by Frank Caruso, AllianceBernstein

Technology unicorns are in the spotlight, with Uber’s high-profile IPO expected this week. As scrutiny of their business models intensifies, we think investors should also ask tough questions about publicly traded companies with high sales growth but scant cash flows.

Uber’s quest to raise $10 billion is making big headlines. It’s one of a group of privately held firms worth at least $1 billion, known as the unicorns, including Airbnb and WeWork. Globally, there are more than 300 unicorns worth about $1.1 trillion, according to CB Insights. These companies have garnered millions of users and customers around the world, and many have generated strong sales. But collectively, they’ve racked up billions of dollars in losses, and few have posted any profits at all.

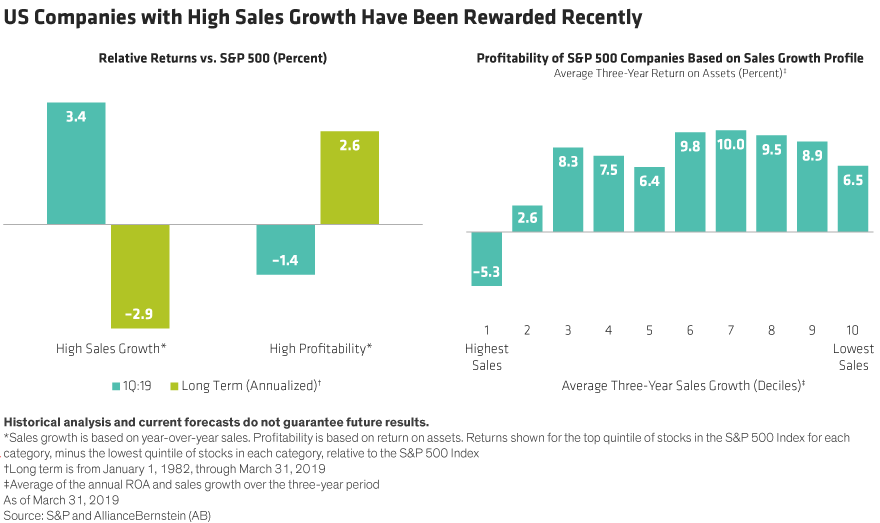

Perhaps coincidentally, investors in US stocks have been enamored by sales growth recently. In the first quarter of 2019, shares of US companies with high sales growth delivered relative returns of 3.4% versus the S&P 500, while those with high profitability fell by 2.9% (Display, left). This contrasts with the long-term tendency of high-sales-growth companies to underperform those with high profitability, as measured by returns on assets. What’s more, our research shows that companies with the strongest sales growth are also the least profitable (Display, right).

Risk Appetite Reduces Sensitivity to Profitability

So what’s been going on? In some ways, these performance patterns aren’t unusual. During the first quarter, markets shifted back to risk-on mode after the late-2018 downturn. When risk appetite improves, investors feel more comfortable buying stocks with little or no profitability. Like the unicorns, strong sales growth in a publicly traded company looks like an appealing attribute that may signal future profitability potential, especially in a world of slowing macroeconomic growth.

But for that potential to be real, you need to ask how the company is generating sales. The tech unicorns are very young companies operating in “land-grab markets”; in other words, they’re throwing massive resources at gaining market share in newly created markets for things like ride shares or desks for rent. The result is high sales growth and no profits.

In their defense, some unprofitable companies have high free cash flows. However, we believe that these cash flows may be fueled by deferred revenue and be distorted by the use of stock-based compensation on the expenses side.

Stock Compensation Distorts Cash Flows

Public companies with high sales growth are subject to similar financial distortions. We took a closer look at S&P 500 companies based on their sales growth profiles and free-cash-flow (FCF) yields. Then we adjusted the FCF yield to account for stock compensation expenses.

The results were striking. Stripping out stock compensation expenses reduced FCF yields—especially for companies with the highest sales growth, whose yields turned negative (Display).

Late-Cycle Concerns

These trends raise some red flags for investors, in our view. In a strong economy and market, the use of stock compensation is less worrying. That’s because when the stock vests, the employee benefits from the higher strike price and the company enjoys a tax benefit that flatters its cash flows.

But what happens in a weakening economy and softer market? Then it becomes more difficult to retain employees with stock-based compensation. This, in turn, makes it harder to maintain sales growth and ultimately leaves shareholders out in the cold.

We don’t think we’re facing a tech bubble, like the one 20 years ago, which featured a concentration of extremely expensive stocks and very inexpensive “old economy” stocks. That said, there are some similarities. The price/sales ratio of the S&P 500 has reached 2.1x, similar to the levels seen in the dot-com bubble, while young, unprofitable tech companies are quite expensive, in our view. At the same time, we’re witnessing a deluge of IPOs as private companies seek to cash in on a buoyant market before it’s too late.

Recent trends serve as a reminder for investors. Whether investing in a unicorn IPO or a publicly traded company, always look beyond the headline sales figures, as seductive as they may seem. And be wary of companies that don’t have real cash flows to support their top line. In our view, high and rising profitability, backed by solid business models, is the best formula for identifying investments with solid growth and return potential that can stand the test of time.

Frank Caruso is Chief Investment Officer of US Growth Equities at AB

Vince Dupont is Portfolio Manager of US Growth Equities at AB

John Fogarty is Portfolio Manager of US Growth Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

This post originally appeared at the AllianceBernstein blog

Copyright © AllianceBernstein