by Blaine Rollins, CFA, 361 Capital

Bond investors liked it. Stock investors loved it. The President and White House pulled the strings perfectly so that it appeared that the Federal Reserve Board members were not acting out of their own accord. The magnificent performance began at the end of December and after a few missteps and crossed strings, the show ran perfectly. First, the Fed puppets conveyed that they would stop shrinking the balance sheet and then that they would stop raising the Fed Funds rate. Some even suggested that rate cuts were behind the curtain. Investors clapped and cheered like little kids at a Punch and Judy show and the financial markets roared to their best first quarter in years.

So what did we learn the last four months?

Rule #1: Don’t fight the Fed.

Rule #2: The POTUS wants to be re-elected.

Rule #3: This Fed is completely controlled by the POTUS.

Bottom line is that the Fed is being HEAVILY pressured to cut interest rates over the next two years. And if they don’t do it then their TV talking head replacements will do it for them. As short-term rates are cut, the economy will get more pumped, scaring longer term fixed income investors which should then steepen the yield curve. Even though the curve just inverted last month, that is probably the last we will see of it unless credit breaks. Economic data should start to improve through the summer, unless the trade wars and a closed Mexican border impede global commerce. The equity markets are trying to tell you that the economy is going to get better. The Treasury bond markets disagree, but the Credit markets choose the side of equities.

I didn’t foresee the White House calling all the shots at the Fed. I thought in November that an independent Fed would remain on track to build up reserves for the next credit crisis. When the Govt shutdown stopped the economy and the markets fell apart in December, I thought that it was prudent to be overly cautious. So the quick caving of the Fed in December caught me flat footed and under-invested in U.S. equities in the first quarter. I applaud any investor who was positive in both December and in the Q1.

From here, you have to have some risk on the books. I want my tallest stack of chips to be in the Emerging Markets which have a valuation advantage, a shot at more green shoots and a potential U.S./China trade deal. But with short-term rates falling and the curve steepening, you will have a tailwind to most equity sectors and geographies. Among U.S. sectors, plenty of great companies to own in the Technology and Consumer spaces. Be picky in Healthcare with all the moves and battles in Washington. And of course, I still want to own bonds, but maybe a bit shorter in maturity now. Also would stick to higher quality but still surprised by how well junk bonds have done. With inflation looking grim in Europe and now in the U.S., a big tailwind for Gold might be gone so I wouldn’t have many chips there. These are crazy times. This show has more twists than a Jordan Peele film so sit back and try to enjoy it.

To receive this weekly briefing directly to your inbox, subscribe now.

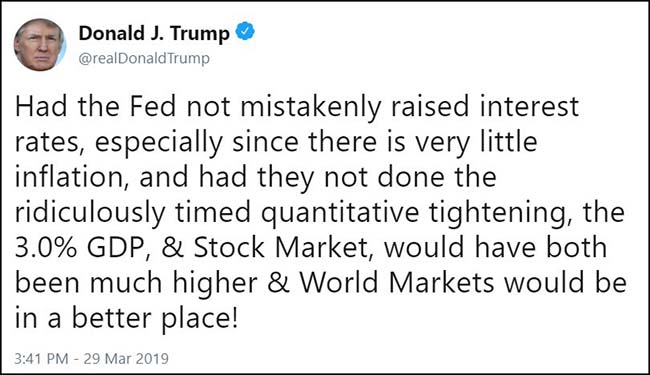

The White House absolutely owns the Fed right now…

And given the wise words of the late Marty Zweig, we don’t fight the Fed. So, it appears that short-term interest rates will continue to be on a downward path through the next election. It also appears that the Fed is going to have much more experienced TV commentators joining its ranks. Can’t wait to see how the future Fed minutes evolve. Maybe evidence of food fights or personal insults?

And the White House would like the Fed to cut rates by 50 basis points…

National Economic Council Director Lawrence Kudlow told The Wall Street Journal in an interview they would like to see the central bank lower its benchmark federal-funds rate by half a percentage point, which would put it in a range between 1.75% and 2.00%.Mr. Kudlow said he believed rates needed to be cut “as a precaution.”

He noted as a concern the recent bond-market rally that has pushed long-term yields below short-term yields, a so-called inversion of the yield curve that tends to predict interest-rate cuts and has preceded recessions by one or two years.

