by Blaine Rollins, CFA, 361 Capital

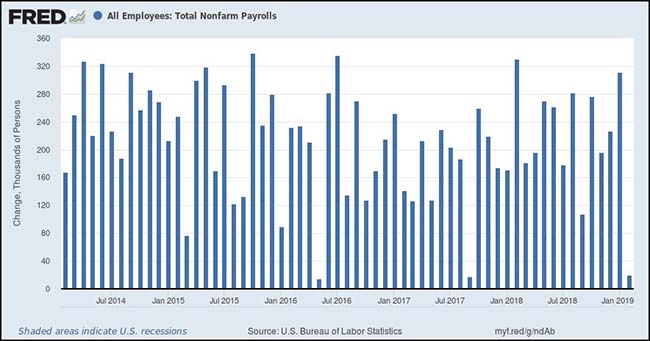

Life is not a straight line. Glitches happen. Like on Friday when Anti-Goldilocks showed herself and took a massive bite out of the Non Farm Payroll number. We expected more than 200,000 jobs created and we only received 20,000 combined with increased wage growth. Chalk it up to a one time blip…unless of course it happens next month and then there will be a full out panic and run on Wall Street.

We will get more data to analyze, and will keep piecing together the mosaic of the global economy. But as we have discussed alongside many others, the slowdown continues. We would like to have more information if it is a natural slowdown as part of the economic cycle or if it is more influenced by the lack of leadership in Washington. If the former, then the Fed is going to try and make it as painless as they can using their toolbox. If it is being caused by tariffs, trade wars and misallocating resources, then your guess is as good as mine as to when the economy will get passed this. It now looks like the China trade meeting and deal will be delayed into April at a minimum. So with the spring planting season in front of the farmers, what do they plant? (My suggestion is oats because every time I go to the store, the oat milk is sold out.)

This has been an incredible six months to be an investor. I have found the intake and processing of all the global macro news to be very tiresome. I think that if I were to filter all news that included: Trade War, Brexit and Washington, D.C. from my news feed that its volume would drop by 50%. It is truly amazing how much time has been wasted by these three issues — all of which have not amounted to anything. I truly look forward to the day that my useful news becomes more voluminous than my useless news. With that said, I know that it is a peaceful week or two for many of you as you head off to the sand or epic snow. Enjoy your time away because the usual corporate and economic news flow will be light.

Friday’s Job Glitch…

Speaking of jobs…

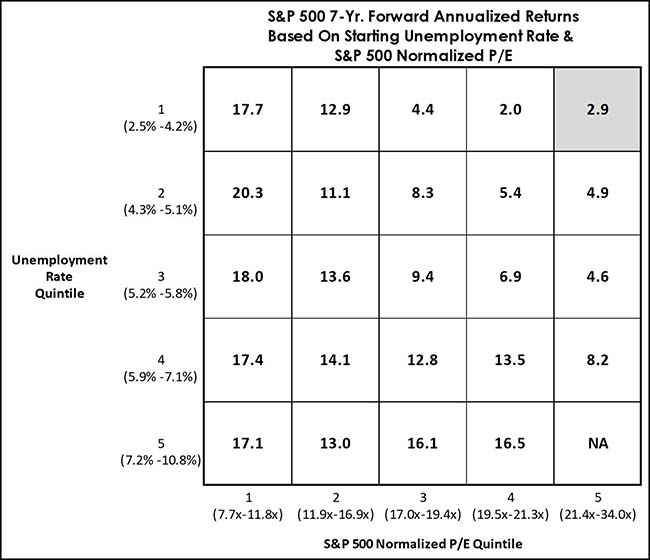

Another reminder that it is often easier to make money in the S&P 500 when stocks are cheap and the unemployment rate is high…

@LeutholdGroup: Regardless of valuation levels, periods of high unemployment were followed by strong $SPY gains, whereas full employment combined with top-quintile valuations produced just +2.9% on a 7-year forward basis. Today’s cyclical backdrop suggests it’s a very poor time to “risk up.”

