by Craig Basinger, Chris Kerlow, Derek Benedet, Alexander Tjiang, RichardsonGMP

There is no shortage of doom and gloom out there amid a simmering trade war, Iran potentially misbehaving and soft economic data circulating through most global economies.

Yet, in this environment just about everything made money in the first half of the year. Even without counting dividends, at the time of writing markets across the board were higher on the year: the TSX +14%, the S&P 500 +17%, Euro Stoxx 50 +16%, Asia +9% and emerging markets +10%.

Add to this, bonds in both the U.S. and Canada, which were up 6%, gold up 10% and oil up 30%. Sure, we could say a chunk of these gains in equities and commodities are being measured against an oversold starting point following the correction in the fourth quarter of 2018, but clearly there is no doom and gloom from an asset price perspective.

Helping asset prices has been renewed dovishness across central banks from the Bank of Japan, European Central Bank and the U.S. Federal Reserve. All have pivoted to varying degrees and become more inclined to lower or keep overnight rates very low.

The Fed, based on the Fed Fund Futures, is now pricing in a 100% probability of a rate cut at the July 31st meeting, with a 26% chance of a 50 basis points cut. Some are calling this a pre-emptive move. Others are calling it simply more financial engineering to keep asset price inflation going.

No doubt the bond market is pricing in slower economic activity with the 10-year Treasury yielding 2.0%. While low, global yields are likely dragging down U.S. yields (and Canadian), more so than the economic data at this point. German 10s are back deep in negative territory with a -0.3% annualized yield to maturity. Poor Germans!

You buy a bond for 100 euros and you get 97 back in 2029. There is now about $17 trillion of debt with a negative yield around the world.

So, with the second half underway, what can we expect?

We will be publishing our Richardson GMP Investor Strategy report in the first week of July. It provides a more detailed market recap, market-cycle update, outlook and key aspects of the market we believe worthy of added attention. The following is a sneak peek into some of the content from this upcoming report.

From a simplistic mean reversion perspective, it will be difficult for all these markets to continue at a similar pace. Sooner or later gravity gets us all. In fact, one of the best indicators of future equity market returns are current valuations. Chart 1 is the average return of the S&P 500 based on entry-point valuations, using data back to the 1930s. If the price-to-earnings ratio is low, the average return over the next year tends to be higher. At the end of December 2018, after the sell off, the S&P 500 traded down to a valuation of less than 15x. Today it is closer to 19x, which should temper return expectations.

Beyond valuations, the remainder of the year is likely going to come down to the global economy. Over the past few months we have seen economic data continue to soften. This has contributed to falling global yields and more dovish central banks. On the positive side, lower yields and more dovish central banks have enabled equity markets to rally with many reaching all-time highs. But that magic combo won’t last and there are two likely scenarios with rather disparate outcomes.

Bad Scenario: Economic data continues to weaken. So far, weak data has lifted bond prices (lowered yields) but the equity markets have ignored this, reveling in lower yields. If the data continues to weaken, there will be a turning point when the equity market will begin to negatively react to soft data. Bad economic news can be good for markets for a while, after which it becomes negative. This can happen without notice and with no apparent trigger.

This scenario would see equity markets give up gains from 1st half, and bond yields move even lower.

Good Scenario: Economic data stabilizes or even improves. This would be very positive for equities and not good for bonds. Given yields are so low, improved economic growth would likely lead to a quick multiple expansion for the equity markets even from mildly elevated levels, and a strong rally.

