by Colin Morton, Franklin Templeton Investments

Investors, both domestic and international, have tended to take a pessimistic view of UK assets in recent months, thanks in large part to Brexit uncertainty. However, Colin Morton and Ben Russon from our Franklin UK Equity Team believe there are some positive developments for the UK economy that many investors may have overlooked amid the Brexit gloom and uncertainty.

When you read the headlines, it’s easy to understand why the United Kingdom is out of favour with investors at the moment.

Uncertainty over Brexit, closure or relocation of manufacturing centres and even the growing possibility of a Jeremy Corbyn-led, left-leaning government have prompted some investors to shun UK equities, and has sent the pound plummeting against other major currencies.

As UK equity investors, we’re alive to the challenges facing the sector, but we’re also encouraged by positive signs that we feel don’t get the recognition they deserve. Chief among these reasons to be cheerful is the employment situation in the United Kingdom at the moment.

Low Unemployment and Rising Wages

UK unemployment is at a 45-year low, and job vacancies remain high. We regard that as a positive trend for consumption and UK spending. Aligned with that positive employment news is the story around real wage growth.

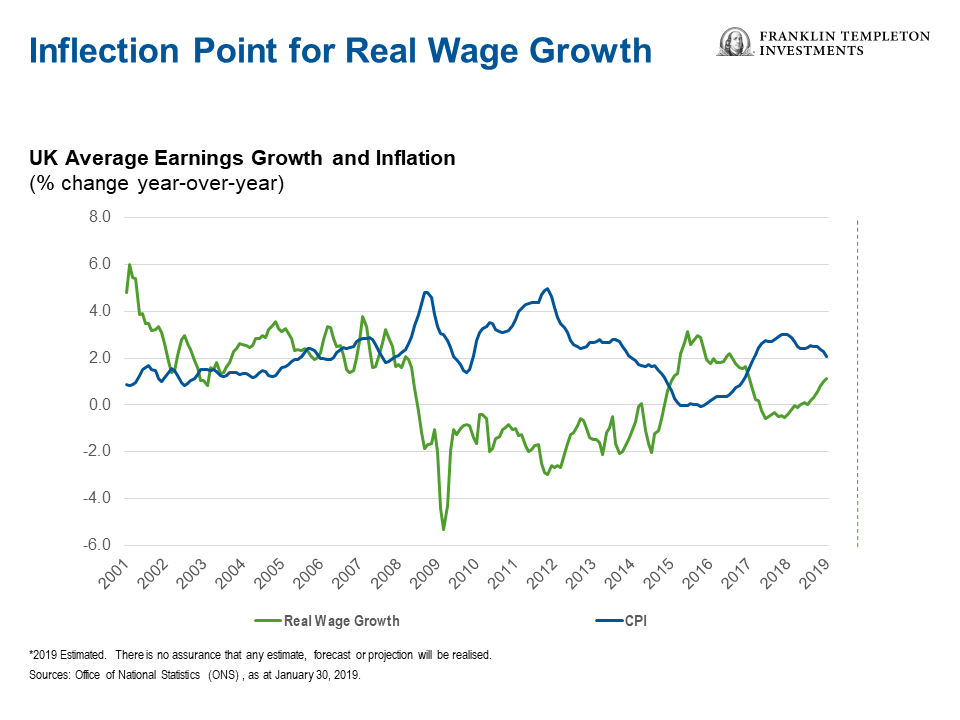

Periods of rising inflation tend to squeeze real wage growth. That was evident in 2016 and 2017 when the UK consumer price index (CPI) was heading upwards.

But as we come to the end of the first quarter of 2019, UK inflation has moderated to below the 2% level, and wages are rising at more than 3%. So, for the first time in a while, we’re seeing real wage growth. That underpins increasing household wealth expectations and should create more spending power for the average UK consumer, in turn providing some stimulus to the UK economy.

Mortgages Appear More Affordable

Similarly, we’re encouraged by data showing improving affordability of mortgages across the United Kingdom.

High house prices mean homes are still expensive to buy, but nationally on average, the cost of maintaining a mortgage appears quite reasonable as a proportion of UK pay.1 And, availability has been improving as banks have become more secure and competitive with their mortgage offerings.

As UK rents have continued to rise, it is now the case that if you can get a mortgage you’re better off as a home owner than as a renter.

