by Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- While risks have receded, Brexit is far from settled, and the stock market impact of the U.K. crashing out of the EU with no plan would probably be significantly negative, despite the pressure already on valuations.

- Yet, the global fallout may be limited, thanks to the isolated and self-induced nature of a resulting U.K. recession.

- If the disorderly “no deal” Brexit scenario is avoided, the chances seem to favor a partial rebound in U.K. stocks and the British pound. This appears increasingly likely.

Last week, the U.K. Parliament held three important Brexit votes. Ministers of Parliament (MPs) in the House of Commons voted:

To clarify, on Tuesday, Parliament voted down the deal May negotiated with the European Union. The following day, MPs voted in favor of a motion ruling out a “no deal” Brexit at any time and under any circumstances, signaling their intention to take the worst case outcome off of the table. However, it is just an intention; a “no deal” Brexit is the default scenario, and could still happen. On Thursday, Parliament attempted to avoid a “no deal” Brexit on March 30 by voting in favor of a short three month extension of the Brexit deadline to June 30.

What’s next?

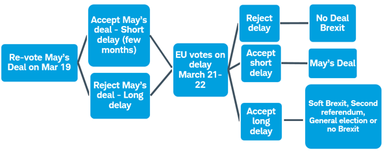

The U.K. Parliament will vote again on May’s Brexit deal on or before March 20, but only if there are “substantial changes” to it, according to the Speaker of the House of Commons. If they are able to vote and again reject a revised deal, the unanimous vote of the 27 European Union member nations on March 21-22 would be required to approve a three month extension to June. In our view, it is doubtful the UK request for an extension would be approved. The EU has previously indicated the UK must have a “credible plan” to warrant a delay. So far, the UK’s only plan is not to have no plan which really isn’t a plan at all.

However, rather than approve a short delay or force a “no deal” Brexit on March 30, the EU may consider a longer Brexit delay of a year or more. Recall that the Brexit referendum was passed in June of 2016. A long delay is unlikely to sit well with the UK’s pro-Brexit MPs and citizens, who would see it as furthering the status quo and potentially lead to a second referendum or general election that would raise doubts over any eventual Brexit.

Brexit decision tree

Source: Charles Schwab & Co, as of 3/17/2019.

What does it mean for investors?

The improvement in the U.K. stock market and British pound this year seems to suggest investors are pricing in a better than 50% chance that some version of the Prime Minister’s current Brexit deal is eventually ratified along with a smaller chance that Brexit is reversed via a second referendum and an even smaller chance that a “no deal” Brexit takes place.

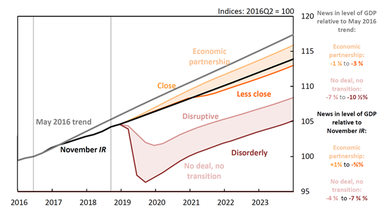

Although seen as a low probability by the markets, a “no deal” disorderly Brexit would likely be very negative for U.K. stocks. U.K. GDP is estimated to fall as much as 10.5% over a five-year period compared to pre-referendum levels, according to an assessment by the Bank of England illustrated below. To put this drop in perspective, GDP contracted 6.5% during the 2008-09 global financial crisis and sent U.K. stocks down nearly 50%.

U.K. GDP in Brexit scenarios

Source: EU withdrawal scenarios and monetary and financial stability. Bank of England. November 2018.

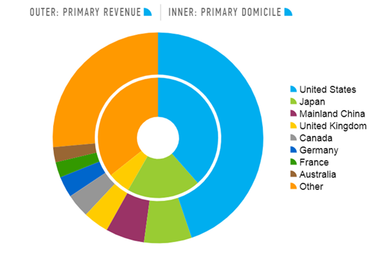

Yet, the global fallout may be limited, thanks to the isolated and self-induced nature of a resulting U.K. recession. Globally, there is a more resilient financial system. Businesses have had two-plus years to prepare for Brexit. Gains for European businesses may offset losses by their U.K. peers. There is also limited global exposure to U.K.-sourced revenues. In fact, the U.K. makes up less than 4% of sales for companies in the MSCI World Index and less than 5% for companies in the MSCI Europe ex-UK Index, according to Factset data.

Geographic revenue exposure (and home country) for MSCI World Index companies

Source: Factset. Data as of 3/17/2019.

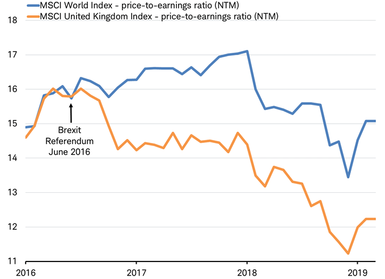

Although the tail risk of a "no deal" Brexit is fading, both the U.K. economy and company earnings may take some time to rebound (they could even soften further in the near-term). We would expect the valuation of U.K. stocks to rise on a brighter and more certain outlook. Since the Brexit referendum in late June 2016, the price-to-earnings ratio has widened by three points, as you can see in the chart below. While we do not expect this gap to close entirely, if the price-to-earnings ratio rose just one point it would result in an 8% gain by U.K. stocks from current levels, assuming no change in earnings expectations.

Brexit has pressured U.K. stock valuations

Source: Charles Schwab, Factset data as of 3/17/2019.

NTM = price-to-earnings ratio uses analyst consensus earnings per share estimate for next twelve months

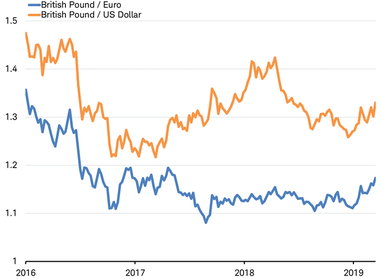

The longer the Brexit delay, the greater chance of a recovery in the British pound in our view, which could further bolster U.K. stocks. Despite two 0.25% interest rate increases by the Bank of England (one in 2017 and one in 2018) the pound has slumped versus the euro and the dollar, as you can see in the chart below. Investors have been shunning the currency less this year as the tail risk of a “no deal” Brexit has eased.

British pound weaker versus the euro and dollar since Brexit referendum

Source: Charles Schwab, Factset data as of 3/17/2019.

Of course, Brexit is far from settled, and the stock market impact of the U.K. crashing out of the EU with no plan would probably be significantly negative, despite the pressure already on valuations. But, if the disorderly “no deal” Brexit scenario is avoided, the chances seem to favor a partial rebound in U.K. stocks and the British pound. This appears increasingly likely.

Copyright © Charles Schwab & Co., Inc.