by LPL Research

Renewed trade tensions have led to this latest bout of volatility. The recent drop in the S&P 500 Index felt worse because of how quickly it happened—from new highs to down nearly 5% in less than two weeks. Keep in mind stocks have come pretty far pretty fast, beginning with the strong rally at the first of the year that put the S&P 500 back at record highs.

Swift rallies like this have also tended to lead to drawdowns as stocks typically have lost some steam midyear—hence sparking the well-known market adage “Sell in May.” The stock market was probably due for some volatility. The S&P 500 has averaged more than three pullbacks of 5% or more each year since 1990, and we’re still waiting for our first one this year. “Even though volatility has picked up, and may be with us for a while as risk of a bigger trade war lingers, a pullback or two in the coming months would be totally normal, even with fundamentals still in solid shape,” explained LPL Senior Market Strategist Ryan Detrick.

The U.S. economy continues to grow at a solid pace, it’s steadily creating jobs, wages are broadly rising, and some benefits of tax reform and other fiscal spending are still flowing through. We expect a pickup in business investment to help extend this economic cycle. Key risks beyond a full-blown trade war include lackluster growth in Europe, a messy U.K. divorce from the Europe Union, and rising geopolitical risk in the Mideast.

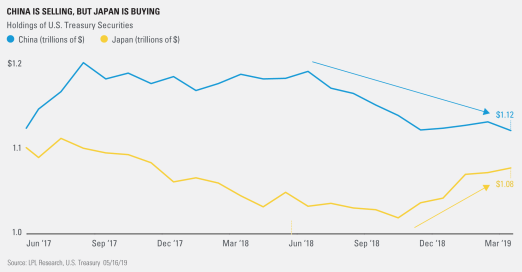

According to the U.S. Treasury, China has cut its holding of U.S. Treasury securities to a 22-month low, potentially in retaliation as the trade dispute lingers. “What isn’t discussed as much, though, is that global demand remains strong, with foreign ownership of U.S. debt hitting a record high last month,” added Detrick.

As our LPL Chart of the Day shows, China has been decreasing how much U.S. debt it holds, while Japan has silently increased its holdings for five consecutive months.

Last, we remain hopeful that the United States and China will reach some kind of a trade agreement—or at least a trade truce—in the next few months. President Trump cares about the stock market and the economy, and considers both part of his path to re-election. Both sides have a lot to lose from further escalation. And the two sides already came very close to a deal, which suggests the remaining sticking points can be worked out.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC

For Public Use | Tracking # 1-854332(Exp. 05/20)

Copyright © LPL Research