by Lance Roberts, Clarity Financial

Just recently Anna-Louise Jackson published an interesting article asking if “The Financial Crisis” still haunted your investing. To wit:

“This month marks the 10-year anniversary of the current bull market’s beginnings. Yet, many Americans remain reluctant to invest in the stock market, a scary hangover from the 2007-09 recession.

From October 2007 to March 2009, the S&P 500 plummeted nearly 57% and it took more than five years for the index to recover. But the share of Americans with money invested in the stock market still hasn’t returned to pre-recession levels, according to various studies.

In 2018, a Gallup Poll survey found 55% of respondents were invested in stocks or stock funds, either personally or jointly with a spouse, down from 65% in 2007. Among those younger than 35, the drop-off is especially pronounced: An average of 38% of the youngest Americans owned stocks from 2008 to 2018, down from 52% in the 2006-2007 period.”

The rest of the article is the typical pedestrian advice of accepting that bear markets happen, ride it out, and hope for the best. (Read this for why you shouldn’t.)

What Anna missed was the most crucial aspect of what is happening to the relationship between individuals and Wall Street.

The Loss Of “Trust”

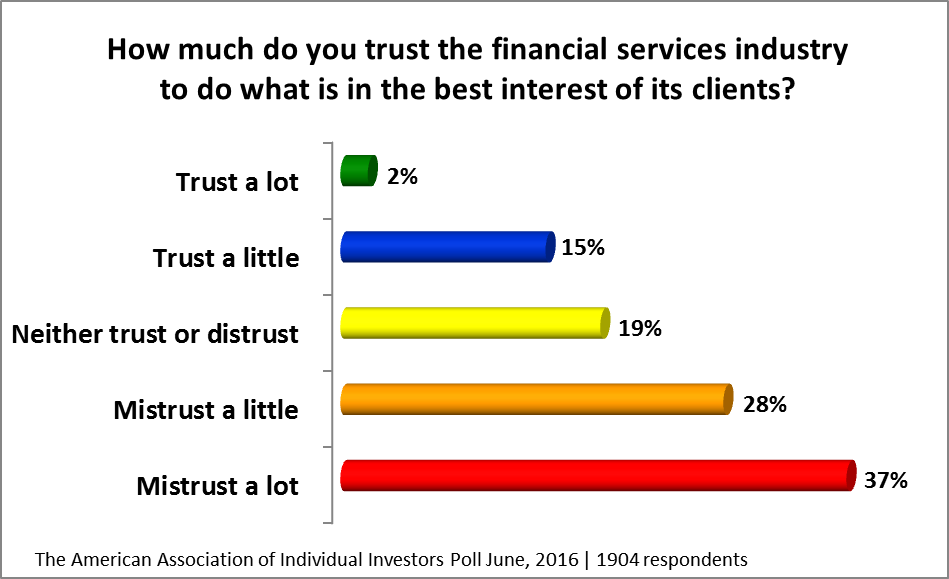

A surprising number of Americans who have financial advisors don’t trust them to act in their best interests. In a 2016 poll by the American Association of Individual Investors (AAII), 65% of respondents said they mistrust the financial services industry to some degree. In fact, only 2% of respondents claim to trust financial professionals “a lot,” while 15% say they trust them “a little.”

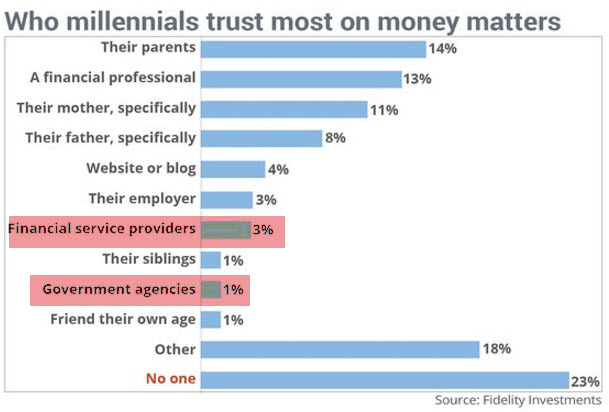

It isn’t just the “Baby boomer” generation who have “lost trust,” but the up and coming millennial generation as well.

