by Stephen Dover, Executive Vice President, Head of Equities, Franklin Templeton Investments

Powerful retailing disruptors are reshaping expectations about shopping and shipping by digitising retail markets across the globe. New conveniences such as ordering groceries with a simple voice command are upending the old-world order. In this excerpt from the latest edition of FT Thinks: “Three Technology Titans Reshaping Retail,” senior equity analysts across our Growth, Value and Emerging Markets teams compare how three retailing giants tailor technology to fit local customs, lifestyles and payment abilities.

Reshaping Retail on the Global Stage

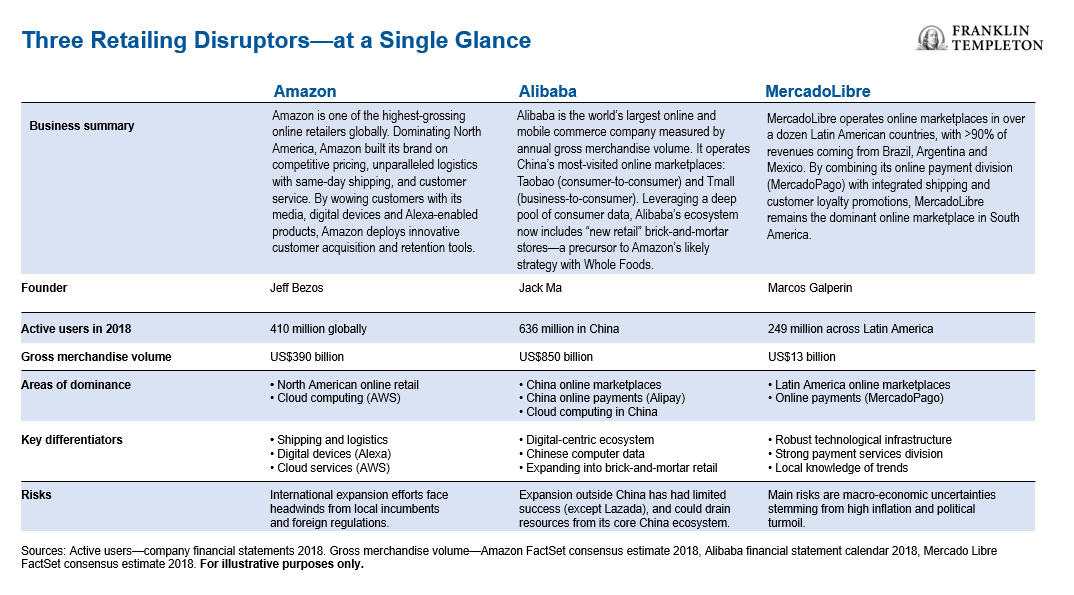

To say that Amazon has shaken up US retailing is almost a cliché at this point. Looking globally, we see powerful tremors from seismic shifts in retailing driven by Alibaba in China and MercadoLibre in South America. These firms, however, aren’t cookie-cutter versions of Amazon. Whereas Amazon spent years building state-of-the-art warehouses and logistics infrastructure, Alibaba and MercadoLibre didn’t need to because they didn’t own inventory. Both firms initially had more in common with eBay, allowing merchants to sell goods on their online marketplaces.

Over time, these distinctions have blurred. Alibaba and MercadoLibre have been investing in logistics infrastructure

to help ensure deliveries reach customers on time. Meanwhile, over half of Amazon’s online sales now come from higher margin third-party sellers, which list their products directly alongside Amazon’s own warehouse inventory.

Amazon—an Advertising Powerhouse

Amazon is big, and its disruptive impacts are far-reaching—just as its name implies. But it has only recently become a profitable disruptor. That change has been driven, in part, by becoming a powerhouse in online advertising. At the core of Amazon’s advertising services is a rich pool of data it keeps on the shopping habits of its estimated 410 million active users globally.

Amazon knows what customers browse for and buy and what they are willing to pay, giving them an information advantage over platforms that don’t facilitate transactions themselves. And because Amazon visitors are primarily there to make a purchase, Amazon ads convert to sales at 3.5x higher rate than Google ads.1 Going forward, our US Growth team believes Amazon’s ad revenues will remain a significant profit stream.

