by Staff, AdvisorAnalyst.com

A Canadian discount broker, well-known by its ads, has mounted a successful campaign to attract assets to it's one-ticket investment solutions, implying that if we move our investment accounts to them, we can retire 30% wealthier. Retire 30% wealthier than what?

At first blush, this sounds like an incredible claim, but it's not. It's just baffling, and, it fuels antagonism. The ads take advantage of the benefits of the idea of low-cost investing. The benefits of lower-costing investments, however, are not an issue. The issue is the way the ad's main messaging confuses outcome with returns.

The ads are compelling, as far as advertising goes - with so much implied in one sentence. They are clever and combative.

For advisors and investment firms, regulation makes it non-compliant to advertise the effective yields, for example, on fixed income products, and there are strict rules on the advertising of returns, and that is because stating high expected returns or yields, for example, could be deemed exploitative, and tempting to consumers in an uneven way, because they may not necessarily provide a full or true picture of what the risks involved in investing may be.

Most advisors or investment institutions would find it imprudent to want to advertise this way anyway.

At issue with the 'retire 30% wealthier' ads is the hard claim of 30%. It's easy to understand the appeal of this messaging. It's enticing (who wouldn't want an extra 30%?), and the inference is that if you do away with over-paying for your investments, or for an advisor, or both (btw, this company does not provide any advice) you'll be 30% wealthier at retirement.

By their math, a 2-percent difference in fees could wind up costing you 30% of your assets, when compounded over fifteen to twenty years. That's assuming you consistently get the extra two percent savings every year over the long term. That is the basis of their "retire 30% wealthier" statement .

Does it matter that the performance of one-ticket investment solutions of comparable mutual fund companies' products is similar, and in some cases better, than theirs?

Does it matter that mutual fund companies must post their returns net of all expenses? When you see the performance numbers of competing mutual funds, what you see is net returns. For example, if a mutual fund reports a return of 8% over three years, that 8% return is net of all fees and expenses.

And, does it matter that the spread in fees and costs is narrowing as competition increases?

As a result, their claim is subject to changes in the spread between fees, as are the returns on investments.

The ultimate implication of the ads is that you don't need an advisor. This is interesting, since, again, advice is the one service they do not provide, and implying you don't need an advisor is their only advice.

Having said all this, this company does provide a potentially valuable service to a growing demographic of investors, at low cost, and online, who are perhaps not ready to have an advisor yet (i.e. they're just starting to save), or don't want to work with an advisor yet, or anymore. It's just the manner in which they have chosen to market themselves that is extraordinary.

So, what is Advice Worth?