“I don’t want any threats to the recovery. I’m aware of the inversion of the yield curve, and I’m aware of the rest of the world’s weak economy,” he said.

Despite the unusual public pressure the White House is putting on the Fed to cut rates, Mr. Kudlow said the administration respects the independence of the central bank’s decision-making authority.

(WSJ)

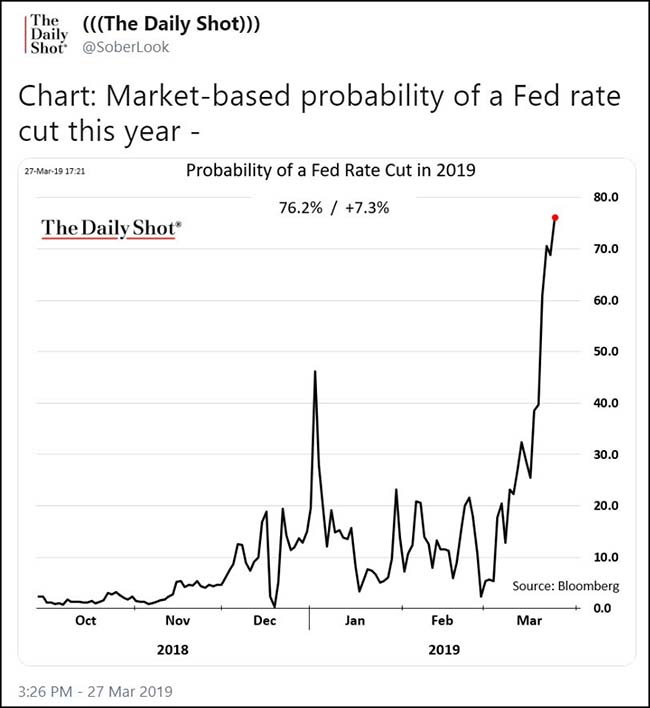

The U.S. Treasury markets are already betting on a 2019 Fed funds interest rate cut…

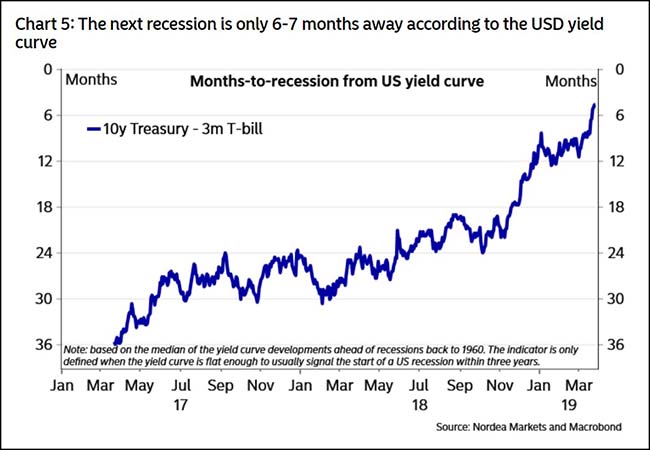

Bonds are suggesting that we are close to a slowdown…

But a quick steepening of the yield curve could readjust this time frame.

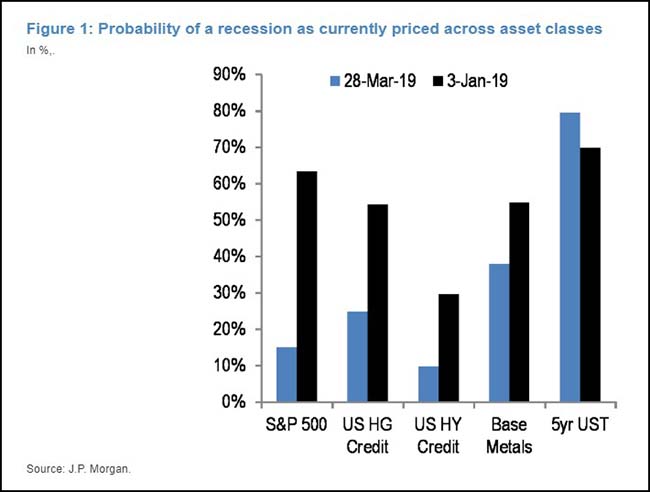

There is a recession outlook battle between the Stock and Bond markets…

US equity markets appear to be currently pricing in only 15% chance of a typical US recession and discount only 3% decline in earnings. This compares to a 66% chance at the start of the year. Similarly US credit markets appear to be currently pricing between 10% and 25% chance of a US recession. In contrast, the 85bp fall in 5-year US Treasury yields from their early November peak points to 80% chance of a US recession on our calculations.