Amazon hasn’t had a straight line to success since going public in 1997. And that’s perfectly fine with Jeff Bezos, chief executive officer (CEO) and founder of Amazon. In his view, being a game changer requires experimentation, a willingness to fail, and a long-term orientation that means capital investments can take five to seven years to bear fruit.2 This approach has led to some surprising breakthroughs, like Amazon’s Echo smart speakers, powered by Alexa, the cloud-based voice assistant. But it’s also produced disappointments that unnerved shareholders, like the Fire Phone, and mounting losses from failed efforts to compete in China.

Alibaba’s Retailing Ecosystem

Two years after Amazon went public in 1997, China’s Alibaba launched a business-to-business (B2B) website for small manufacturers looking to export overseas. Alibaba’s birth as an online retailing giant, however, didn’t really happen until four years later in 2003, the year eBay acquired China’s Eachnet.com. Countering eBay’s move, Alibaba quickly launched an online marketplace called Taobao, connecting fledgling merchants and small entrepreneurs with Chinese shoppers.

In just two years, Taobao’s share of China’s market of small businesses selling to consumers approached 60%, forcing eBay to close down Eachnet.com in 2006.3

Most shoppers in China didn’t own credit cards, and many were suspicious that online products might arrive as something less than advertised. Alibaba developed Alipay to resolve both issues. It creates an escrow service in which cash received for a sale isn’t released until the product arrives in satisfactory condition.

Alipay was quite lucrative as a standalone business, but it also gave Taobao a leg up over eBay, which didn’t offer an Alipay-like service. Today, Alipay processes 80% of all transactions across Alibaba’s ecosystem of online marketplaces and 60% of China’s total mobile transactions.4

Taobao’s rapid growth and ability to outmaneuver eBay were extraordinary by any yardstick, and it became hugely profitable. Like eBay, Taobao didn’t own or hold inventory in expensive warehouses.

Taobao’s strong operating margins come from consumer data, and the advertising services it sells to merchants eager to stand out from the online crowd. Long before Amazon bought Whole Foods, Alibaba was investing in retail chains, including a Costco-like market called Sun Art, department-store operator Intime, electronics retailer Suning, and its own homegrown grocery chain named Hema Xiansheng.

By integrating offline and online retail, Alibaba wants to deliver products to shoppers by whatever route they prefer—ordered online and delivered home, pre-sorted for in-store pick up, or neatly displayed so consumers can touch and experience new brands in person.

Behind the scenes, Alibaba’s new retail strategy aims to digitise the entire supply chain, both online and offline, and collect more detailed consumer data. The ability to follow and analyse vast quantities of product and consumer data helps Alibaba eliminate inefficiencies with smart logistics, digital inventory management, anticipating evolving consumer trends and personalised shopper experiences.

MercadoLibre’s Evolution from eBay to Amazon

Ten years ago when investors called MercadoLibre the eBay of South America, they were halfway correct. CEO Marcos Galperin started the company in eBay’s image with his Stanford business school classmates in 1999. They’ve since transformed the company from an internet auction site into Latin America’s leading online marketplace on par with Amazon.

Our Global Growth team sees two key ingredients to MercadoLibre’s early success: 1) a heavy emphasis on advanced technological infrastructure and, 2) tailoring its websites and payments services to fit South America. Understanding Latin America’s specific local context was key to avoiding the missteps eBay and Amazon made in China.

In its early days, MercadoLibre gave merchants the option of listing products at fixed or auction prices. It quickly discovered the majority preferred fixed prices. MercadoLibre also changed the way merchants interacted with buyers.

Shoppers couldn’t interact directly with sellers the way eBay allowed, because MercadoLibre rightly understood that would likely cut it out of the transaction entirely. Instead, it developed Q&A message boards, which buyers found helpful.

Over time, to attract more merchants to its busiest online marketplaces in Argentina, Brazil and Mexico, MercadoLibre developed logistical shipping solutions through its MercadoEnvios division, helping ensure merchant deliveries arrived on time for a better shopping experience. It also generated powerful synergies through MercadoPago, a payment services division.

It’s MercadoLibre’s push into new financial technologies that holds significant promise in our Global Growth team’s eyes. Half of Latin America’s population remains without bank accounts (or credit cards), and its economies are still largely cash-based. One side effect for cash-based entrepreneurs is that banks won’t issue working capital without a history of verified bank transactions.