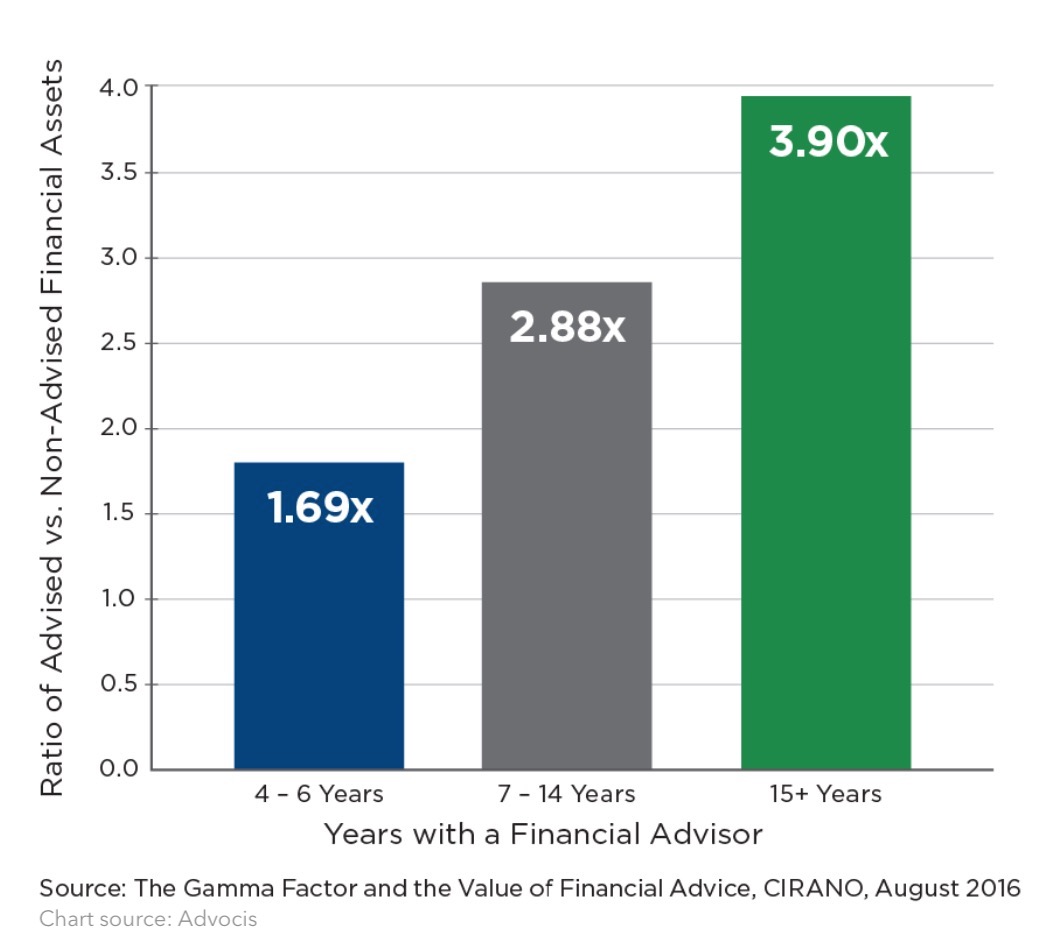

What is the value of advice? Academics (Claude Montmarquette, Nathalie Viennot-Briot, CIRANO, August 2016, The Gamma Factor and the Value of Financial Advice) have looked into this question, and their findings may surprise you.

Source: CIRANO

Here are the highlights of the academic research:

According to the findings of the research,

"the effect of having a financial advisor took effect as soon as of 4 years: for comparable households, the one with a financial advisor gains 69% more value for its investment assets. The additional value reaches 290% for a household with an advisor for 15 years or more (3.9 times the value of the assets of the equivalent non-advised household) ." (page 24, paragraph 1)

The positive impact of financial advice arises from factors other than better stock picking, such as an increase in savings rates, better portfolio diversification, and more tax-efficient investments. Also, sticking with an advisor induces more disciplined behaviour during periods of stock market volatility and therefore resulted in better compounded growth rates on assets. (page 25, paragraph 1)

...

The research confirmed that a household which went from not having an advisor to having an advisor did significantly better than the household that continued without an advisor. (page 36, paragraph 3)

...

It also confirmed that households with an advisor (who had an advisor, and kept working with their advisor) did significantly better than households who dropped their advisor, during the same period. (page 36, paragraph 4)

...

In our opinion, too much emphasis has been placed on the cost of investing versus the intended outcome, or rather, the point of investing in the first place, which is to address one's future liabilities of retirement and other milestones.

As households, we need to focus on what our needs are, what our requirements are, not only of financial assets, but of financial literacy about all of our options, and we need to investigate those options with the help of well-informed professionals, and understand the risks – market risk, investment risk, as well as the most misunderstood factor, behavioural risk. These are a few of the aspects where an advisor may have an immeasurable impact on whether we succeed or not. We need help and vision to determine what our financial objectives and goals are, and what is possible, and what we'll need to do in order to bridge the gaps.

It's also notable that within the scope of this academic research, that 85% of the equivalent households who had an advisor chose their advisor; their advisor did not choose them. It demonstrates that they made the effort to look at who they could work with and what their options were, and when they were settled on both the scope of their options and the choice of advisors, made an informed decision.

It's penny-wise, pound-foolish to make cost the basis of our investment and financial planning decisions, in an unbalanced way. Costs do matter, being economical definitely matters, however, as investors, we should address costs in the context of the benefits of investing, tax, estate, insurance, and other financial planning advice. Once we have determined what our needs are going to be, then we can move to address how the costs of investing and financial planning can be collaboratively reduced with the assistance of our advisors.

Copyright © AdvisorAnalyst.com

Image: Adobe Stock