by Russ Koesterich, Portfolio Manager, Blackrock

• the mystery of why gold is performing surprisingly well while stocks are rallying.

In good times insurance is a liability; you don’t expect to make money on an insurance policy unless something goes wrong. Which is why it’s interesting that gold, a form of portfolio level insurance, is performing well despite a so far stellar year equities.

I last discussed gold in late October. At that time, gold had been struggling for much of 2018. I suggested that a flatter dollar and lower interest rates, along with a more volatile equity market, would provide a more supportive environment for gold.

Since I wrote that at the end of October gold has rallied roughly 9%. That gold advanced in the fourth quarter, the worst quarter in years for stocks, is no mystery. What is more puzzling is gold’s performance year-to-date. Typically investors lose interest in hedges like gold when stocks are doing so well.

What has supported gold?

The precious metal has benefited from a few themes, specifically a range-bound dollar and lower real rates (in other words, after inflation). With the economy decelerating and the Federal Reserve apparently on hold, real interest rates have fallen sharply. The yield on U.S. 10-Year Inflation Protected Securities (TIPS) is down 25 basis points (bps, or 0.25%) since the end of last year, putting U.S. real yields back to where they were in late August.

The drop in real yields explains much of gold’s resiliency. Historically, changes in real yields explain approximately 20% of the variation in gold returns. For every one basis point (1/100th of a percent) drop in real yields gold has typically gained about 0.10%. The 3% year-to-date advance in gold is completely consistent with the recent drop in real interest rates.

In case of emergency

While gold has turned in a respectable performance year-to-date, it has obviously trailed stocks by a meaningful margin. This is to be expected. It would be unusual for gold to outperform when stocks are posting this strong of a rally. The real value to gold is how it performs when things go wrong.

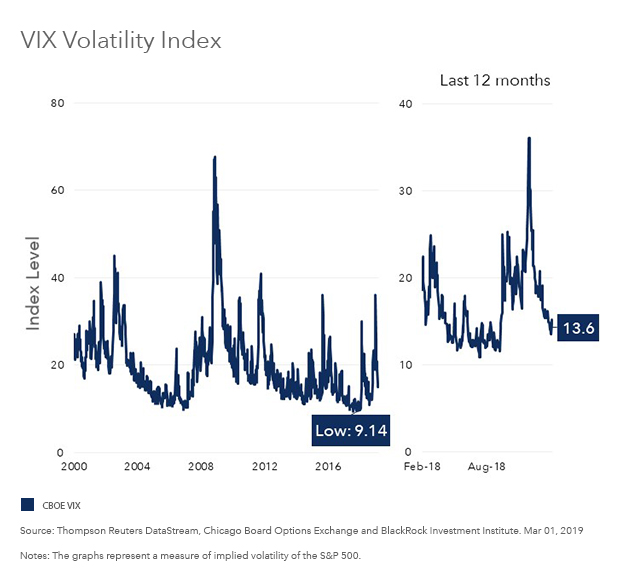

Since 1990, in months when volatility was rising gold beat the S&P 500 Index by an average of 30 bps. When volatility really spikes, defined as a monthly advance of more than 20% in the VIX Index, gold beats the S&P 500 by 5% on average. This is an important consideration going into March, particularly given the magnitude and consistency of the recent rally.

Not only has the market advanced nearly 20% from the December low, it has done so with very few pullbacks. Volatility, defined by the VIX Index, has been down nine weeks in a row, an unprecedented streak (see Chart).

Investors have consistently bid up stocks and pushed volatility lower on the assumption that the Fed is on hold. For volatility to remain this low will require a Goldilocks-like combination of modest but solid growth with a Fed content to leave rates where they are. Any other scenario is likely to see volatility rise, traditionally when gold really adds value.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.