by Larry Adam, Chief Investment Strategist, Raymond James

The “inconvenient truth” of equity market pullbacks is that investors tend to want them in order to invest at more favorable prices, but when they actually occur, investors get nervous, question their conviction and postpone their purchases. As we have mentioned in recent Weekly Headings, we had grown more cautious on the equity market as the S&P 500 matched our year-end target of 2946 on April 30. We believed the S&P 500 had gotten ahead of itself and suggested that the combination of investor complacency and weak seasonality would likely lead to a modest pullback. As a result, we had targeted the 2800 (5% upside) and 2700 (~10% upside) levels for the S&P 500 as potential buying opportunities. As we wrote last week, despite the vacation and summer fun between the Memorial Day and Labor Day holidays, investors need to remain engaged and patient with the market as a pullback would likely provide an “inconvenient opportunity.” Some of the reasons we believe weakness should be bought include:

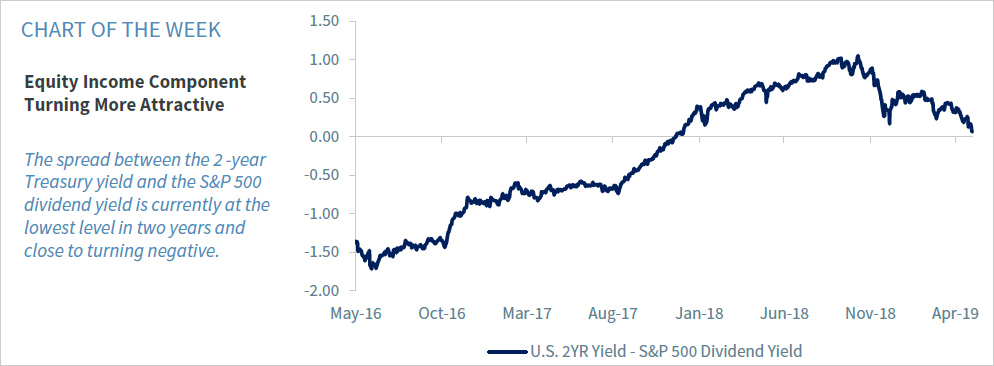

- Bottoming Bond Yields? | The 10-year Treasury yield fell to year-to-date (YTD) lows (2.17%). There is no doubt that Treasuries have served their purpose as a portfolio diversifier amidst the recent uptick in volatility as longer duration Treasuries have significantly outperformed equities by ~800 basis points (bps) since April 30. However, bonds are not without risk as low interest rates (and high duration) make them susceptible to unfavorable performance if interest rates bounce from current levels. While we are not suggesting selling your bond exposure and violating your asset allocation strategy, we would note that the 5.8% upside for the equity market to our year-end target is better than the –5% performance if rates rise 50 bps (consistent with our 2.75% 10-year Treasury forecast) between now and year end. Equities are now particularly attractive relative to bonds as the spread between the S&P 500 dividend yield (+1.9%) and the 2-year Treasury yield is at the narrowest spread (~6 bps) in two years.

- Earnings Valuations | S&P 500 earnings forecasts have stabilized and the consensus has slowly come down to our once considered conservative estimate of $166/EPS for 2019 S&P 500 earnings. More importantly, 2020 earnings are expected to be even better than 2019’s as they notch another record high (current consensus $186). Given our fair market P/E estimate of 17.75x against the current economic, interest rate and risk environment backdrop, the current P/E (on 2019 earnings) of 16.75x is relatively attractive.

- Cash Firepower | The amount of cash in money market accounts is $3.13 trillion, the highest level YTD and the highest since 2010. As that money is deployed and finds its way into the equity market, it should support higher equity prices.

- Changing Temperament | The American Association of Individual Investors’ Bullish Sentiment indicator has fallen to its lowest level since December and the second lowest level over the last two years. Meanwhile, the Bearish Sentiment indicator has skyrocketed to its highest level since January. Historically, sentiment indicators are a contrarian indicator.

- Shifting Fed | While we still believe it is too early to pencil in a Fed rate cut by year end, the bigger story is that the Fed is mindful of the burgeoning risk to the economy from the protracted trade friction and stands ready to cut rates, if necessary. More importantly, by our metrics, while growth is likely to slow in the second quarter (Atlanta Fed GDPNow 1.26% and NY Fed Nowcast 1.41%), there remains a low probability of a recession over the next 12 months.

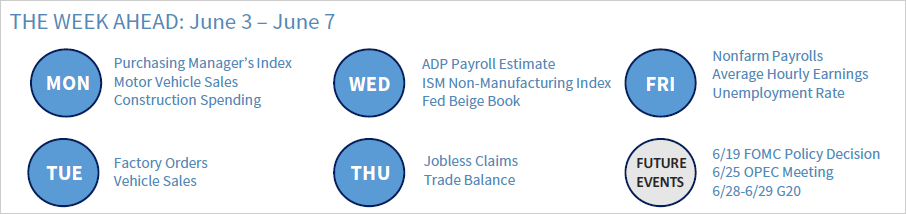

- The Whole Trade | Our base case remains that the U.S. and China (as well as the U.S./Mexico) will come to some sort of a trade deal by the end of the summer. Assuming a compromise, the details of the deal are less important than removing the cloud of trade uncertainty from the front-page headlines, allowing both consumer and business sentiment to remain strong and support the economy. The June 28-29 G20 meeting in Japan looms large as a potential trigger for progress in negotiations.