(J.P. Morgan)

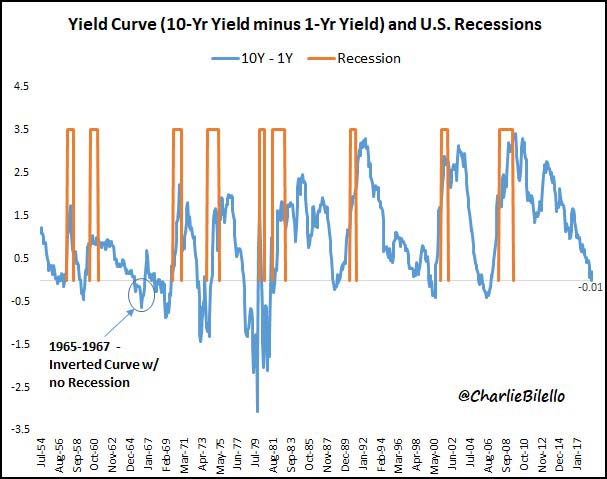

In the past, an inversion has been troubling for the economy…

@charliebilello: Was there ever an inverted yield curve w/o a US recession? Yes, from Dec 1965 to Feb 1967. (Note – there was, however, a bear market during this period: -24% S&P 500 decline from Feb-Oct 1966).

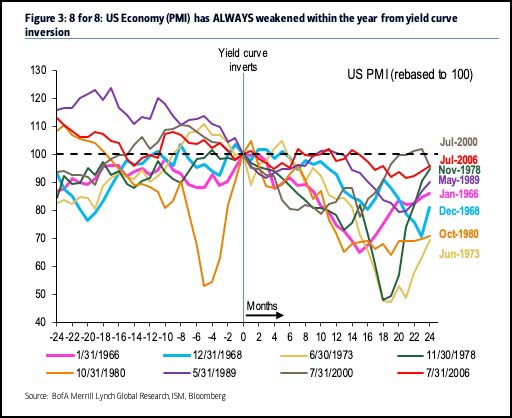

PMI should be in trouble here but maybe it will be different this time with Fed Chairman Trump driving rates lower…

@AndrewThrasher: “In all 8 cases of yield curve inversion since 1960, the US PMI fell for the subsequent 12 and 18 months” via BofAML

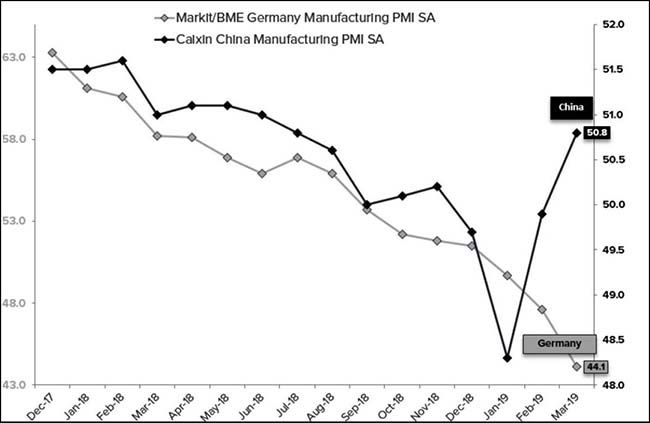

What is going on here?

German economic data continues to deteriorate. Meanwhile, as we wait for a U.S./China trade deal, their data is bouncing off of the bottom. A new reason to favor China and Emerging Markets exposures?