Can you blame them?

After two major bear markets, years of retirement savings goals were wiped out. More importantly, financial plans which depended on 6%, or more, in annual returns were decimated due to the time lost in getting to retirement goals. This isn’t just recently; this has been the case throughout history.

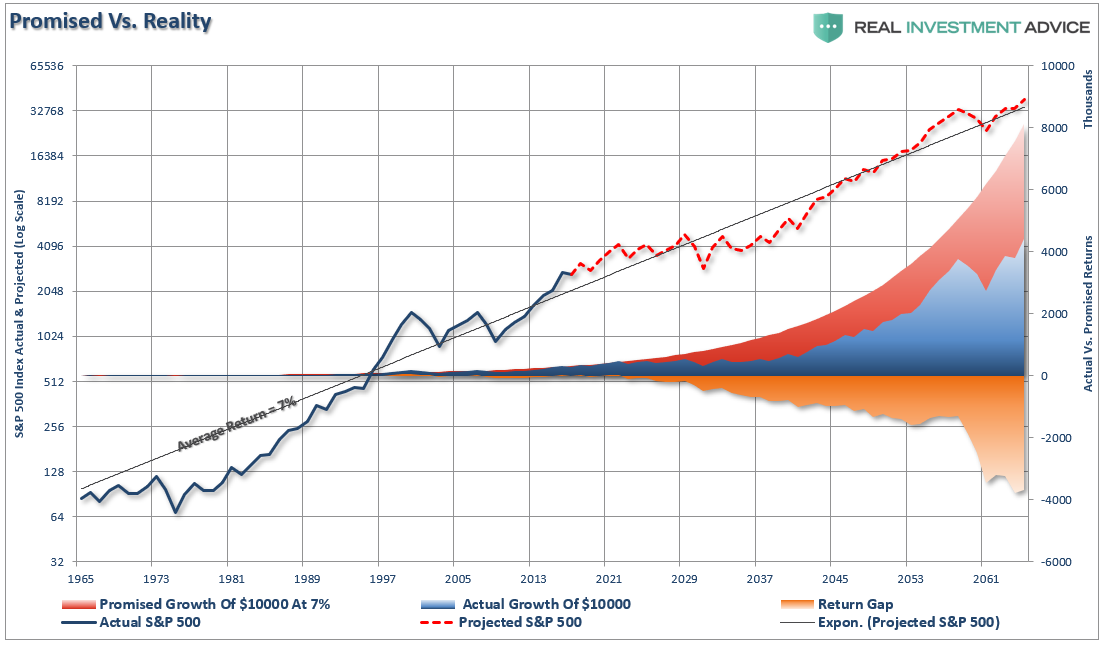

All those promises of “buy and hold” investing cranking out 7-8% average annual rates of return, every single year, have simply not happened. The chart below of real S&P 500 returns from 1965 to present with forward return projections, illustrates the problem.

The forward projections are based on two assumptions:

- Current valuations which suggest weaker front loaded returns, and;

- Stocks remain in a longer-term trend of 7% average growth.

This is for example purposes only to show the issue of variable versus average rates of return.

In the example, while the market did indeed deliver 7% annualized rates of return, the years spent getting back to even following down years, corrections, and outright bear markets left investors well short of what Wall Street had promised them. (This is one of the fatal flaws in financial planning which is the use of “average” versus “variable” rates of return.)

Compounding this problem has been years of Wall Street effectively “raping and pillaging” individuals for the benefit of their “institutional” clientèle.

A study by Lawrence Brown, Andrew Call, Michael Clement, and Nathan Sharp clearly showed the conflict of interest between their own self-interest and you. The study surveyed analysts from the major Wall Street firms to try and understand what went on behind closed doors when research reports were being put together. In an interview with the researchers, John Reeves and Llan Moscovitz wrote:

“Countless studies have shown that the forecasts and stock recommendations of sell-side analysts are of questionable value to investors. As it turns out, Wall Street sell-side analysts aren’t primarily interested in making accurate stock picks and earnings forecasts. Despite the attention lavished on their forecasts and recommendations, predictive accuracy just isn’t their main job.”

