event that BMO stock is above $105 at expiration. If BMO is trading below $105 upon expiration, the investor keeps the $1 income and can continue to sell covered calls to generate an income stream.

Covered Call Best Practices

- Sell strike prices above the current stock price. Lower delta strikes are suitable (15-20 delta)

- Sell short-dated options (3-7 weeks) as they take advantage of higher time-decay (theta)

Learn more about selling covered calls with our Practical Guide to Selling Covered Calls

Strategy 2: Cash Secured Puts

A cash secured put simply involves selling a put option while setting aside cash to buy the stock in the case of assignment. The cash secured put is primarily considered to be a stock acquisition strategy but can also be an income generating strategy. A put selling receives the premium from selling the option and can generate an income stream while acquiring stocks. For example, if BMO stock is trading at $100 and an investor sold 1 BMO $95 put for $1 per share, the investor would be obligated to buy the stock in the event that BMO stock is below $95 at expiration. This allows the investor to use the income received to net against the total cost of buying the stock at the strike price. The overall effective cost of buying each share is therefore reduced to $94 ($95-$1).

If the market price rallies, the investor profits from the premium received and if the price drops, the investor will purchase shares at the strike price plus a discount ($1 premium).

Cash Secured Puts Best Practices

- Sell strike prices below the current price. Higher delta strikes are suitable (35-45 delta)

- Sell short-dated options (3-7 weeks) as they take advantage of higher time-decay (theta)

Learn more about selling Cash Secured Puts with our Quick Guide on Selling CSP

Strategy 3: Credit Spreads

Credit spreads is a limited risk option strategy can be used to generate income from a modest bullish, bearish or even neutral view on a stock or ETF. However, this strategy is not ideal when a large move is expected.

In the following examples, consider BMO trading at $100

Bullish Outlook – a bull put vertical spread can be used.

Strategy:

- Sell $100 Put @ $4 Credit

- Buy $90 Put @ $1 Credit

- The maximum reward is the $3 income received. ($4 Credit -$1 Debit)

- The maximum risk is $7 (the difference between the 2 strike prices – premium received)

Outcomes:

- If BMO is above $100 at expiration = Max Profit of $3

- If BMO is at $97 at expiration = Breakeven of $0 profit

- If BMO is below $90 at expiration = Max Loss of $7

Bearish Outlook – a bear call vertical spread can be used.

Strategy:

- Sell $100 Call @ $4 Credit

- Buy $110 Call @ $1 Credit

- The maximum reward is the $3 income received. ($4 Credit -$1 Debit)

- The maximum risk is $7 (the difference between the 2 strike prices – premium received)

Outcomes:

- If BMO is below $100 at expiration = Max Profit of $3

- If BMO is at $103 at expiration = Breakeven of $0 profit

- If BMO is above $110 at expiration = Max Loss of $7

Credit spreads are a forgiving strategy that allows for income generation even if the stock moves in the opposite direction of the intended outlook. This is traded off by risking more than the income received when the stock moves significantly against the expected outlook.

Credit Spreads Best Practices

- Sell 1-month “At-the-money” strikes (50 delta) and buy “Out-of-the-money” strikes (25 delta)

- Sell short-dated options (3-7 weeks) as they take advantage of higher time-decay (theta)

To learn more about trading Credit Spreads, please register for our upcoming webinar on August 26th – Maximizing Income with Credit Vertical Spreads

Summary

Long term stock investors should consider cash secured puts to acquire the stocks at a lower price and then sell covered calls to generate an income after acquiring them. Additionally, investors who wish to generate an income from speculating on the direction of a stock should consider credit spreads. The key to generating a consistent income with the above strategies is to use a methodological approach based on best practices every cycle. Additionally, with all income generating strategies, selling shorter dated options may provide income at a faster rate due to the affects of time decay (theta).

Take advantage of free access to OptionsPlay Canada: www.optionsplay.com/tmx

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

This post was originally published at the Option Matters blog.

*****

Tony Zhang, Head of Product Strategy for OptionsPlay

Tony Zhang is a specialist in the financial services industry with over a decade of experience spanning product development, research and market strategist roles across equities, foreign exchange and derivatives. As the current Head of Product Strategy for OptionsPlay, Tony leads the research and development of their OptionsPlay Ideas & Portfolio platform. He has leveraged his interest in financial technology and product development to provide innovative, reimagined solutions to clients and the users they seek to serve. Previously he spent 7 years at FOREX.com with a capital markets and research background as a market strategist specializing in equity and FX derivatives markets.