by Jørgen Kjærsgaard, Fixed Income, AllianceBernstein

European Banks have mostly been magnets for bad news and disappointment for their equity holders. But we believe other parts of the banks’ capital structure offer solid returns, backed by resilient balance sheets.

The Problem? Poor Profitability, Not Weak Balance Sheets

European banks have been struggling to improve profitability in a persistently tough environment. Continuous low rates, a flat yield curve and low regional economic growth have proved to be a toxic trifecta for their earnings. On top of that, equity shareholders have faced a continuing stream of governance lapses and potential litigation. It’s little wonder that European bank stocks have performed badly—both compared with the wider stock market and in absolute terms—over the last few years.

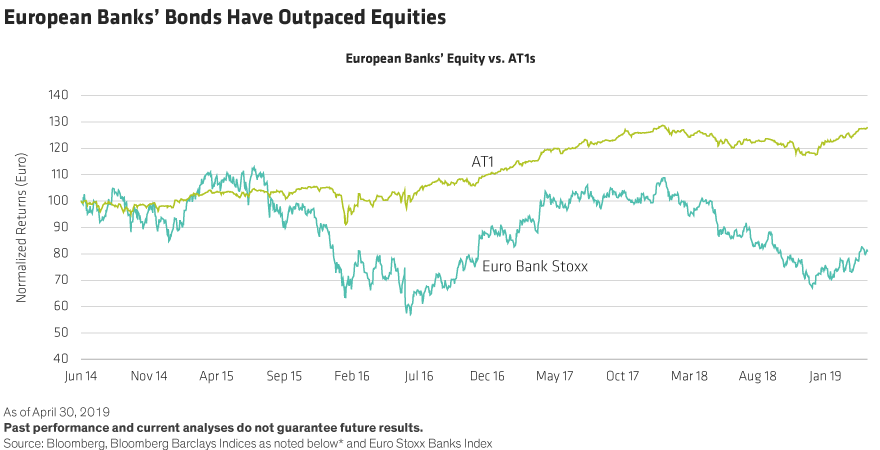

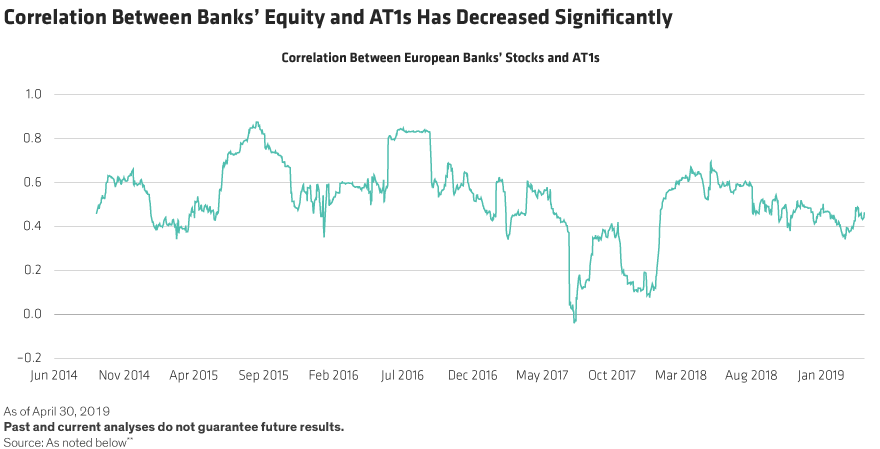

On the other hand, European bank bonds have generally performed well. In particular, contingent convertible securities (CoCos)—including Additional Tier 1 (AT1) CoCos—have delivered robust returns, driven by stronger and more liquid bank balance sheets, with higher capital and better asset quality. The result has been a divergence in performance, with AT1s outperforming banks’ stocks by almost 50% over the last five years, and a lower correlation between banks’ bonds and equity (Displays, below).

Over this period, AT1 prices have also been relatively stable, with volatility ranging between just 6-8%—compared to equity volatility averaging around 25%.*

Choosing the Right Exposures to Banks for the Future

There are several reasons why, going forward, we think AT1s offer an attractive opportunity for European investors.

First, most European banks’ balance sheets are strong, and will suffer relatively low impact from pressure on earnings.

Second, in an income-starved market, AT1s offer exceptional yields for securities backed by strong issuers. Plus, the average coupon (currently 7% in USD terms and 6% in EUR terms) is less discretionary, and so less vulnerable than an equity dividend distribution.

As a result, the coupon and carry of AT1s remain the main sources of return and provide a substantial cushion against any potential price depreciation. By contrast, banks’ stocks lack this level of downside protection—while in many cases their upside potential remains limited by weak earnings’ prospects. It’s no surprise, then, that AT1s have exhibited substantially less volatility than banks’ equity shares.

Of course, there are exceptional cases. Selective equity investors can still find opportunities in specific European banks that have stronger fundamentals than their peers, attractively valued stocks and company-specific catalysts for a potential rebound. But overall, in the current environment we see advantages in AT1s. In our view, the euro area will continue to experience low but positive growth, and European banks’ non-performing loans will likely continue to stay low with minimal capital deterioration. Over the last nine years,** against a similar backdrop, European banks’ AT1s have returned an annualized 7.4% in euros. As long as the European economy avoids recession, we expect banks’ AT1s to continue to perform relatively well.

Managing for Performance

Against this backdrop, European bond investors should take a close look at the financial sector. Despite challenges to profitability, bank balance sheets will likely remain solid, supporting AT1s and their highly attractive yields. The key for future performance is to adopt a dynamic investment approach across countries and across the banks’ capital structure. In our view, that’s the way to navigate a continuing tough and volatile environment for the European banks.

* Returns are calculated using the Legacy Tier 1 Index (the Bloomberg Barclays Global Capital Securities Tier 1 Index) from December 2009 to December 2014 as a proxy for the AT1s, as they did not exist at that time, and using the AT1 index from December 2014 until 5 April 2019 (the Bloomberg Barclays European Banks CoCo Tier 1).

** Volatility and three-month correlation is calculated using daily data from the Bloomberg Barclays European Banks CoCo Tier 1 Index and the Euro Stoxx Banks Index from 18 June 2018 until 12 March 2019.

Past performance is no guarantee of future results.

This article is not intended as investment advice. Readers should make sure they obtain appropriate advice from their financial advisor before making an investment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

This post was first published at the AllianceBernstein blog

Copyright © AllianceBernstein