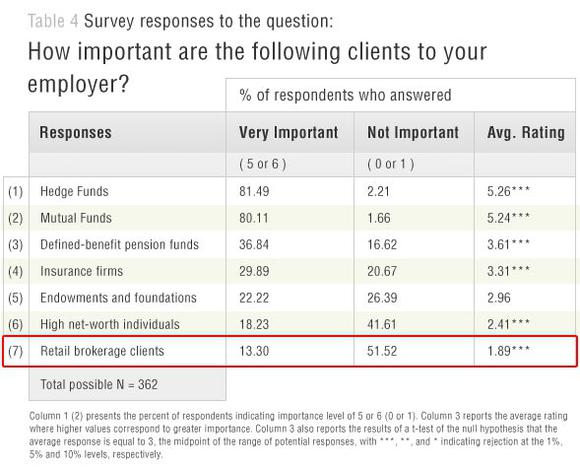

The chart below is from the survey conducted by the researchers which shows the main factors that play into analysts compensation. It is quite clear that what analysts are “paid” to do is quite different than what retail investors “think” they do.

“Sharp and Call told us that ordinary investors, who may be relying on analysts’ stock recommendations to make decisions, need to know that accuracy in these areas is ‘not a priority.’ One analyst told the researchers:

‘The part to me that’s shocking about the industry is that I came into the industry thinking [success] would be based on how well my stock picks do. But a lot of it ends up being “What are your broker votes?”‘

A ‘broker vote’ is an internal process whereby clients of the sell-side analysts’ firms assess the value of their research and decide which firms’ services they wish to buy. This process is crucial to analysts because good broker votes result in revenue for their firm. One analyst noted that broker votes ‘directly impact my compensation and directly impact the compensation of my firm.’”

The question becomes then “If the retail client is not the focus of the firm then who is?”

The survey table below clearly answers that question.

Not surprisingly you are at the bottom of the list. The incestuous relationship between companies, institutional clients, and Wall Street is the root cause of the loss of trust in the financial system. It is a closed loop which is portrayed to be a fair and functional system; however, in reality, it has become a “money grab” that has corrupted not only the system but the regulatory agencies that are supposed to oversee it.

But it isn’t just Wall Street’s fault.

You Are Part Of The Problem

While the “financial system” is very lucrative for Wall Street, as we discussed last week, it hasn’t been for Main Street.

Most individuals desperately want to believe they are giving their life savings to someone they can trust, who knows more than they do, and will specifically look out for their best interest.

As we have already established, the “advice” game isn’t really built that way.

However, it isn’t all their fault. Clients also put their “financial advisors” into a precarious position of having to chase market returns or suffer career risk.

I consistently meet with individuals who swear they are conservative about their investing. They don’t want to take any risk but want S&P 500 index returns.

In other words, they want the impossible:

“All of the upside reward, but none of the downside risk.”

This demand for performance, which requires an exceptional amount of investment risk, forces advisors to “cave to demands” rather than “do what is right” by their client. The risk to the advisor is that if they don’t acquiesce to the client’s demands, the client goes to another advisor who promises them the impossible.

It’s the same as going to a doctor who tells you to stop eating a pound of salt every day. Instead of doing what he says, you search out a “quack” who tells you it’s just fine.

In both cases, in the short-term, it will seem as if the “quack” is right. In long-run, you will wind up paying a higher price than you ever imagined,.

You are responsible for keeping your greed in check.

“But if I had been conservative, I would have missed out on the bull market.”

Not really.

