by Dan Roarty, AllianceBernstein

Many equity investors want to help create social benefits while generating strong returns. Deploying a clear investment process that draws on the UN Sustainable Development Goals and integrates environmental, social and governance (ESG) factors in research can help investors achieve these twin goals.

Building a sustainable equity portfolio is no easy task. It requires a thorough process that can sift through thousands of global firms to identify those that are really making a difference on ESG issues. Equally important, it requires disciplined financial analysis to make sure that an ESG-focused target company is a good long-term investment.

Social Benefits and Return Potential

Apollo Hospitals, an Indian healthcare provider, provides a good example. The company operates the largest chain of private hospitals and pharmacies in India. Two years ago, we traveled to India to find out how the Apollo is helping fill the gaps where India’s public healthcare system has failed to deliver. For responsible investors, the company is a great example of an opportunity to help create social benefits while also generating profits.

With one of the country’s most trusted healthcare brands, Apollo is benefiting from rising demand for hospital beds. Its innovative business model includes a telemedicine command center to connect rural clinics with doctors in larger cities. Our research in 2017—including a grassroots meeting with consumers—gave us confidence that Apollo was poised for sustainable revenue and earnings growth.

A Blueprint for Responsible Equity Investment

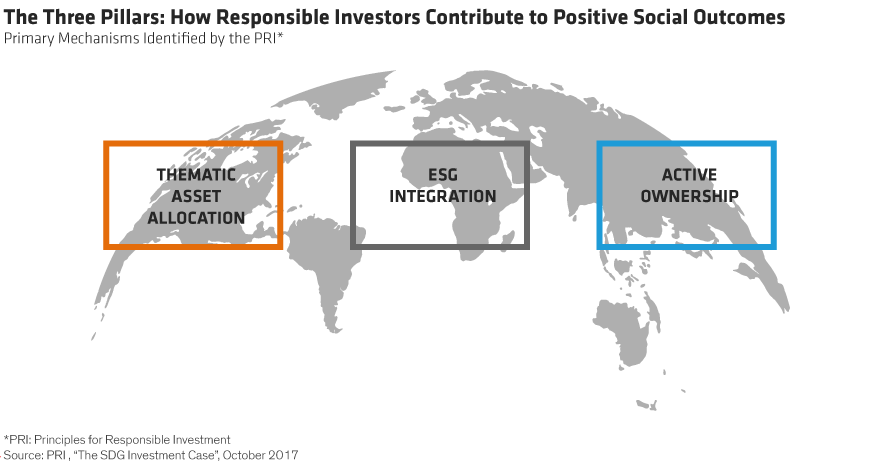

Finding companies like Apollo requires a clear blueprint for a sustainable investing plan. Investors can start with the Principles for Responsible Investment (PRI), an independent network supported by the United Nations and endorsed by more than 1,800 signatories across the global financial industry. In a report published in October 2017, the PRI outlined three pillars of responsible investing (RI) practices: thematic asset allocation, ESG integration and active ownership (Display 1).

These three pillars can help equity investors translate ESG words into action. As people around the world pay closer attention to how their money is deployed in investment portfolios, the asset-management industry has responded with an endless array of responsible portfolios. But it can be hard for investors to really know how an investment strategy’s process and positioning deliver on ESG ambitions—or if they do at all.

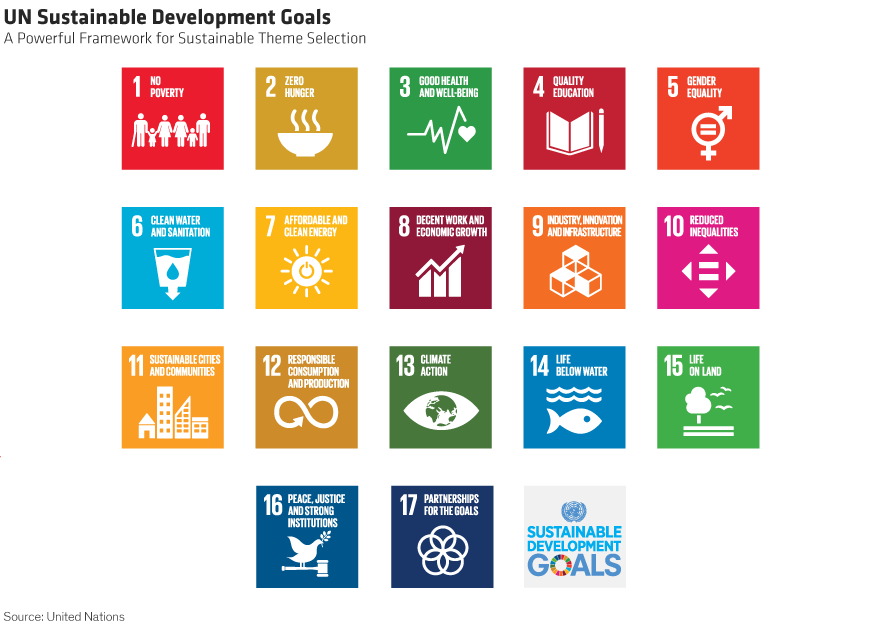

The UN has made big efforts to advance the development of RI. After the PRI was launched in 2006, the UN introduced the Sustainable Development Goals (SDGs) in 2015. The SDGs represent an aspirational view of what the world could look like by 2030 and include consideration of the role that the private sector must play to achieve these goals.

The 17 goals and 169 specific targets address areas of critical importance to humanity, including eliminating poverty and hunger, improving access to education and healthcare, and addressing the negative impact of climate change (Display 2). Crafted and agreed to by 193 nations, the SDGs attempt to build on the earlier Millennium Development Goals by broadening the focus beyond developing markets and explicitly considering a role for the private sector. These important changes make the SDGs a more useful tool for equity investors.

Fulfilling these goals will require about US$90 trillion of investment over 15 years, according to the UN. That’s a very tall order. Philanthropy and government spending will play an important role, but won’t be enough to get the job done. The private sector—and equity investors—must be the biggest part of the solution, in our view.

Why Do Equities Matter for a Responsible Investing Agenda?

In its 2017 article on the SDGs, the PRI aimed to guide investors toward action that can lead to tangible results by outlining its three mechanisms for “positive outcomes,” or tangible real-world change. Now the onus is on investors to demonstrate how they incorporate these mechanisms in their day-to-day portfolio management. We’ve developed a disciplined process over several years that is consistent with the three pillars, designed to find stocks that can make a difference and deliver long-term returns in a focused sustainable portfolio.

Investing in equities matters in an RI agenda. Investing in stocks is important for responsible outcomes because publicly traded companies are massive. They employ the most people around the world, consume the most natural resources, generate the most pollution and have a large impact on political systems because of their lobbying efforts and financial muscle. As a result, what they do has a profound effect on countries, societies and sustainability in general. Shareholders who deploy a coherent approach to both making investments and wielding influence can make a big difference.

This blog is based on a white paper that was published in April 2019 titled Responsible Returns: Better Stocks for a Better World.

Dan Roarty is Chief Investment Officer—Thematic and Sustainable Equities at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein