by Isabelle Mateos y Lago, Blackrock

Trade tensions between the U.S. and Europe may be heating up. Isabelle explains the potential impacts.

We expect a recovery in Europe’s economy later in the year. But there’s a key risk to this base case of ours: Trade tensions between the U.S. and Europe may become front and center, as the two sides get ready to start trade negotiations. We would expect the direct economic fallout to be manageable, but it could have outsized market impacts.

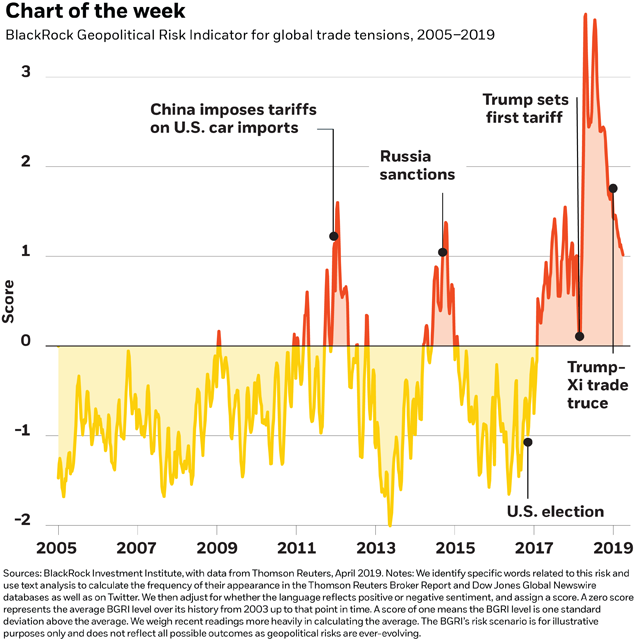

The market’s attention to global trade tensions has dropped off from last summer’s peaks. It now stands less than one standard deviation above the long-term average, as measured by our BlackRock Geopolitical Risk Indicator, which scans analyst reports, financial press and tweets for keywords related to the risk. See the chart above. Our work shows that the potential market impact of a particular risk is typically larger when the market’s attention to it is low. We may have arrived at such a moment with global trade tensions: Market fears over trade tensions have calmed over recent months as the U.S. and China inch toward a trade deal. Focusing on just that–or expecting trade problems to go away with a U.S.-China trade deal – is risky. U.S. President Donald Trump appears keen to apply his “playbook” from U.S.-China negotiations–using tariffs as a key tool–to talks with the European Union (EU). European leaders have made clear that they would retaliate swiftly, and neither side is likely to back down in a hurry.

A bumpy road ahead

We expect the European economy to pick up pace in the second half of 2019. Financial conditions have eased significantly since the start of the year, and China’s stimulus efforts could boost capital spending–a potential boon for Europe’s manufacturers. The pressure on growth from some one-off factors last year (such as Germany’s auto production shortfalls) may be subsiding. An economic recovery would help underpin European stocks, a laggard in global markets for the majority of the post-crisis period. European stocks are trading at a 12% discount to developed market peers. But high-quality stocks including multinationals are trading at a premium to the rest of European market, while the structurally challenged sectors are at a discount.

Trade talks between the U.S. and EU are set to start, after the two parties had put a tariff tit-for-tat on hold in July 2018. The negotiation objectives laid out by the two sides have highlighted some key challenges. For example: Greater market access for agricultural products is a key focus for the U.S.–and explicitly excluded from the scope of the talks by the EU. Potential U.S. tariffs on Europe-made vehicles are another focus. The direct impact from any auto tariffs on Europe’s growth would likely be contained, according to studies by the IMF and by the European Central Bank (ECB). Heated trade tensions between the two also would likely have global implications. We see the full impact on the European–and global–economies as potentially larger if trade tensions led to a hefty shock to confidence and a material tightening of financial conditions, as they did in 2018. If the growth outlook did worsen, we see European policymakers as having limited fire power to support the economy. The ECB has little room to further ease its monetary policy. And high debt levels mean many countries (except Germany) are already running out of headroom to deliver substantial fiscal stimulus.

Bottom line

Investors should not mistake a U.S.-China trade deal for a resolution of global trade tensions, as the U.S. ITS turning his focus to Europe. Political risks including trade tensions keep us cautious toward European risk assets, even as we see signs of green shoots emerging in the European economy. We prefer to take equity risk in other regions such as the U.S. and emerging markets.

Isabelle Mateos y Lago is BlackRock’s Chief Multi-Asset Strategist. She is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

BIIM0419U-833718