by Gershon Distenfeld, Director, High Yield, Fixed Income, AllianceBernstein

The S&P 500 Index hit an all-time high on April 23, thanks to improving investor optimism. But for some equity investors, market highs signal a good time to reduce downside risk.

There are additional reasons investors may want to trim their sails. We’re nearing the end of one of the longest credit cycles on record. And the US yield curve has flattened—historically a signal of slower growth or possibly a recession ahead. Market conditions are likely to get rough.

That’s why it’s time to remind investors that—while equities should continue to comprise a very large part of a portfolio—a complementary allocation to high yield can be healthy.

Want Lower Volatility? Consider High Yield

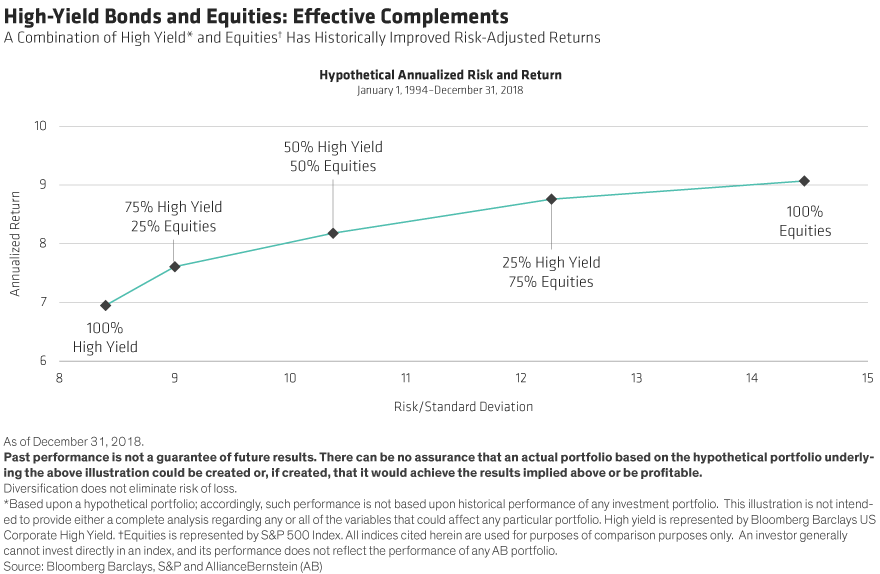

Investors can efficiently lower their overall risk while only modestly curbing potential returns by shifting a modest allocation away from US equities and into US high yield (Display).

How is this possible?

First, high-yield bonds provide investors with a consistent income stream that few other assets can match. This income—distributed semiannually as coupon payments—is constant. It gets paid in bull markets and bear markets alike. It’s the main reason high-yield investors have historically looked at starting yield as a remarkably reliable indicator of future returns over the next five years—no matter how volatile the environment. After accounting for maturities, tenders and callable bonds, the high-yield market typically returns anywhere from 18% to 22% of its value every year in cash.

Along with these payments, high-yield bonds also have a known terminal value that investors can count on. As long as the issuer doesn’t go bankrupt, investors get their money back when the bond matures. All this helps to offset stocks’ higher level of volatility—and provide better downside protection in bear markets.

Average calendar year returns for the S&P 500 and the Barclays US High-Yield Index between 1998 and 2018 were 8.2% and 7.4%, respectively. But the average drawdown for stocks over that period was 11.0%, nearly twice high-yield’s tally of 5.7%.

Recovering Losses Quickly

Some of high-yield’s advantage comes down to valuations. As spreads widen, high-yield bonds’ income-generating potential grows, and investors can reinvest their proceeds at higher yields. And if spreads widen in 2019, causing short-term price declines, investors can take comfort in knowing that high yield tends to make up its losses more quickly than stocks do.

For instance, the high-yield market has suffered 10 peak-to-trough losses of greater than 5% over the last 20 years. On average, investors recovered their losses from those drawdowns in less than six months—and sometimes in as few as two. Meanwhile, stock markets have seen much larger losses and have taken longer to recover from drawdowns.

Of course, it’s still critical to choose your exposures carefully. It’s late in the credit cycle and default rates will likely rise this year. And companies with high debt levels are likely to remain highly sensitive to signs of slower growth.

But over the long run, we’ve seen that adding a dash of high-yield debt to an equity portfolio can tamp down volatility without sacrificing too much return potential. When markets are volatile, that’s a reassuring thought.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

Gershon Distenfeld is Co-Head of Fixed Income and Director of Credit and Will Smith is Portfolio Manager–High Yield Credit at AllianceBernstein.

This post was first published at the AllianceBernstein blog

Copyright © AllianceBernstein