by Scott Thiel, Blackrock

We see high yield bonds as a key source of income in bond portfolios, and advocate a balanced and diversified approach. Scott explains.

Global high yield bonds sold off amid the latest spike in market volatility, along with other risk assets. Yet this does not change our view that exposure to the asset class is important for fixed income investors in an environment where carry, or coupon income, is becoming the main driver of bond returns.

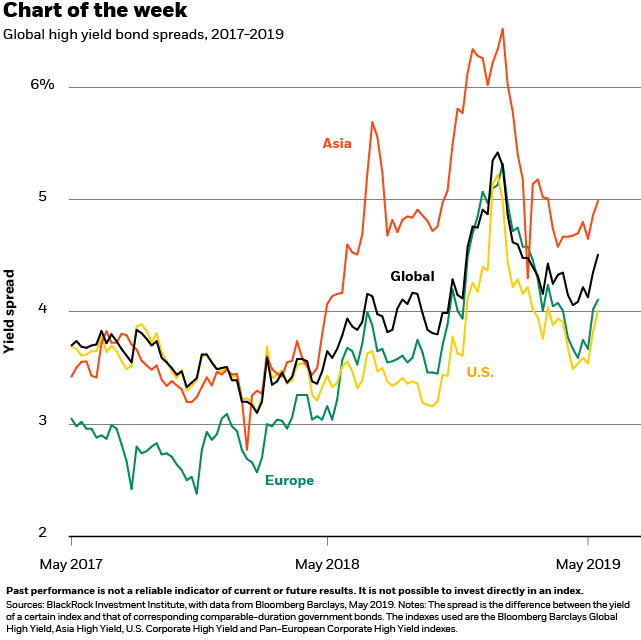

The recent selloff in global high yield is evident in the small upticks in the far right of the chart above. High yield bond spreads – the difference in yields between high yield bonds and comparative government bonds – have widened, as perceived safe havens outperformed. These moves come amid a longer-term widening trend in credit spreads over the past couple of years. We see rates generally stable in the near term, with income taking back the reins from price changes as the key driver of credit returns in the quarters ahead, as we write in our latest Fixed income strategy update Carry is king. The patient stance of global monetary policy makers amid ongoing low inflation supports this view. A slowing, but still growing global economy – with recent data pointing to signs of European and Chinese growth pickups – does too.

How the regions stack up

A flare-up in U.S.-China trade tensions sparked recent market volatility – and the accompanying selloff in high yield bonds and other risk assets. We see a narrow path ahead for risk assets to move higher at this late stage of the business cycle, but escalating trade conflicts could make this path even narrower (see our geopolitical risk dashboard for more on trade tensions). We believe a balanced, diversified approach is key to investing in this environment. For fixed income investors in particular, we see high yield bonds as a key part of this approach, given their income-providing potential.

We see reasons to like U.S. high yield. First-quarter corporate earnings results pointed to healthier fundamentals in high yield issuers. These include signs of declining gross leverage and near-record high levels of interest coverage – a measure of issuers’ ability to service their debt. In addition, the longer-term credit quality of the index has improved. Evidence includes a shift in issuance toward higher quality (less CCC-rated bonds), shorter maturities and larger individual issues. Fewer leveraged buyouts and an increase in the share of secured bonds are also positives. We believe this improved risk profile should support greater stability in the asset class’s performance. We are more cautious on European high yield. Europe’s relatively greater vulnerabilities to geopolitical risks and slower growth make for a less attractive risk/reward profile, in our view. Yet we see the asset class as attractive from a fixed income portfolio perspective, particularly for U.S. dollar based investors. Spreads on euro high yield bonds are roughly 1 percentage point higher than their U.S. counterparts after adjusting for different ratings quality, we estimate. And interest rate differentials mean U.S. investors can gain an extra 3 percentage points in yield after hedging euro exposure back into dollars.

Lastly, we see attractive income potential in Asia high yield, despite the risk of a further deterioration in the U.S.-China trade relationship. Corporate fundamentals have improved since 2017 due to strong earnings, following years of deterioration.

Bottom line

We see high yield bonds as an attractive source of income in a world where carry is king. And we advocate a balanced approach, given geopolitical risks such as global trade tensions — and potential for further late-cycle bouts of volatility.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.