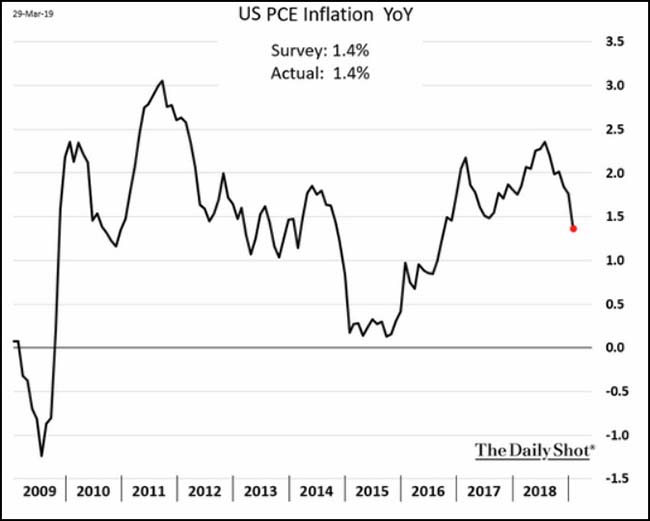

Gold is losing a key supporter as U.S. consumer inflation continues to slow…

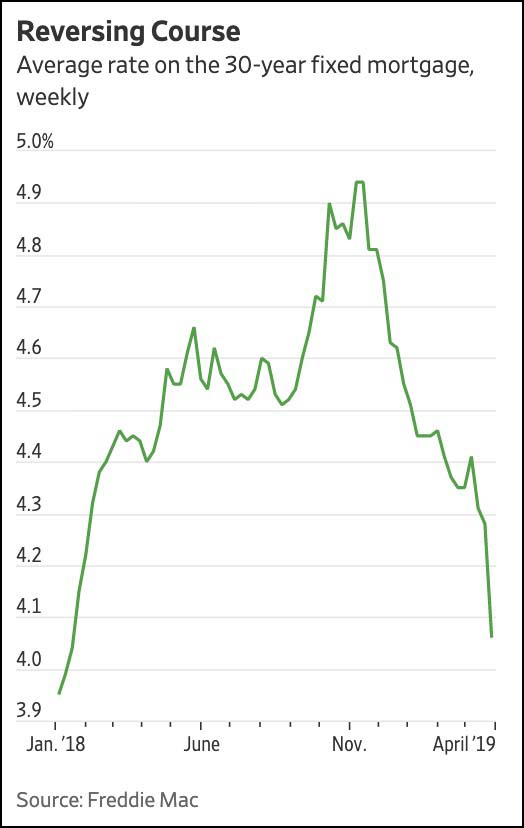

Lower inflation and lower interest rates is all good news for mortgage rates…

(WSJ)

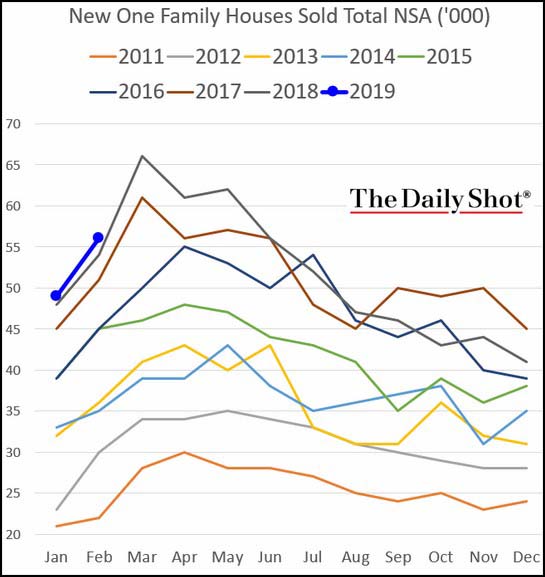

And thus for the outlook for Housing…

And if you are living in the Bay Area, good luck hunting for any house…

Deniz Kahramaner, a luxury real-estate agent at Compass, estimates that there will be 4,600 tech workers poised to make all-cash offers for homes in the $1 million to $5 million range after companies including Airbnb and Uber go public. But not all will be able to purchase homes because of limited supply. For instance, the in-demand neighborhood of Noe Valley currently only has about 12 single-family home listings. Mr. Kahramaner predicts that the restricted housing supply, growing demand and wealth will mean that the minimum price to buy any home in San Francisco’s most desirable neighborhoods, like Pacific Heights, Russian Hill and Cow Hollow, in five years will be $1 million.