- Positive Historical Dynamics | This week marked the sixth consecutive weekly decline for the Dow Jones Industrial Average. Over the past 25 years (only six occurrences!), this has led to more favorable performance as the median performance of the equity market has been up 3%, 5% and 7% in the six, nine and twelve months following six consecutive weekly declines.

Economy

- The estimate of real GDP growth was revised slightly lower, to a 3.1% annual rate (vs. 3.2%). The headline figure was boosted by faster inventory growth and a narrower trade deficit, while consumer spending and business fixed investment slowed.

- The Conference Board’s Consumer Confidence Index strengthened further in the advance estimate for May. April personal income and spending figures were in line with expectations, consistent with a lackluster-to-moderate pace of growth in the near term.

- However, given increased growth concerns, Federal funds futures are pricing in a 68% chance of one or more Fed rate cuts by the September 17-18 FOMC meeting, and a roughly 90% chance by the end of the year (with about a 59% chance of two or more cuts).

- Trump announced that he will impose a 5% tariff on all goods imported from Mexico starting on June 10, which then increases by an additional 5% each month for three months in an attempt to force Mexico to take action on illegal immigration. Mexico is the U.S.’ third largest trading partner, and therefore such tariffs will impact U.S. consumers and corporations.

- Focus of the Week: Next week, fresh May economic figures will arrive, including the ISM surveys, motor vehicle sales, and the employment report. These will be closely watched as concerns about the strength of the economy grow. The Chicago Fed will host a conference on the Fed’s monetary policy framework.

U.S. Equity

- Re-escalation of the trade conflict this month pushed the May U.S. Manufacturing PMI to its lowest level in nearly 10 years (at a slightly positive 50.6). The increase in tariffs on $200B worth of Chinese goods to 25% (from 10% previously), as well as the threat to put 25% tariffs on the remaining $300B worth of Chinese imports and increase non-tariff barriers (i.e., a ban on Huawei equipment), is reintroducing volatility and uncertainty to a soft global backdrop. The G20 meeting (where Presidents Trump and Xi could meet) at the end of June is being viewed as the next potential catalyst for U.S.-China trade negotiations.

- Q1 earnings season was much better than expected, driven by companies with more exposure to the U.S. (and less overseas). For example, S&P 500 companies with over 50% of revenues from the U.S. exhibited 5.6% sales growth and 8.1% earnings growth on average in Q1, whereas those with over 50% of revenues from overseas grew sales and earnings by an average of 2.1% and 4.0% respectively. Looking forward, earnings growth expectations are similar for these two groups over the next 12 months.

- Focus of the Week: We expect volatility to increase in the coming weeks and would exercise patience with new purchases as favored sectors and stocks are likely to present opportunities to accumulate during weak periods.

Fixed Income

- Interest rates on both the long and short end continued their recent decline, with longer-term interest rates declining further as the 10-year Treasury yield is now over 100 bps below the November 2018 high and is at the lowest level (+2.17%) in almost two years.

- The 3-month T-Bill and 10-year Treasury note have been inverted since May 23. There has never been a longer than seven day inversion that didn’t result in a recession. If the inverted curve holds, it may act as a warning signal for a potential upcoming recession which by historical norms occurs ~8 to 13 months on average following the inversion. On the positive side, however, the 2-year and 10-year Treasury bond spread, our preferred metric given its accuracy in predicting past recessions, has not yet inverted (18 bps spread) in this cycle which gives us hope that this current soft patch will prove temporary.

- Focus of the Week: As we enter July, the market will experience the largest two-month period of municipal redemptions. Supply will not be able to match the redemption pace, which should continue to support municipal prices in the near term.

International

- On June 6 the European Central Bank might formally announce new stimulus measures for the euro zone economy. These appear most likely to be in the form of a new targeted longer-term refinancing operation (TLTRO) which supports bank lending, but may also be dependent on confirmation on June 4 of continued modest consumer inflation data in the euro zone of clearly under 1.5%.

- Focus of the Week: President Trump's visit to the United Kingdom starting on June 3 will be watched for insights into the current state of the relationship between the two historically aligned G7 powers, especially as the UK Prime Minister Theresa May will formally stand down on Friday 7 June.

Commodities

- Despite the negative U.S. inventory data in recent weeks, we remain very bullish on oil prices this summer and over the next 12+ months. We believe that the concerns surrounding the recent inventory builds are overblown, because they can be explained by a temporary increase in U.S. net imports due to a transitory narrowing in the price spread between Brent and U.S. Gulf Coast crude.

- Focus of the Week: This narrowed price spread came about because the U.S. needed to import more crude to compensate for seasonal production outages in the Gulf of Mexico and the ongoing decline in Venezuelan supply. Toward the end of May, this issue began to subside, which suggests to us that U.S. oil imports will soon be decreasing. This reduction in imports should provide a catalyst for a bounce in oil prices later this summer.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James