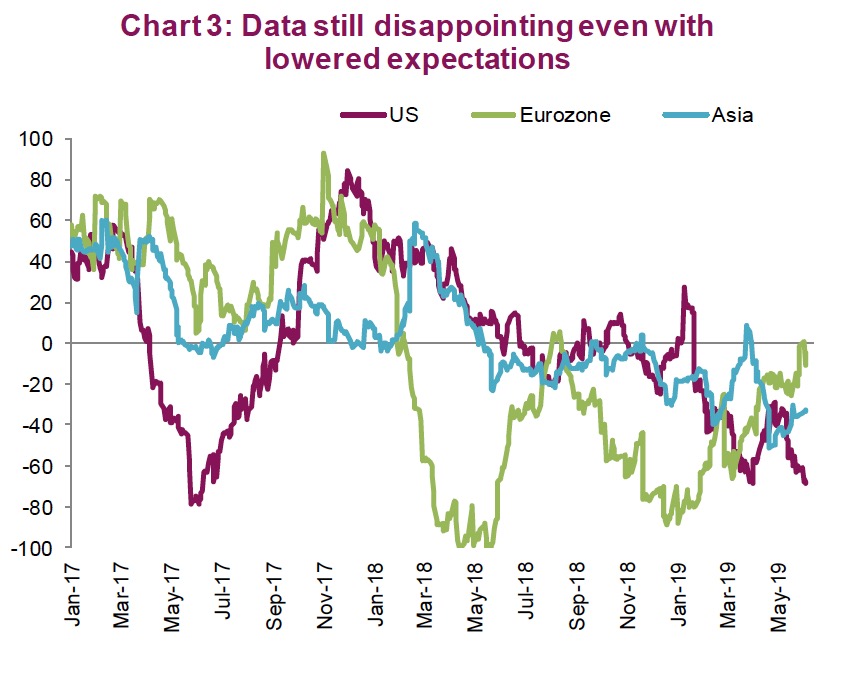

Clearly these are two very different alternatives. One encouraging aspect are the consensus estimates for global growth. These had been declining for all of 2018 and some of 2019, but now appear to have stabilized (Chart 2). Without suggesting that the consensus knows best (wisdom of the crowd and all), the fact that these declines have slowed is positive. Countering this somewhat is the Citigroup Economic Surprise indices (Chart 3). U.S. economic data continues to miss the market, Asia has seen some improvement and Europe is looking better. This is partially due to such low expectations for European growth.

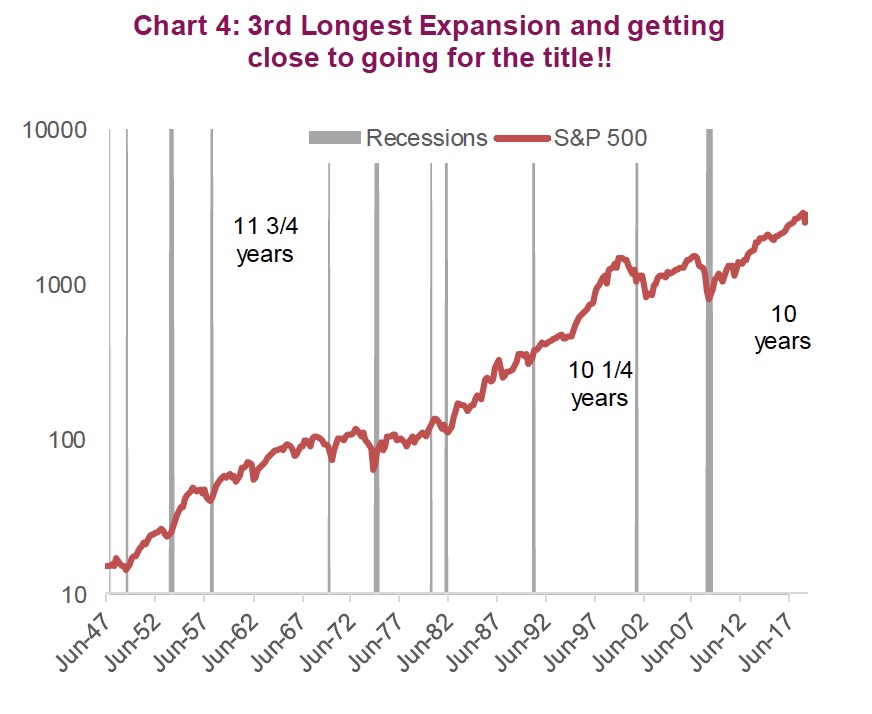

Then there is geopolitical risk, which can lead to a large amount of volatility in this uncertain environment. Trade talks, in either direction, will continue to move markets. This is not because this risk impacts GDP by all that much, but it increases uncertainty and that leads companies and consumers to behave differently. We are already seeing this across many corporations that are becoming more focused on paying down debt than increasing dividends or share buybacks. If companies and individuals become more conservative, this can lead to the end of a cycle. Given how long the cycle has been going – 10+ years (chart 4) – corporate and investor behaviour is rather important these days.

Ponder this for a while and we look forward to sharing our analysis and views in the upcoming Richardson GMP Investor Strategy report.

*****

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP.

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness.

The opinions, estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor.

Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them. Richardson GMP Limited is a member of Canadian Investor Protection Fund.

Richardson is a trademark of James Richardson & Sons, Limited. GMP is a registered trademark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

©Copyright July 2, 2019. All rights reserved.