The Fed is definitely done…

The February employment report, with unsettling signs of a sharp hiring slowdown despite rising wages, bolsters Federal Reserve officials’ decision to stop raising interest rates.

The central bank signaled in January that it was moving to the sidelines after raising its short-term benchmark rate four times last year.

Since then, several Fed officials have stopped talking about further raising rates at all, a change since December when the Fed projected two increases in 2019.

Fed officials have been assessing whether market turmoil, trade tensions and a partial government shutdown at the end of 2018 left a mark on the U.S. economy…

The February report is likely to further tamp down talk about the need to raise interest rates. Most immediately, it could convince more officials to lower their projected interest rate path at the Fed’s March 19-20 meeting to show that no further increases will be needed this year under their baseline economic forecast.

If future economic reports later this year highlight a serious deterioration in the outlook, that could put interest-rate cuts on the table.

(WSJ)

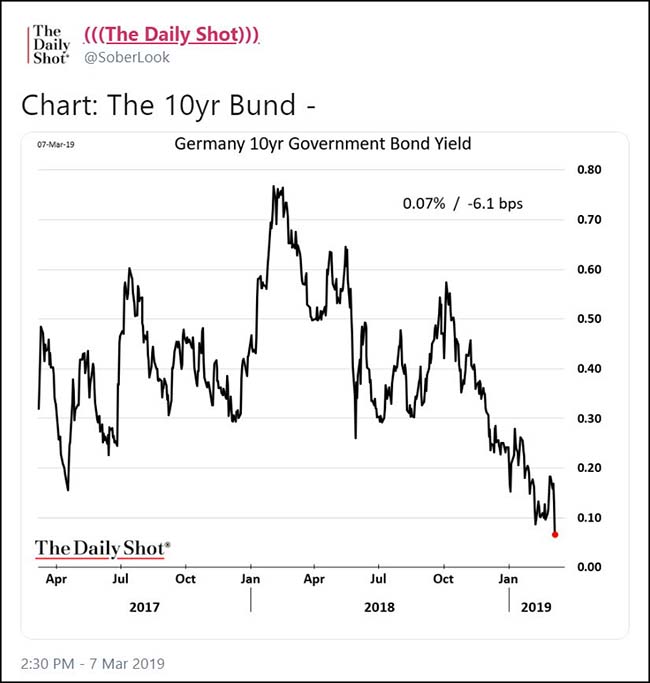

And the ECB is beyond done…

The European Central Bank’s U-turn this week — reviving part of its stimulus programme after two years of weaning the eurozone off easy money — took markets by surprise. It should not have done. Signs of eurozone weakening, especially in Germany, and in key partners such as China, had been evident for months. Once the US Federal Reserve signalled a pause before lifting rates again, the ECB became likely to follow suit. In his final months in the role, ECB president Mario Draghi is clearly trying to get ahead of events. Less clear is whether the bank has done enough, or has the means to do so, if the weakening continues.

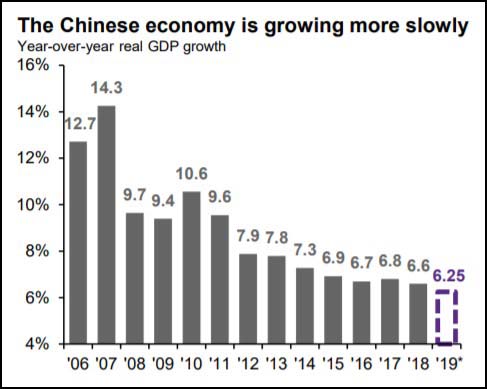

The ECB’s downgrade of its eurozone growth forecast this year to 1.1 per cent, from 1.7 per cent just three months ago, reflects the scale of the uncertainties. Expectations of a strong expansion in the US this year have been scaled back. China, at its National Policy Council this week, lowered its target for economic growth in 2019 to a range of 6-6.5 per cent, from a hard target of 6.5 per cent in the past two years — in part because of its economic and trade frictions with the US.