Both the number of first-time buyers and the number of housing transactions have been creeping up since the 2007/2008 global financial crisis, and the current UK government has put in place some policies to encourage house purchases.

If these trends—affordable mortgages and people switching from renting to owning—continue, we’d expect to see more of families’ monthly income freed up to spend on the economy.

UK Public Finance Position Is Improving

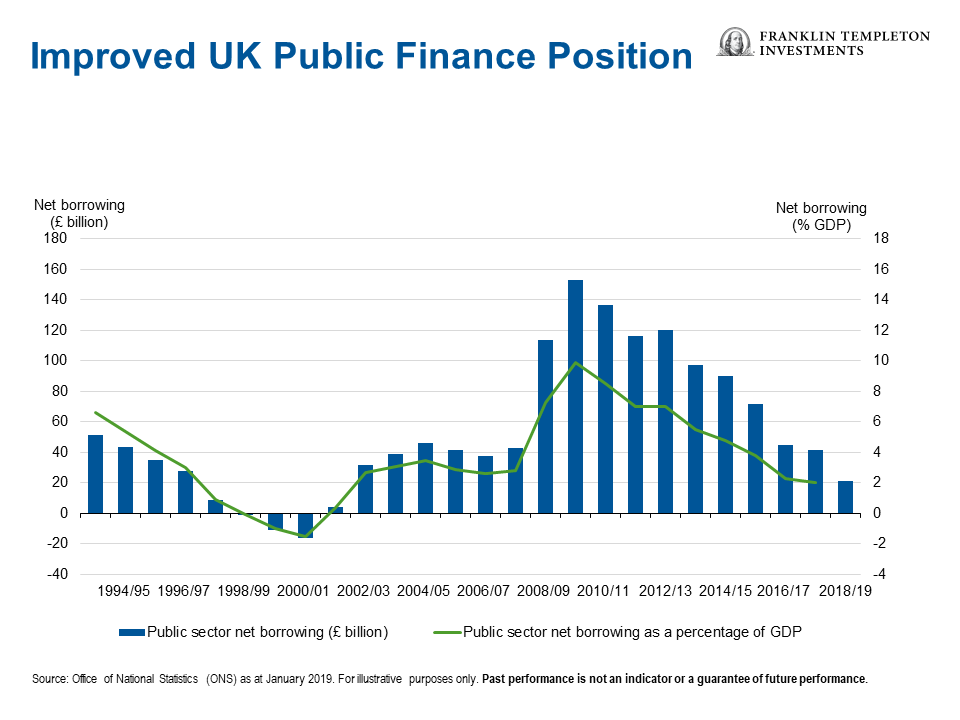

The relative strength of UK government finances offers another bright spot, in our view.

Certainly, government finances are in a much stronger position than they were in the immediate aftermath of the financial crisis.

And although there remains a huge question mark over how Brexit will play out economically, the Chancellor of the Exchequer at least has the scope to do some pump priming once the situation becomes a little clearer. At some stage we might hope to see some focus on policies that aren’t Brexit-related as well, including potentially some public sector wage improvements, which would prove to be a further positive for the UK consumer.

Our Brexit-Neutral Approach

While we’re delighted to see these positive UK economic signs, when it comes to our investment approach, we have to be pragmatic.

Much of the United Kingdom’s unpopularity with investors can be laid directly or indirectly at the door of Brexit. Fully two years into the Brexit negotiations, there remains a large number of equally probable outcomes from here, each requiring a different investment approach.

The challenge facing UK equity investors is that a portfolio suitable for a Hard Brexit would be totally different from a portfolio built for a Soft Brexit. That dichotomy is one of the reasons international investors have been reluctant to get involved in the UK equity market in recent times.

We have tried to take a “Brexit-neutral” approach with our UK equity portfolios.

Around two-thirds of the UK equity market is made up of stocks that derive most of their income internationally. The remaining one third is domestic UK-focused.

Clearly, it would be possible to build a UK equity portfolio of mainly internationally focused stocks. That could offer some protection against the negative impact on domestic stocks of a Hard Brexit or a Jeremy Corbyn-led government. But if there were to be a more benign Brexit outcome, or if sterling strengthened dramatically, in our view, an internationally focused UK equity investor might miss out on some potentially big moves that could happen very quickly.

Our preference, therefore, is for a balance of international and UK domestic stocks.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

__________________________________

1. Source: Council of Mortgage Lenders, 31 January 2019.

Copyright © Franklin Templeton Investments