by Richard Turnill, Global Chief Investment Strategist, Blackrock

Small cap stocks are on a tear, yet we advise caution on chasing the rally – and favor higher-quality large cap shares. Richard explains.

Global small cap stocks have had a strong 2019 so far, outperforming large caps by more than three percentage points. This is not a rally worth chasing, in our view. As the pace of the global expansion slows, we prefer large cap equities. We favor exposures to firms with quality markers such as strong balance sheets.

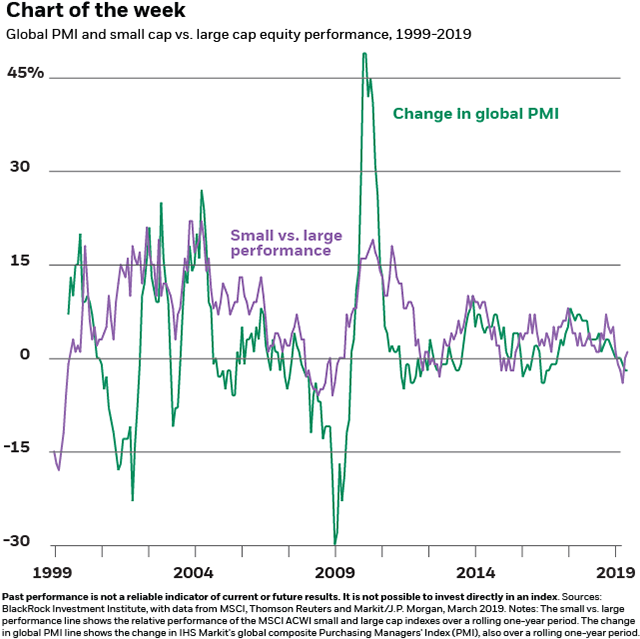

Small caps tend to be more domestically oriented than large caps. Their sector composition is slightly more cyclical, with greater representation in sectors such as construction, real estate and manufacturing. This means they are more sensitive to changes in economic activity. The chart above shows how global small caps’ relative performance has historically shown a tight relationship with swings in global Purchasing Managers’ Index (PMI) data. Global composite PMIs have mostly fallen over the past year, with small cap performance following suit–until this year. Small caps have roared back to life, with only a modest recent bounce-back in PMI data. We attribute much of the small cap move to multiple expansion amid the fading of key risks to the macro outlook–higher rates and escalating trade conflicts. More dovish monetary policy guidance from central banks globally and a lessening of perceived geopolitical risk have provided relief for risk assets–and for small caps too.

Fewer catalysts ahead

We see fewer catalysts for sustained small cap out-performance ahead. Small caps tend to have higher operational leverage and less diversified businesses than larger companies in the same sectors. This leaves them less resilient during periods of decelerating growth and rising uncertainty, like the one we see ahead in 2019 as the U.S. economy enters a late-cycle phase. Meanwhile, small caps’ greater average reliance on floating rate debt could pose a challenge to U.S. firms in particular, if market expectations for Federal Reserve rate increases were to reset higher. We believe markets may be under-appreciating the possibility that the Fed could raise rates further this year. Lastly, small caps generally have less direct international sales than large caps, but they are often part of global supply chains that could feel pressure from slower global trade. Our indicators show markets may be complacent about trade risks.

Read more market insights in our Weekly commentary.

Valuations are not flashing warning signs. Global small caps’ 12-month forward price-to-earnings multiples are still modestly below their five-year averages. Small caps are trading just below their average five-year premium to large caps, and their performance is still lagging that of large caps over the past 12 months. We expect earnings across all market size segments will be challenged in the first half of 2019 on tougher year-on-year comparisons and weaker economic activity. Estimates for small cap earnings growth are nearly double those of large caps for both 2019 and 2020, but downward revisions to small cap earnings forecasts over the past three months have exceeded those for large caps. Small caps on average have thinner margins and riskier debt profiles than larger companies, leaving them more vulnerable to downgrades. More than half the debt issued by companies in the MSCI ACWI Small Cap Index is sub-investment grade. Testifying to investor caution: flows data show a trickle out of small caps since late December, even amid the rally.

Bottom line

Today’s late-cycle economic environment of slowing growth and rising uncertainty calls for carefully balancing risk and reward. We advocate building portfolio resilience through high quality exposures and caution toward lower-quality market segments, such as small caps. We favor large caps for their stronger balance sheets, more diverse businesses and greater operational flexibility.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.