Despite signs that Washington and Beijing might be near an agreement to end their current spat, trade tensions could easily flare elsewhere. The risk remains that US president Donald Trump might slap tariffs on cars and components from the EU, dealing a severe blow to the German and broader European economy. As the UK parliament prepares for crucial Brexit votes next week, a calamitous no-deal crash-out from the EU can still not be ruled out.

In response, the ECB has promised to keep interest rates at their current record low until at least 2020. While it stopped expanding quantitative easing in December, it has indicated it will keep constant the amount of financial securities it acquired under QE until after rates begin to rise. Taken together, that constitutes a delay to the moment when “quantitative tightening” will finally begin.

German Bonds took note of the ECB moves…

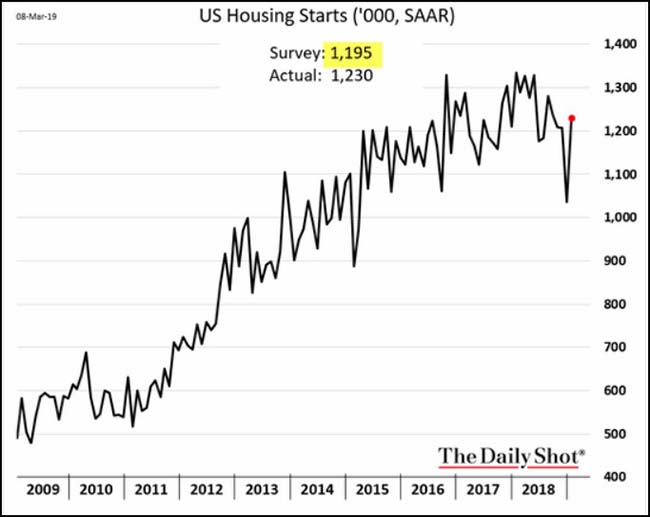

As we look for signs of a rebound in the numbers, here was a good one last week…

The Chinese Government rolled out their forecast for 2019 and it was fairly cautious…

(JPMorgan)

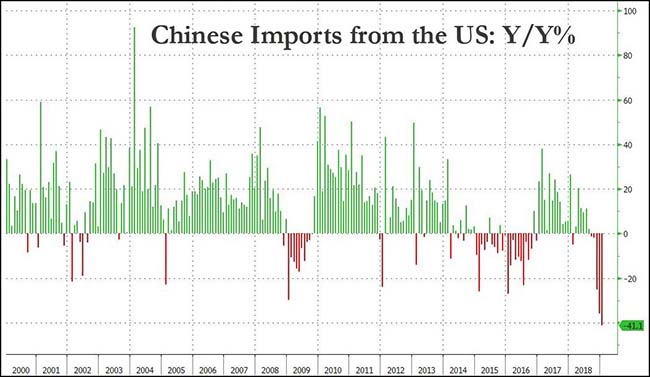

So a slowing Chinese economy plus the Trade War with the U.S. is shutting down our sales to China…

@zerohedge: Chinese imports from the US crash most ever

The Trade War damage is being quantified…

In a study published on Saturday, economists from the Federal Reserve Bank of New York, Princeton University and Columbia University found that tariffs imposed last year by Trump on products ranging from washing machines and steel to some $250 billion in Chinese imports were costing U.S. companies and consumers $3 billion a month in additional tax costs and companies a further $1.4 billion in deadweight losses. They also were causing the diversion of $165 billion a year in trade leading to significant costs for companies having to reorganize supply chains.

Significantly, the analysis of import price data by Mary Amiti, Stephen Redding and David Weinstein also found that almost all of the cost of the tariffs was being paid by U.S. consumers and companies. That contradicts Trump’s claim that China is paying the tariffs.

“This is kind of the worst-case scenario in terms of consumers,’’ Weinstein said in an interview. “It’s pretty unclear that this trade war is a net win for the economy at this point.’’

Meanwhile, nice work South Carolina…

Speaking of trade, for the 5th year in a row, BMW is the largest auto exporter in the U.S.