(WSJ)

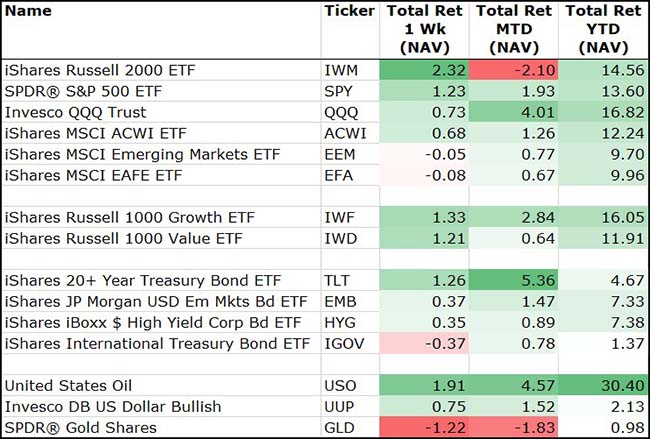

End of the Week, Month and Quarter puts the Nasdaq, Growth stocks, Long Bonds and Oil at the head of the lists…

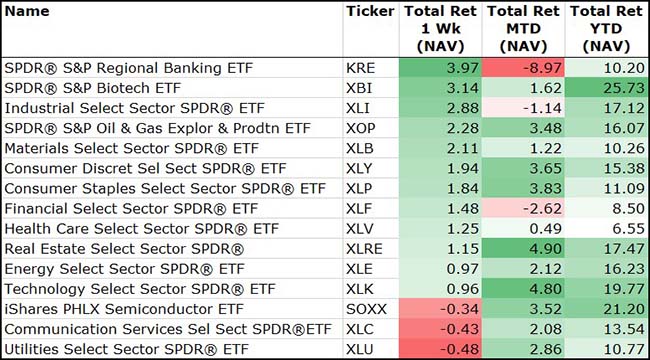

And solid green across all sectors for the Q1 numbers…

To receive this weekly briefing directly to your inbox, subscribe now.

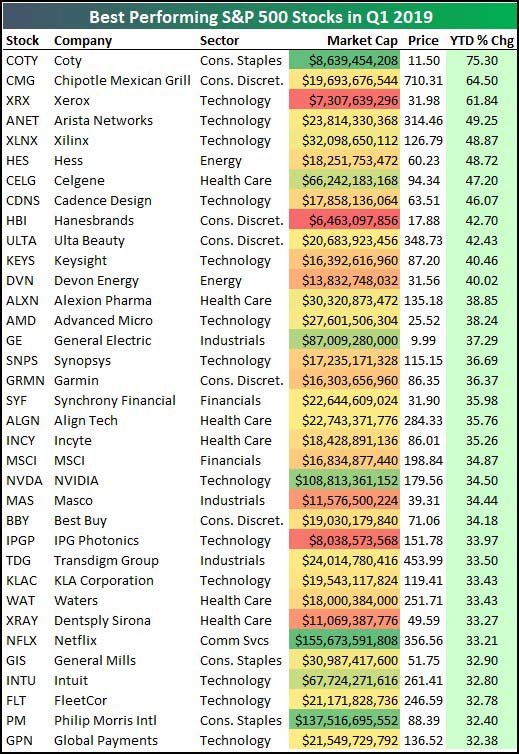

Some incredible three-month moves here in the top decile of S&P 500 stocks…

You don’t hear about anyone getting sick at Chipotle with the stock +65% in 3 months.

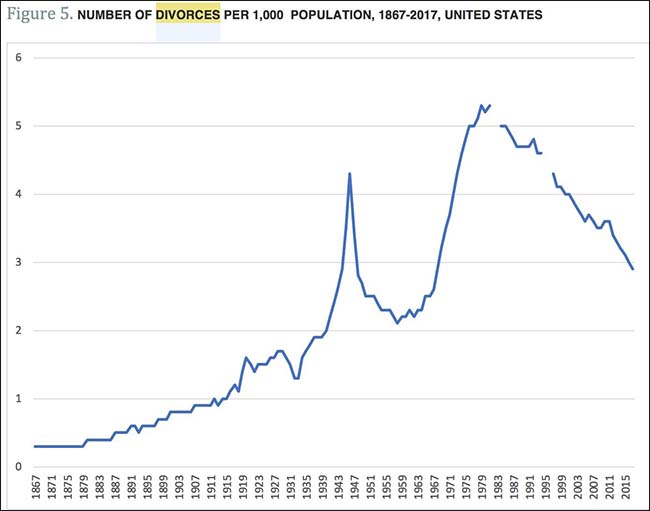

If your career as a divorce lawyer started 35 years ago, you have only been witness to a slowdown…

