by Tony Zhang, Option Matters

Many equity investors utilize options to generate income on their portfolio. A covered call is the single most popular options strategy to add income to the existing stocks and ETFs in your portfolio. This simple option strategy only requires 100 shares of a stock or ETF and selling a call option against it to generate yield. Effective in most market conditions and outlooks, this income strategy is suitable for most investors. However, selecting the right expiration and strike price may seem daunting with so many options, this is where OptionsPlay eases the process! See how you can access OptionsPlay free of charge at www.optionsplay.com/tmx.

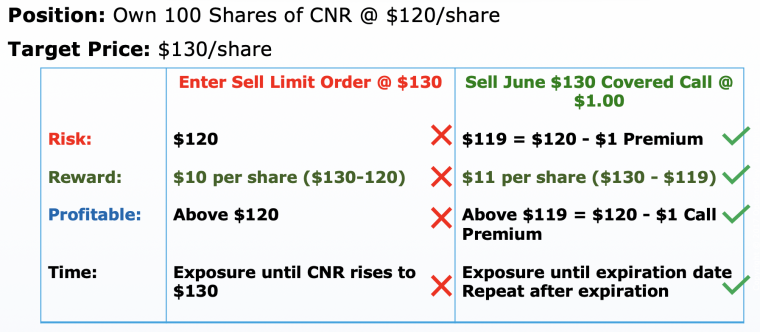

Covered Call vs. Sell Limit Order

Imagine buying CNR stock at $120/share and having a target price of $130. You have two choices; place a sell limit order at $130 and wait, or sell a covered call with a $130 strike price. Selling a 2- month $130 strike call could generate an immediate income of $1 per share ($100 per 100 shares). Conversely, placing a limit order would not offer any income. Additionally, with the $1 income, your risk is reduced to $119 while your maximum gain is now increased to $11, instead of $10 with the limit order. Lastly, with covered calls, you have the opportunity to sell calls every month if the stock does not finish above the strike price by the end of the expiration cycle, therefore generating a consistent income stream!

Table 1: Comparing Covered Call vs. Limit Sell Order

Source: OptionsPlay

Selecting the Right Strike Price

Selling a covered call obligates you to sell the stock at the strike price upon the expiration date if the stock closes above the strike price. Just as a limit order would be placed at a price higher than the current price, the same methodology applies to selling a covered call. Covered calls should be sold with “Out-of-the-Money” (OTM) strike prices. For example, if CNR was trading at $120, an investor might want to sell a call option with a $130 strike. The higher the strike price, the less premium is paid to the seller as there is a lower probability of the stock price reaching the strike price before expiration. Picking a strike price that is close to the current price of the stock may be tempting with higher premiums, but the tradeoff is limiting the gains on the underlying stock. This tradeoff is the primary decision every investor must make when selecting a strike price for covered calls. Our research shows that a 20 Delta Call (20% chance of the stock being called away) provides a reasonable balance between income and upside gains for the underlying stock.

Managing Expiration Dates

Selling short-term options (three to seven weeks) tends to provide better long-term returns. Short-term option contracts have an advantage due to the ability to avoid earnings announcements. Additionally, shorter-term options take advantage of accelerating time decay as an option approaches expiration. Longer-term options simply do not offer the same yield for the same unit of time and typically have a higher probability of including an earnings announcement.

Short Dated: Sell 12 x 1-Month Calls = 4 out of 12 Per Year (25% have earnings uncertainty)

Long Dated: Sell 4 x 3-Month Calls = 4 out of 4 Per Year (100% have earnings uncertainty)

A Practical Application of Covered Calls

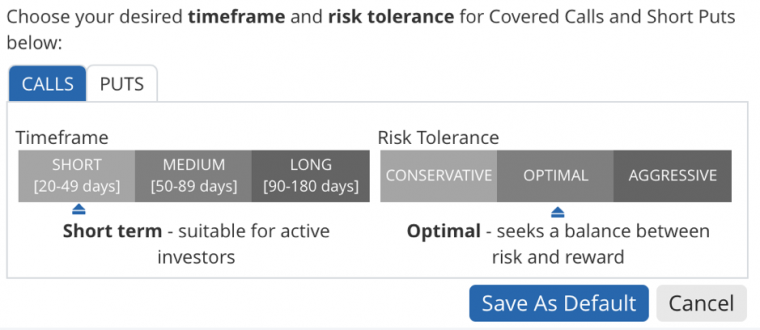

With any option strategy, manual selection of expiration and strike prices subjects an investor to mistakes and emotions that affect trading performance. The covered call is a strategy that yields the best results when a systematic approach is implemented. OptionsPlay is designed to automate the selection process to facilitate a systematic approach, increasing yields while reducing research time. Utilize OptionsPlay Income Settings to personalize your covered call preferences and allow OptionsPlay to find the covered calls to suit your needs. Simply select a time-frame (Short, Medium or Long) and risk-tolerance (Conservative, Optimal or Aggressive).

Please view our full webinar on this topic to see this platform in action.

Chart 1: OptionsPlay Income Settings

Source: OptionsPlay

With covered calls, the goal is to hold the trade until expiration and let the contract expire worthless. Therefore, it is important to pick a strike price and expiration that minimize the risk of the stock reaching that price while maximizing the premium received. Once an option expires worthless, the covered call strategy can be repeated, generating a consistent stream of income from simply owning any stock or ETF. Utilize your free access to OptionsPlay to help you find the right balance between income and probability of selling your stock. Lastly, keep in mind that if your stock does get called away, this equates to a large gain in your underlying stock position and a profit taking opportunity!

Take advantage of free access to OptionsPlay Canada: www.optionsplay.com/tmx

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

The post The Definitive and Practical Guide to Selling Covered Calls appeared first on Option Matters.

This post was originally published at the Option Matters blog.