BMW Manufacturing announced today that it exported 272,346 BMW X models from the Spartanburg plant during 2017. Nearly 87 percent of these Sports Activity Vehicles and Coupes were exported through the Port of Charleston with an export value of approximately $8.76 billion, according to data from the U.S. Department of Commerce. This confirms that the South Carolina factory is the leading U.S. automotive exporter by value.

The remaining 13 percent of BMW X models were exported through five other southeastern ports: Savannah, GA; Brunswick, GA; Jacksonville, FL; Miami, FL; and Everglades, FL. All totaled, the Spartanburg plant exported more than 70 percent of its total production volume of 371,284 units.

(BMW)

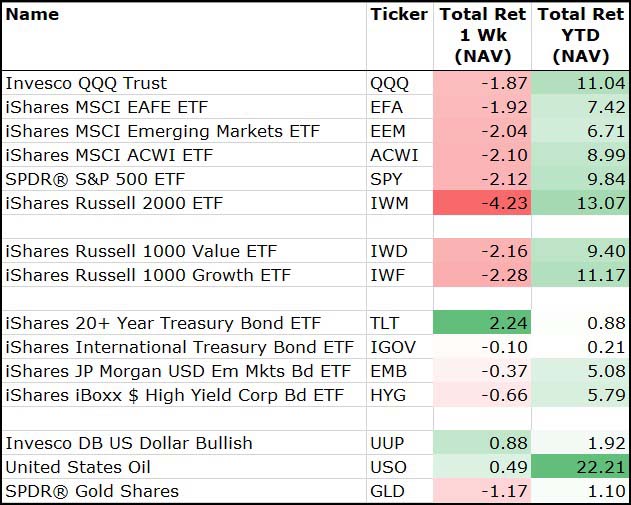

It was a risk off week…

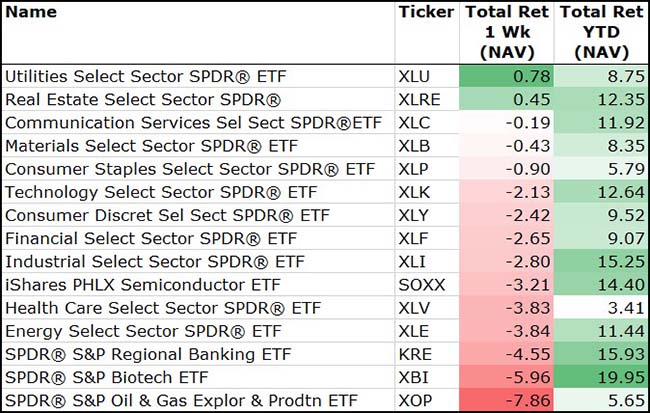

With only the defensive industries outperforming…

To receive this weekly briefing directly to your inbox, subscribe now.