And my first recommendation as Mayor, Governor or President would be to propose this idea for all major cities…

It’s like falling in love all over again; every Sunday without fail, and holidays too, the inhabitants of the car-choked, noise-filled, stressed-out city of Bogotá, 8,660 feet up in the thin air of the Andes, get to feel that the city belongs to them, and not to the 1,600,000 suicidal private cars, 50,000 homicidal taxis, nine thousand gasping buses, and some half-million demented motorcycles that otherwise pack into the buzzing capital of Colombia.

The weekly miracle occurs at an event you could call the Peaceful Community Gathering on Wheels, but is actually named the Ciclovía, or Bicycle Way. Starting at seven in the morning and until two in the afternoon, vast stretches of the city’s principal avenues and highways are turned over to everyone looking to enjoy a bit of fresh air. All kinds of transportation are welcome—bicycles, roller skates, scooters, wheelchairs, skateboards—as long as they are not motor-driven.

A little over 75 miles (120 kilometers) of roadway are turned over to the Sunday Ciclovía and—just to get one last statistic out of the way—a slightly wobbly census shows that as many as one-and-a-half million Bogotanos come out on Sunday to bike or ride. The extremely lazy are free to stroll.

And eat. And dance. And people watch. Along the Séptima Norte stretch of the Ciclovía, which cuts through a narrow park in an upper class section of the city, flaneurs fill sidewalk cafes, their dogs parked below their chairs, baby strollers alongside. Nearby, a capoeira group rehearses, and a bit further several dozen tai chi students push the air gently away in this direction and that.

The Los Angeles Times threw incredibly good April Fools’ shade on New York City today…

The bright lights of New York City beckon to the restless and the hungry. In the city that never sleeps, as they say, the marquees of Times Square nearly make one forget the concrete dystopia of what is seemingly an unlivable urban wasteland. Surrounded by rats, black trash bags and graffiti-tagged storefronts on Broadway Street, New York’s primary thoroughfare, I wondered aloud if I would be able to find a decent meal in what was surely a culinary heart of darkness.

In Los Angeles, we’re spoiled by the breadth and quality of our dining options. In addition to outstanding year-round produce, I can get great huaraches, refreshing mul naengmyeon and impeccable chả giò within 15 minutes of where I live. But what about New York, a largely culturally bereft island that sits curiously between the Hudson and East Rivers at the foot of the Catskill Mountains? Sure, we’ve all heard of hot dogs, a staple of every New Yorker’s diet, famously gnawed on by rodent and human alike in that “toddling town.”

(LATimes)

Possibly the greatest dinosaur dig in mankind is happening right now in Northwestern U.S…

The Tanis site, in short, did not span the first day of the impact: it probably recorded the first hour or so. This fact, if true, renders the site even more fabulous than previously thought. It is almost beyond credibility that a precise geological transcript of the most important sixty minutes of Earth’s history could still exist millions of years later—a sort of high-speed, high-resolution video of the event recorded in fine layers of stone. DePalma said, “It’s like finding the Holy Grail clutched in the bony fingers of Jimmy Hoffa, sitting on top of the Lost Ark.” If Tanis had been closer to or farther from the impact point, this beautiful coincidence of timing could not have happened. “There’s nothing in the world that’s ever been seen like this,” Richards told me.

One day sixty-six million years ago, life on Earth almost came to a shattering end. The world that emerged after the impact was a much simpler place. When sunlight finally broke through the haze, it illuminated a hellish landscape. The oceans were empty. The land was covered with drifting ash. The forests were charred stumps. The cold gave way to extreme heat as a greenhouse effect kicked in. Life mostly consisted of mats of algae and growths of fungus: for years after the impact, the Earth was covered with little other than ferns. Furtive, ratlike mammals lived in the gloomy understory.

(DePalma’s thesis adviser estimated that the site will keep specialists busy for half a century. “Robert’s got so much stuff that’s unheard of,” he said. “It will be in the textbooks.” – Photograph by Richard Barnes for The New Yorker)

Finally, welcome back Baseball…

This year the Arizona Diamondbacks will be sponsored by Lipitor.

Copyright © 361 Capital