by John Lynch, Chief Investment Strategist, and Ryan Detrick, CMT, Senior Market Strategist, LPL Financial

KEY TAKEAWAYS

- Our Five Forecasters are collectively indicating that further economic growth and stock market gains appear likely.

- This economic cycle is about to turn 10 years old, but we see reasons it can continue.

- We take a look at market breadth and stock valuations.

Our favorite leading indicators are signaling that further economic growth and stock market gain may lie ahead. With the economic cycle celebrating a record tenth birthday this summer, the big question is how much longer can the expansion go? This week, we will look at our Five Forecasters for late-cycle warnings. Historically, these indicators—which are summarized in our Recession Watch Dashboard—have collectively signaled a transition to the later stages of the economic cycle and an increased potential of an oncoming recession and bear market.

In this week’s commentary we will examine market breadth and stock valuations. In our Weekly Economic Commentary and today’s Macro Market Movers blog we will examine the other three forecasters.

MARKET BREADTH: HEALTHY

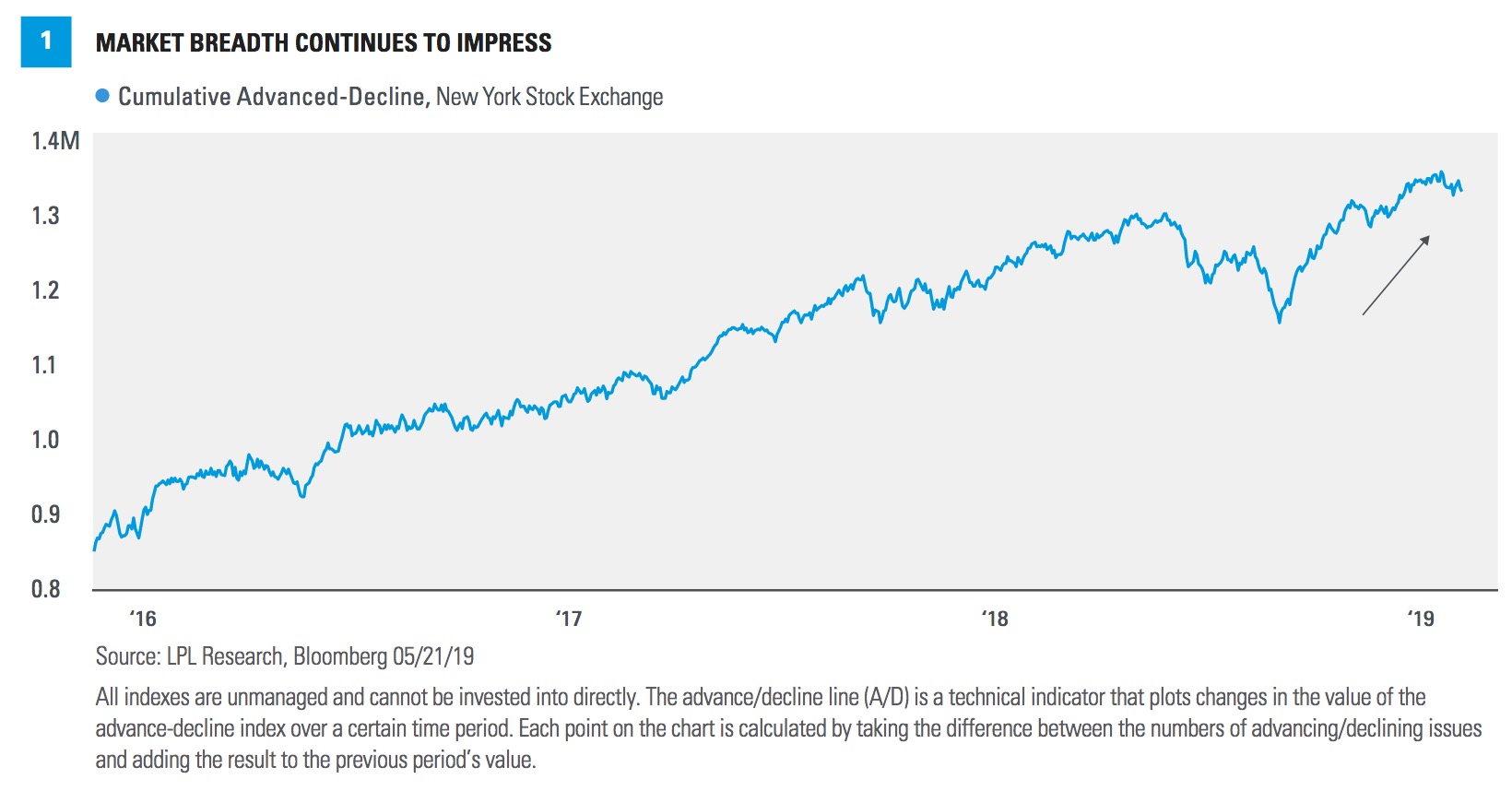

Market breadth, which we measure by the number of stocks advancing versus declining, gives us a sense of how broad and durable a rally may be. For example, if breadth begins to decline and diverge from the rise in the New York Stock Exchange (NYSE) Composite Index and is followed by an overall decline in the Index (as it begins to succumb to the dwindling number of still-rising stocks), we’ve seen that the potential for a market downturn increases. (We use the NYSE Composite because of its many constituents.)

Looking back at historical data, we’ve found that market breadth tends to top out 6 to 12 months ahead of overall equity prices. The late 1990s provide a great example: Technology was the only thing holding up the market before the weak technical underpinnings eventually led to a bear market.

Currently, the NYSE Composite Advance/Decline line shows no major warning signs [Figure 1] or any concerning divergences between equities and breadth that might suggest an imminent downturn.

VALUATIONS: REASONABLY PRICED

With stocks still up quite a bit this year (as of May 22), and throughout the entire more-than-10-year-old bull market, some of you may think stocks are expensive. We would argue they remain reasonably priced. The S&P 500 Index price-to-earnings ratio (PE) based on consensus earnings estimates (Source: FactSet) for the next 12 months stands at 16.4, slightly above the 25-year average of 16. The S&P 500’s PE against earnings for the previous 12 months is 18.3, slightly below the 25-year average of 18.7. We find these measures quite reasonable, especially given low inflation and low interest rates.

We can also gauge stock valuations by comparing stock market earnings with the earnings, or income, that bonds generate. We do this by comparing the earnings yield for the S&P 500 (S&P 500 earnings per share divided by the Index price level) with the yield on the 10-year Treasury bond. This statistic, referred to as the equity risk premium (ERP), has climbed to more than 3% currently. (It has averaged only 0.5% over the past six decades.) What does this tell us? That stocks are actually historically inexpensive relative to bonds. The best future returns for stocks have tended to come when the ERP has been over 2%, again suggesting stocks are reasonably priced and not overvalued. For more on ERP, please read our Lower Valuations Offer Long-Term Opportunity.

CONCLUSION

Despite its old age, we believe the 10-year-old bull market and nearly 10-year-old economic cycle may have quite a bit left in their tanks. We currently do not see warning signs from our favorite forecasting indicators that might signal the end of the economic cycle. However, we are not complacent. After one of the best ever starts to a year for stocks, we think a potential market correction is likely during the summer months. We continue to recommend adhering to your long-term investment plans and for suitable investors to consider using any further volatility as an opportunity to rebalance diversified portfolios back toward targeted asset allocations.

Thanks to Jeff Buchbinder for your contributions this week.