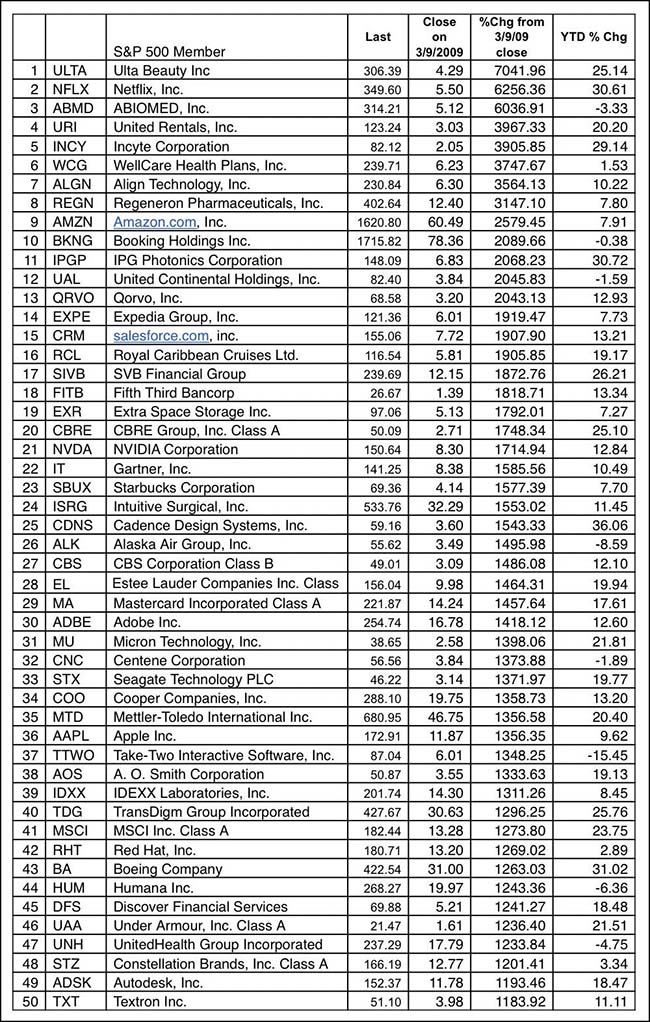

What a great list. Note that there are names from nearly every sector…

@carlquintanilla: Top-performing S&P stocks since the market low, 10 years ago. (via @CNBC)

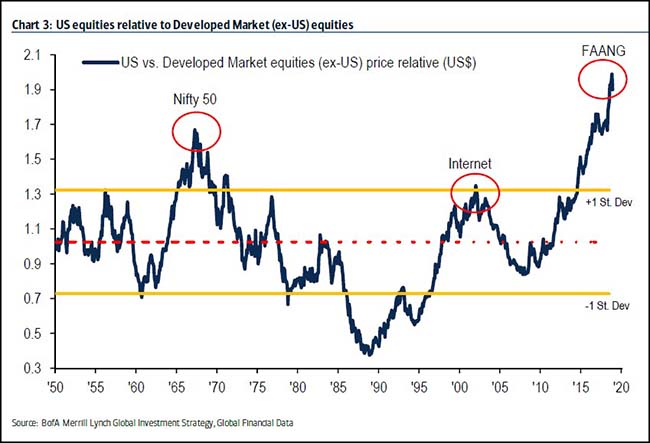

Powerful chart on how strong U.S. Equities have been…

Have to think that the best future opportunities are overseas.

(BofA Merrill Lynch/Biggest Pictures)

London Eating?

A hard Brexit should make for a very interesting night of dining out. Think of a nightly Iron Chef episode with 4 main ingredients: dairy, mutton, bread and whiskey.

Home-grown meals more akin to an industrial-age diet are what Britons could be eating if the U.K. leaves the European Union without a deal that sets up basic trading relations with other countries. The U.K. relies heavily on imports and has been such a hotbed of agricultural trade for centuries that it’s easy to forget what the British palate would look like in a world where food trade grinds to a halt.

It’s hard to predict what could happen at this stage: Parliament now has the opportunity to avoid “no-deal,” or at least postpone it. While it’s highly unlikely that food imports would completely cease if the U.K. crashed out of the bloc without a deal, grocery stores and farmers are preparing for the worst. If that were to happen: There’d at least be plenty of meat and potatoes, but forget “five-a-day” fruit and vegetables. And with months until U.K. harvests, traditional Sunday roast dinners would be light on the trimmings for a while.

Finally a great long read how well Epic/Fortnite is positioned to dominate the digital future…

Much has been said about Fortnite’s revenue, users, business model, origin and availability. But these narratives are overhyped. What matters is how these achievements, when added to the rest of Epic Games, stand to change the entertainment industry forever.

In 2018, there was a lot to read about Fortnite, and even more to learn from it. And to point, “the game” is indeed the future of entertainment (as well as the greatest threat to today’s media giants). But probably not in the way you think. Fortnite’s real opportunity is much bigger and more significant than the ways the game is notable today. In fact, most of the existing narratives around Fortnite success are overhyped – even if they’re critical to its long-term evolution.

(REDEF)