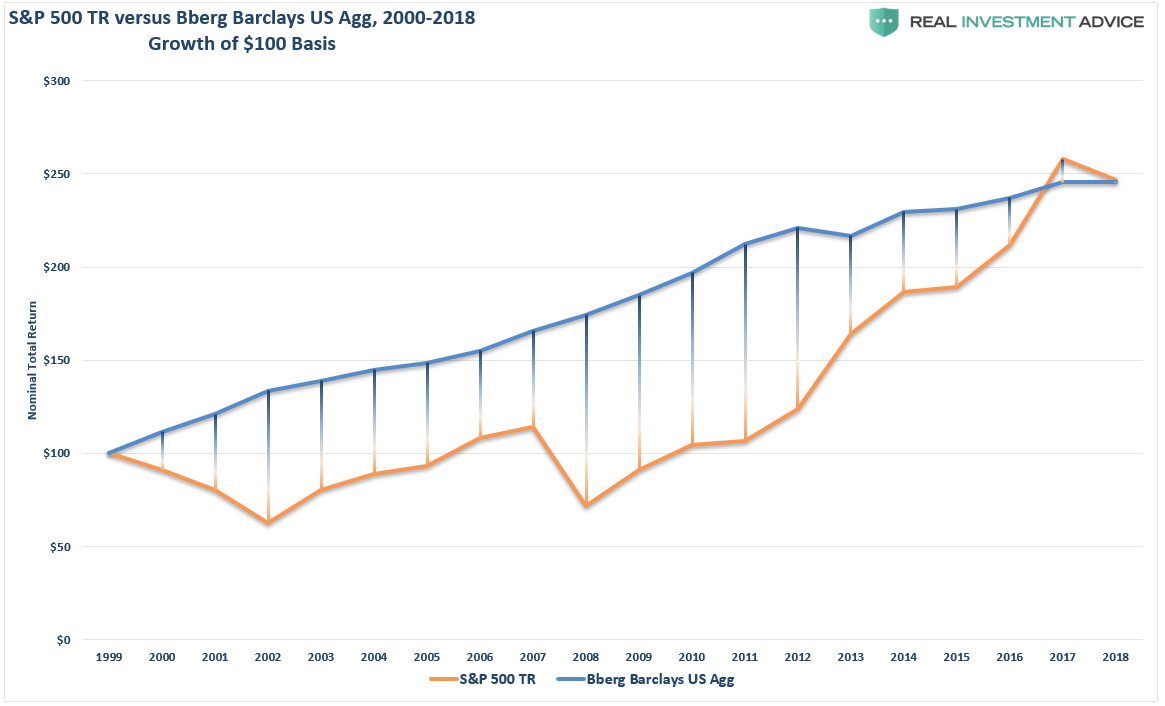

The chart below shows the nominal total return of stocks versus bonds.

Since 2000, you could have owned a portfolio of bonds and virtually had the same performance as owning stocks without the volatility. (Okay, bonds underperformed by $1, literally.)

What Can You Do?

Here are the core principles we use with every one of our clients.

- Understanding that Investing is not a competition. There are no prizes for winning but there are severe penalties for losing.

- Checking emotions at the door. You are generally better off doing the opposite of what you “feel” you should be doing.

- Realizing the ONLY investments you can “buy and hold” are those that provide an income stream with a return of principal function.

- Knowing that market valuations (except at extremes) are very poor market timing devices.

- Understanding fundamentals and economics drive long term investment decisions – “Greed and Fear” drive short term trading. Knowing what type of investor you are determines the basis of your strategy.

- Knowing the difference: “Market timing” is impossible – managing exposure to risk is both logical and possible.

- Investing is about discipline and patience. Lacking either one can be destructive to your investment goals.

- Realizing there is no value in daily media commentary – turn off the television and save yourself the mental capital.

- Investing is no different than gambling – both are “guesses” about future outcomes based on probabilities. The winner is the one who knows when to “fold” and when to go “all in”.

- Most importantly, realizing that NO investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

Unfortunately, most investors remain woefully behind their promised financial plans. Given current valuations, and the ongoing impact of “emotional decision making,” the outcome is not likely going to improve over the next decade or possibly two.

Markets are not cheap by any measure. If earnings growth continues to wane, economic growth slows, not to mention the impact of demographic trends, the bull market thesis will collapse as “expectations” collide with “reality.” This is not a dire prediction of doom and gloom, nor is it a “bearish” forecast. It is just a function of how the “math works over time.”

This time is “not different.” The only difference will be what triggers the next valuation reversion when it occurs.

For most, the next bear market will be their last.

Copyright © Clarity Financial