by Jonathan Curtis, Vice President, Research Analyst, Franklin Equity Group, Franklin Templeton Investments

The technology sector has been on a volatile ride of late, driven in large part by the fortunes of some household names. Franklin Equity Group’s Jonathan Curtis believes the sector offers attractive long-term potential. In this article, he champions the contribution of lesser known names and explores the opportunities presented by the rollout of fifth-generation (5G) technology.

A few big names, notably the so-called “FAANGs” (Facebook, Apple, Amazon, Netflix and Alphabet’s Google), tend to dominate many investors’ perception of the technology sector.

However, there’s more to the technology sector than just those few giants. While we are excited about many developments impacting larger companies, we also have our eyes on some lesser-known companies that are playing an integral role in the delivery of digital transformation.

We’re on the lookout for companies that are integrating new technology, changing their culture and challenging the status quo.

Digital Disruptors Force Legacy Businesses to Adapt

Increasingly, we’re seeing companies across a range of industries turn to artificial intelligence and machine learning solutions in their quest to remain competitive, such as voice recognition apps like Siri or Alexa, or the Netflix recommendation engine. We think that dynamic presents interesting investment opportunities.

Digital transformation is helping a wider array of companies amend existing business processes or create new ones. As investors within the tech space, we are keen to identify digitally minded businesses outside the information technology sector that have embraced new technology at a faster rate than their peers. That being said, we also think certain companies involved in the commercialisation of fifth-generation (5G) broadband cellular network technology could represent some potential opportunities in the longer term.

Beyond 5G Technology

Many commentators have identified the roll-out of 5G mobile data networks as the next big thing for the technology sector globally. We certainly think it could be a game-changer, and we recognise there are several ways investors can approach the potential 5G opportunity.

In our view, the most attractive investment opportunity is in the supply chain for 5G implementation, rather than among telecommunication equipment manufacturers. For instance, we see potential in the semiconductor space—such as chip and memory manufacturers—whose products are vital for 5G rollout.

We also see potential opportunities among wireless communications infrastructure companies that help 5G carriers distribute their network services out to mobile devices.

Because they control the distribution, these communications tower operators have a good deal of pricing power over the mobile carriers. In our view, tower companies’ business models could become more attractive as the shift towards 5G becomes more apparent.

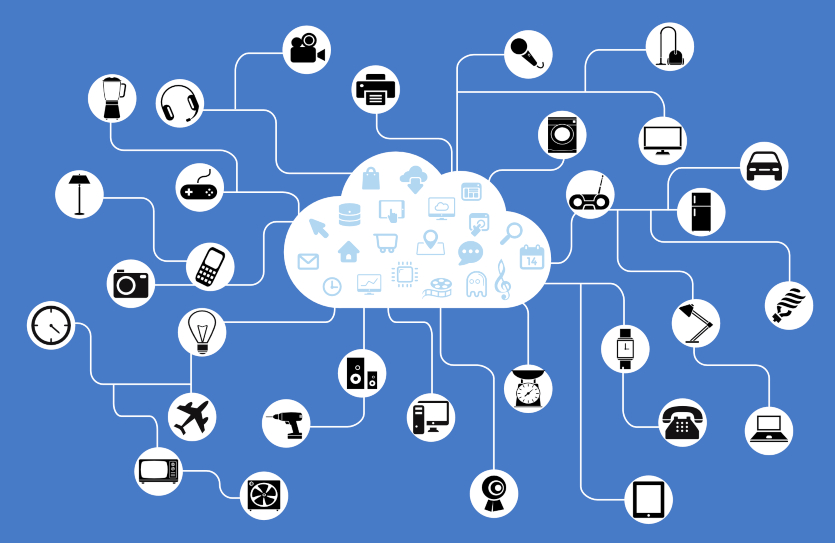

We recognise too that the evolution of 5G creates further opportunities in the realm of the Internet of Things, the integration of devices into everyday items via wireless internet.

We think the number of devices connected to the internet is likely to rise dramatically in the coming years, thanks to the extra bandwidth and lower latency that 5G offers. With that in mind, we’ve identified some potentially exciting opportunities among companies providing secure enterprise cloud solutions.

Taking a Longer-Term View

While some investors may use the high-profile FAANG stocks as a bellwether for the tech sector in general, we tend not to take too much notice of short-term movements in a handful of names.

We typically invest with a three-to-five-year outlook and are also looking for opportunities in companies tied to the broad theme of digital transformation that might not be household names.

__________________________________________________

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

To comment or post your question on this subject, follow us on Twitter @FTI_Global and on LinkedIn.

The comments, opinions and analyses presented here are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

The companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton Investments. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable, but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security. Past performance does not guarantee future results.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in fast-growing industries like the technology sector (which historically has been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasising scientific or technological advancement or regulatory approval for new drugs and medical instruments.

Copyright © Franklin Templeton Investments