by Larry Adam, Chief Investment Strategist, Raymond James

June 21 is the beginning of the astronomical summer, otherwise known as the summer solstice. The summer solstice is the perfect time as it is the longest day of the year (Americans get anywhere from four to eight hours of sunlight more than the shortest day of the year in December) and temperatures are mild (or at least less hot and humid than in July/August!). That perfection does not last forever and tends to dissipate as we progress through the summer months.

[backc url='https://www.dynamic.ca/leadership/eng/active.html#pools?video=pools&utm_source=aa&utm_medium=edirect&utm_campaign=alwayson&utm_content=activepools_pools']Similarly, the equity markets are seemingly priced to perfection as the S&P 500 sits comfortably above the 2900 level. As we referenced in previous Weekly Headings, improving trade rhetoric with Mexico and China, a proactive Federal Reserve (Fed) attempting to ensure an ongoing economic expansion, and attractive valuations served as catalysts to propel the recent 7.7% rally (since June 3), taking the S&P 500 to a new all-time high.

However, with much of this positive news now priced in and the markets susceptible to disappointment, we turn tactically more cautious on the equity market at current levels.

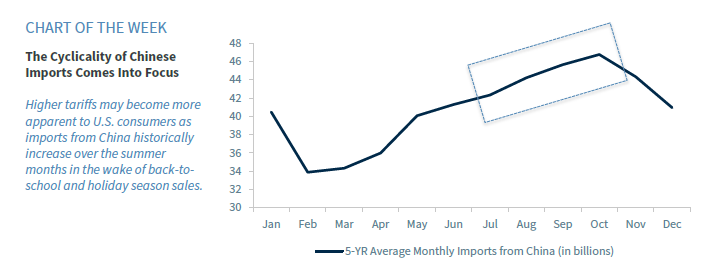

- Dialogue, But No Details. Ahead of the G20 meeting next week, President Trump tweeted that talks would resume between the U.S. and China, which raised expectations for a “deal” between the world’s two largest economies or (at least) a postponement of the additional tariffs that President Trump had threatened to place on the remaining $300 billion of Chinese exports to the U.S. As a result, progress and a commitment to continue to negotiate (our expectation) is likely already priced into the market.However, while a surprise official deal (unlikely) would lead to further upside, any breakdown in the discussions would pose a downside risk to the market (which has happened previously). In addition, the negative economic repercussions of current and potential tariffs on consumers could become amplified as we begin the seasonal increase in Chinese exports to the U.S. in the wake of upcoming back-to-school and holiday shopping sales.

- Fed Fever Fading. The Federal Open Market Committee (FOMC) and Chairman Powell appear more likely to cut interest rates before year end. Interestingly, at their March meeting, none of the Fed members suggested a rate cut this year. At their June meeting, seven of the 17 members saw two interest rate cuts and one member saw one rate cut by year end. The futures market has priced in a 97% and 70% probability of two and three cuts this year. Our expectation is two 25 basis point (bp) cuts this year, at the July and October FOMC meetings. Assuming these cuts lead to an extension of the expansion and no recession, this is a long-term positive for the market and earnings growth.However, the ever increasing optimism of multiple cuts is now priced into the equity market and any hesitation by the Fed could lead to downside pressure. From a global perspective, while the market applauded the more dovish commentary by European Central Bank (ECB) President Mario Draghi this week. However, there remains uncertainty around its actual implementation given Draghi will leave his post in October and a new head (who is unknown as of now) will take over.

- Lofty Valuations. As the S&P 500 rose above our year-end target of 2946 six months ahead of schedule, it has subsequently become expensive; the current 18.2x LTM (last twelve months) P/E is above our fair value 17.75x P/E multiple. Admittedly, lower interest rates are a positive development and supportive of higher valuations, especially if lower rates stimulate the economy. This is apparent as the next 12-month S&P 500 dividend yield (2.04%) is above current Treasury yields out to the 10-year maturity level. However, uncertainty surrounding the strength of future earnings offsets this fall in rates. Future earnings continue to be revised lower and have now been revised down ~4% year-to-date. With continued concerns surrounding global growth and trade, there are few catalysts to push earnings forecasts materially higher from current levels.

- Guiding Growth Forecasts Lower – Economic data (e.g., Empire Manufacturing, Philadelphia Fed Index) released this week continue to suggest a slowing in 2019 economic growth from the robust pace in 2018. While we do not forecast a recession over the next 12 months, our current 2019 GDP forecast (1.9%) is well below the consensus forecast of 2.4%. If market participants lower their more optimistic forecasts toward ours, earnings and equities may come under modest pressure.

