by Scott Thiel, Blackrock

We are cautious on U.S. Treasuries in the short term after the recent rally. Yet we still advocate exposure to build portfolio resilience. Scott explains.

U.S. Treasury yields dropped sharply in March, breaking out of the tight range they had traded in early this year. Could yields head lower still, extending the rally in Treasury prices? We take a cautious short-term stance, and see recent moves as excessive. Yet we still like U.S. Treasuries for their key role as portfolio diversifiers.

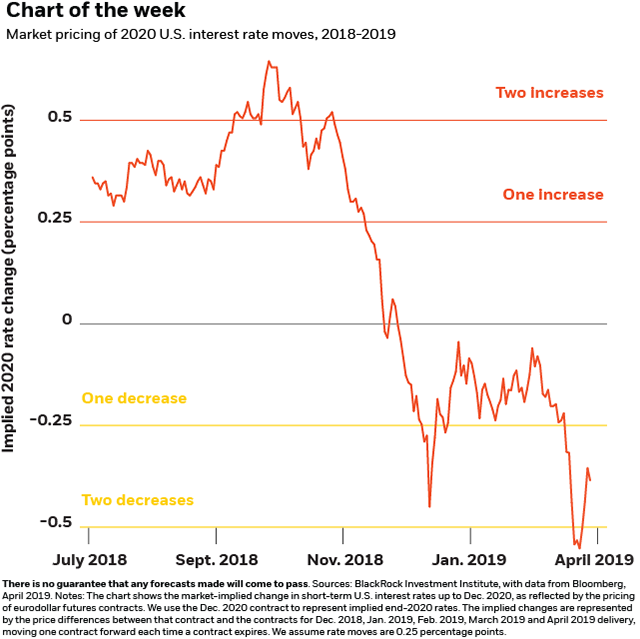

Just one illustration of the extent of the recent rally: The 5-year U.S. Treasury yield fell to 2.25% from 2.5% over the course of March, a similar move not seen since the late-December drop in global equity markets. Yields have recovered somewhat in early April, but remain well below early-March peaks. A major factor fueling the rally in Treasury prices: Market reaction to the Federal Reserve’s dovish pivot this year, with the central bank indicating its rate hike pause could be an extended one. Yet we believe market expectations of Fed policy have become too dovish. Markets have swung from pricing in two quarter-percentage-point Fed rate increases between fall 2018 through the end of 2020 to now pricing in two decreases by the end of 2020. See the line’s drastic downward shift since last fall in the chart above. We still expect the Fed’s next rate move to be up—just not for a while as the Fed remains on hold.

Be patient like the Fed

We also attribute the U.S. government bond rally to markets overreacting to surprisingly weak European economic data. The data reinforced the economic downside risks the European Central Bank pointed to in early March, when it gave a more dovish forward guidance for rates. This was part of a global dovish shift in central bank policy. Investors appear to have interpreted the weak European data as a sign that the global economy is slowing more than previously expected. We do see global growth slowing as the long post-crisis expansion nears its final stage, but we expect the global economy can remain in the late-cycle phase, avoiding recession throughout 2019 (see our Global investment outlook Q2 2019). A rebounding Chinese economy should help global growth, and U.S. growth is again poised to outpace that of developed peers, including Europe.

The recent surprise move lower in Treasury yields also seems to have been exacerbated by technical factors. When bond yields broke sharply below their recent ranges, some investors in markets such as U.S. mortgages were prompted to buy additional U.S. Treasuries to hedge their positions. This type of buying rarely has a long-lasting impact on a market as liquid as that of U.S. Treasuries, in our view. Against this backdrop, we advocate patience before adding to U.S. Treasuries exposure, and see yields moving back into their early-2019 range (2.4% to 2.6% for the 5-year yield). We focus on the 5-year, as a relatively flat yield curve means the incremental yield currently offered by longer-term exposures is not worth the extra interest rate risk, in our view.

We do see Treasuries retaining their attraction as portfolio diversifiers. The traditional inverse relationship between U.S. equity and government bond returns is alive and well. We see the negative correlation being sustained in this late-cycle period, with Treasuries acting as a buffer to any selloffs in risk assets driven by growth scares. In fixed income overall, we still see income as king. We expect income (carry) to power returns in the quarters ahead, taking the reins from price appreciation. We prefer shorter-dated bonds and allocations to inflation-protected securities, amid the likelihood of a steeper yield curve and higher market-based inflation expectations.

Scott Thiel is BlackRock’s chief fixed income strategist, and a member of the BlackRock Investment Institute. He is a regular contributor to The Blog.