by Holly Framsted, Blackrock

Thinking it’s time to hit sell on your dividend strategy? Think again. First of a two-part series.

It’s no secret that with the Global Financial Crisis came the widespread decline of interest rates. Some countries even saw rates pushed into negative territory. So what’s an income-oriented investor to do? With an attractive, reliable stream of income no longer available from traditional fixed income investments, many investors looked to dividend-oriented strategies to fill this void. In fact, these strategies have seen over 121 BN USD in net flows from the beginning of 2009 through April 30, 2019[1]. That’s over 10 BN USD in net flows per year! But with bond yields gradually increasing and the rise in stock prices since the Global Financial Crisismany investors are left wondering whether now is the time to hit the sell button on their beloved dividend investments. Can dividend strategies still play a role in portfolios given the current environment? We would argue a resounding yes! In addition to historically providing consistently higher income, dividend strategies can provide greater resilience in the face of uncertainty.

1. Dividends may help provide a buffer to downside returns

It’s simple. There’s no such thing as a negative dividend. The return of an investment can be broken down into capital appreciation/depreciation and dividend payments. The former can be volatile and potentially decline to zero, while the latter, if paid, is positive and generally more predictable based on the company’s dividend payment history. Once dividends are paid, investors can redeploy that capital as they see fit. Dividends, therefore, may help buffer losses when markets turn sour.

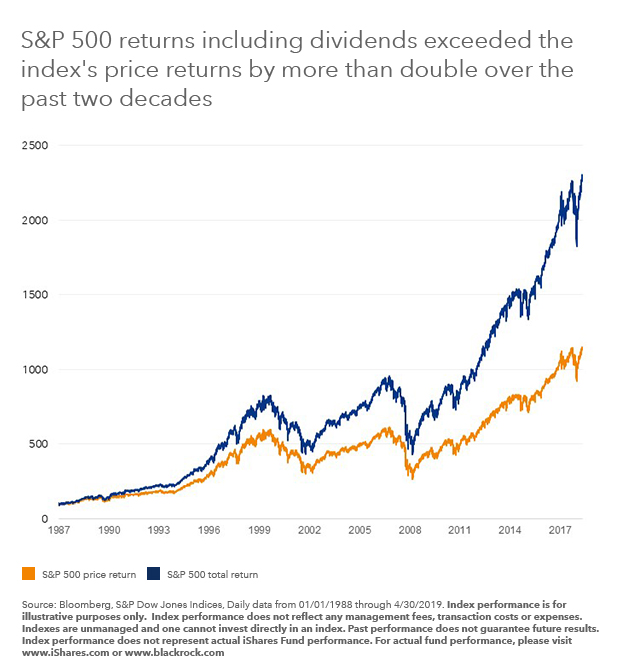

The uncertainty of market prices is one of the reasons investors have often relied on dividends: The compounding effects from the reinvestment of dividends have had a significant impact on portfolio returns over the long run. As the chart shows, reinvested dividends have explained almost 50% of the S&P 500’s total return over the past 30 years.

2. Interest rates are less likely to rise in 2019

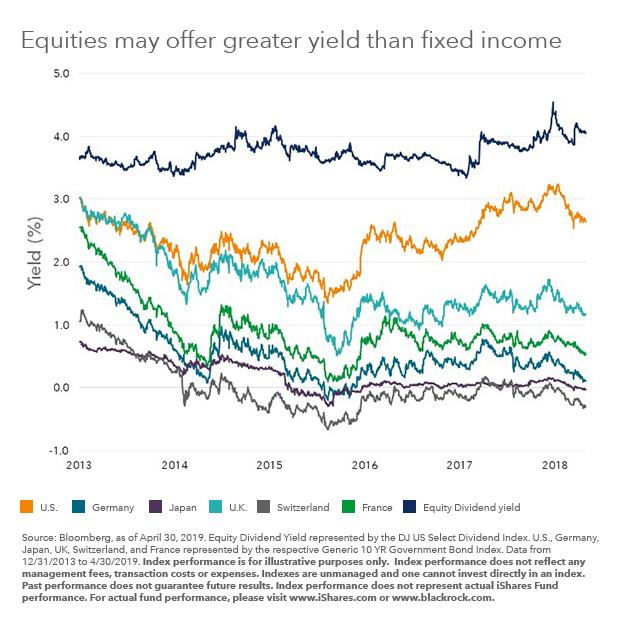

Rising interest rates are often a key theme in our discussions with clients. When rates rise, dividend-oriented stocks tend be pressured broadly. The rationale makes sense: a higher discount rate lowers the present value of a stock’s future dividend stream. However, while rates have risen somewhat, they remain low globally as the Fed and other central banks have softened their stances on rates hikes. That should help shore up the market value of dividend stocks. What’s more, with rates looking like they will stay low for the foreseeable future, equity dividend yields continue to be an attractive option for those looking for a source of income, as the chart below shows.

3. Dividends can offer portfolio resilience

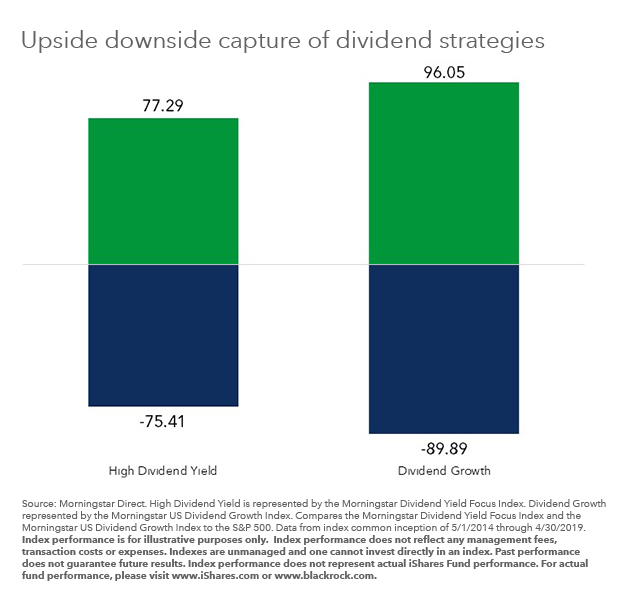

The ability to consistently pay, or grow dividends is no easy feat. It typically implies that a company has stable or rising earnings, consistent cash flow, a proven business model and disciplined management teams. These characteristics also tend to align with greater resilience over business and market cycles. As the chart below demonstrates, both high- dividend and dividend-growth stocks have experienced less downside during market declines and participated strongly on the upside.

Dividends for the longer term

Investors have long sought dividend-oriented strategies for their steady income potential and attractive risk-return characteristics. In addition, dividends have proved to be a significant component of investment returns over time. With the uncertainty present in markets today and low rates a feature for the foreseeable future, dividend strategies remain an important part of the investor toolkit and can help investors build resilience into their portfolios.

Be sure to check back for my upcoming blog on how to distinguish between dividend funds.

Holly Framsted, CFA, is the Head of US Factor ETFs within BlackRock’s ETF and Index Investment Group and is a regular contributor to The Blog. Elizabeth Turner, CFA, Vice President and Christopher Carrano, Associate are members of the Factor ETF team and contributed to this post.

[1]Source: BlackRock, as of 04/30/2019.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risks, including possible loss of principal.

There is no guarantee that any fund or security will pay dividends.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. This document contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of March 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2019 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH0519U-852340-1/1