by David Zahn, CFA, FRM, Franklin Templeton Investments

Many observers had low expectations ahead of this week’s European Central Bank (ECB) governing council meeting. But as David Zahn, Franklin Templeton Fixed Income Group’s Head of European Fixed Income, explains, the decisions made at the meeting have some intriguing implications and show the extent of the bank’s determination to achieve its inflation target.

We have felt for several weeks that the European Central Bank’s (ECB’s) June meeting would be more significant than many commentators were expecting. And so it has proved.

It’s important to remember that the ECB remains an inflation-targeting central bank. So, as the market’s interest-rate expectations for the eurozone plummeted in recent months, we expected decisive action from ECB President Mario Draghi and his colleagues.

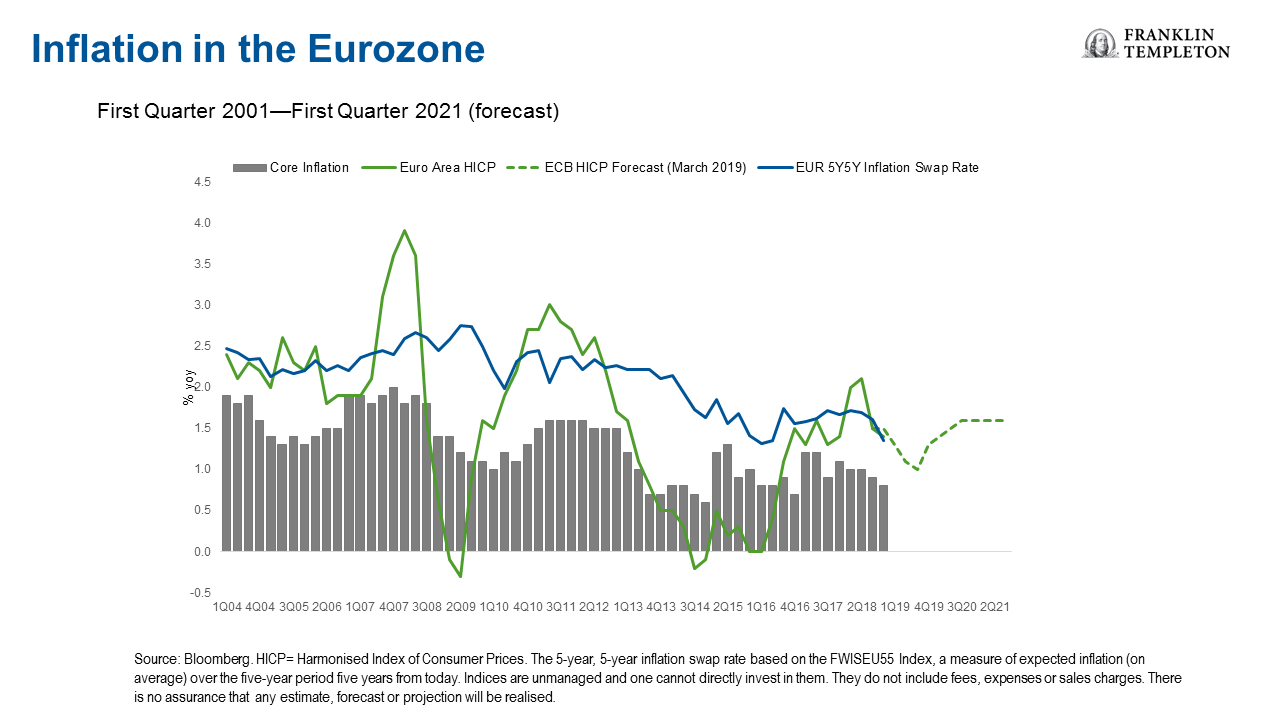

In the past, we’ve seen the ECB step in to address a significant decline in the 5-year, 5-year (5yr-5yr) forward inflation index—a measure of the market’s inflation expectation for five years, five years from today.

The most up-to-date available figures show the 5yr-5yr eurozone inflation swap rate at around 1.3% in the first quarter of 2019, compared with 1.7% in the third quarter of 2018, and it’s been moving further and further away from the bank’s 2% target.1

In fact, the five-year inflation expectation is below the level it was when the ECB embarked on its quantitative easing programme back in March 2015.

The main focus of the ECB’s response announced today is its Targeted Long-Term Refinancing Operations (TLTROs) programme. Around €700 billion of the current TLTROs are due to mature in 2020-2021. We think the more attractive refinancing terms announced by the ECB today should encourage banks to refinance and probably borrow more and buy short-dated bonds. That in turn should keep yield curves in the eurozone’s so-called peripheral countries—those with smaller or less-developed economies in Europe—in good shape.

The main focus of the ECB’s response announced today is its Targeted Long-Term Refinancing Operations (TLTROs) programme. Around €700 billion of the current TLTROs are due to mature in 2020-2021. We think the more attractive refinancing terms announced by the ECB today should encourage banks to refinance and probably borrow more and buy short-dated bonds. That in turn should keep yield curves in the eurozone’s so-called peripheral countries—those with smaller or less-developed economies in Europe—in good shape.

What Future for ECB Policy?

Growth in Europe remains decent (but no more than that). Amid geopolitical uncertainty, such as Brexit and trade tensions, it seems obvious to us that almost all of the risks are to the downside. Therefore, we’d expect the bank to continue to be accommodative. We’re not expecting a eurozone interest-rate hike before 2022.

However, it’s important to recognise that a lot of the players dictating the direction of the ECB will be changing this year. Draghi’s tenure ends at the end of October, and by the end of the year eight of the 19 national central-bank governors on its rate-setting body will have stepped down.

That leaves a question mark over whether the reaction function of the ECB will change. We should understand that the ECB’s past behaviour might not be replicated under a new regime, it might be more hawkish or more dovish.

As long as the ECB remains an inflation-targeting body, we think it will continue to pursue accommodative policy.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments.

___________________________

1. Source: Bloomberg, as at 6 June 2019. The 5-year, 5-year inflation swap rate based on the FWISEU55 Index, a measure of expected inflation (on average) over the five-year period five years from today. Indices are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. There is no assurance that any estimate, forecast or projection will be realised.

Copyright © Franklin Templeton Investments