- Stretched Technicals – While technicals are not yet at extreme levels, they are stretched as the 14-day RSI (Relative Strength Index) is nearing overbought territory (a level above 70) and put/call ratios have declined sharply amidst the equity rally.

Economy

- As generally expected, the FOMC left short-term interest rates unchanged. In the revised dot plot, senior Fed officials were unusually split – divided on whether the federal funds target would be unchanged at the end of the year or be lowered by 50 bps. Officials’ projections of inflation were lowered. In his press conference, Chairman Powell said that crosscurrents, including trade developments and concerns about global growth, have reemerged.

- While Powell suggested a wait-and-see attitude to a potential rate cut, the federal funds futures market quickly priced in a 100% chance of a July 31 move (~62% probability of a 25 bp cut and a 38% chance of a 50 bp cut).

- Focus of the Week: Next week, May data on durable goods orders will give insights into the state of business fixed investment. Investors will be more focused on trade policy discussions between President Trump and Chinese President Xi around the G20 meeting in Osaka (June 28-29).

U.S. Equity

- The Fed’s “dovish” signal and S&P 500 break out to a new high are good intermediate term signs for stock returns. However, near term we would not chase the market given its overbought status and the G20 meeting next week. We doubt any major negatives come from the meeting, although the risk is still there.

- It is our view (and we believe the market's expectation) that the next tranche of tariffs gets delayed following next week's meeting, however an escalation in tensions could be the catalyst for a market pullback in the short term.

- Looking for opportunities, we continue to favor U.S. equities (over non-U.S.) with a bias toward large-cap growth. Additionally, we favor companies with more U.S. revenues (given that President Trump is making trade a campaign topic).

- Focus of the Week: We would like to see breadth improve if the advance continues. For example, the S&P 500 Equal Weight Index, as well as the small caps, have not been able to gain relative strength in the recovery. Relative improvements from those indices would reflect broadening participation and be more supportive of the market technically.

Fixed Income

- The slowdown in global economic momentum and continued trade uncertainty has led to a “global easing cycle” with rising probabilities of central bank rate cuts. As a result, global sovereign bond yields have fallen substantially over recent months as the 10-year Treasury yield fell below 2% for the first time since November 2016, German bund yields declined to a record low, and the Swedish 10-year sovereign bond yield closed in negative territory for the first time on record. As a result, the market value of negative-yielding global sovereign bonds ($13 trillion) rose to the highest level on record. Low global rates should anchor U.S. rates to remain lower for longer.

- Focus of the Week: Next week’s U.S. Personal Consumption Expenditure (PCE), which is expected to show that inflation rose 1.6% YoY in May, should give the Fed more ammunition to cut interest rates as inflation remains well below its 2% target rate.

International Politics

- We continue to view the G20 talks as a binary event. Although near-term indications are trending to a more market-positive result following a Trump-Xi phone call this week, the expanded scope of the trade fight at this juncture may make it harder to come to any sort of agreement, even in the form of a delay. The G20 talks essentially come down to the personal relationship between Trump and Xi, which has previously produced de-escalatory outcomes (December 2018 tariff delay, ending of ZTE export order).

- In the event of a good meeting that leads to a potential 90 day delay on tariff implementation, the chances of a full 25% tariff on $300 billion of additional Chinese goods likely drops to near zero for the near term, but the threat of the tariffs being implemented longer term is approximately 40%. We may still see some sort of tariffs levied on this tranche of goods at some point, but they would likely start off lower (perhaps at 5%) and gradually rise to create additional inflection points in negotiations.

- If the meeting produces a negative outcome, we see a 75% chance that Trump moves quickly to implement further tariffs on the $300 billion of goods on or around July 1. However, we expect that the initial tariffs would not be set to the highest 25% rate. If next week fails to yield a meaningful result, the next likely opportunity for the two leaders to meet may be around the UN General Assembly meetings in the fall.

Commodities

- Gold prices continued their recent move higher as the metal is now at a five-year high (~$1,390/oz). Gold is being supported by rising expectations for rate cuts, muted inflationary pressures, depressed sovereign yields and rising geopolitical risks.

- On July 2 (postponed from its original June 26 meeting date), OPEC member states and a small number of non-members, led by Russia, will hold their regular biannual meeting. The central item on the agenda will be whether to extend the production cuts that date back to December 2018.

- Given the correction in oil prices during the May/June timeframe, an extension is looking more realistic than before.

- This correction was mainly due to market concerns about the recent increases in U.S. petroleum inventories – and it came despite the widened geopolitical risk premium arising from escalation of Iran-related tensions, including attacks against oil tankers and the downing of a drone. If indeed an extension were to be announced, this would very likely spur a bounce in oil prices.

*****

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James