MercadoLibre, on the other hand, has the data to determine creditworthiness by tapping into its online sales history and customer reviews. Spurned by banks, more merchants are turning to MercadoLibre for loans. Interest-free loans offer tremendous value to shoppers, given high interest rates in Latin America. This ease of doing business also increases customer loyalty.

These new approaches to financial services are one of the reasons our Global Growth team thinks MercadoLibre offers an efficient way to gain exposure to online retailing in South America. As more internet users migrate to online and mobile commerce in Latin America, we believe MercadoLibre has the opportunity to capture a majority of these shoppers.

Pathways to Sustainable Cash Flows

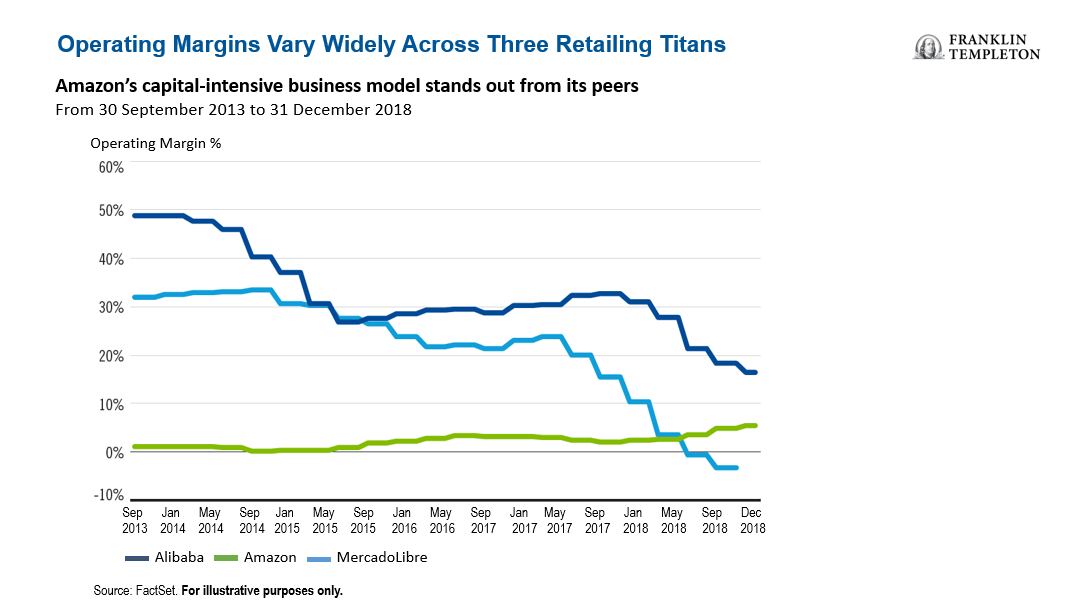

Across our equity teams, we evaluated recent company operating margins side-by-side so we could compare and contrast each firm’s accomplishments from growth and value perspectives. What struck us right away was the impact Amazon’s capital-intensive business model has long had on its profit margins. Compared with Alibaba, Amazon looks anemic. Also noticeable are Alibaba’s declining margins and recent negative margins for MercadoLibre.

Amazon’s Profits Gain Momentum

Since going public, Amazon’s heavy investments in technology, logistics and new products have long dampened its operating income. Bezos must constantly balance between deploying capital to build future growth and holding back to boost near-term profits.

It’s for this reason our US Growth analysts think traditional valuation metrics like price-to-earnings and enterprise value/EBITDA aren’t good yardsticks for Amazon.5 Simply put, these metrics aren’t a reliable snapshot of Amazon’s long-term profit potential, in our analysts’ views. Our US Growth analysts think Amazon’s margin expansion story is finally taking root.

Alibaba’s Data-Centric Ecosystem

Unlike Amazon’s recent positive profit momentum, Alibaba’s operating profits have faced headwinds from spending on businesses outside its core China retail marketplace. Agile competitors with deep pockets mean Alibaba needs to spend to keep existing customers happy and to lure new ones.

So how does Alibaba steer margins back in an expanding direction? Our Emerging Markets team sees a couple of avenues, starting with growing its cloud computing business in China. Alibaba also aims to help more brick-and-mortar retailers digitise their own back office supply chains through smart logistics, and by boosting front-end traffic by tapping into Alibaba’s deep pool of consumer data and cloud analytics. We see Alibaba less as a collection of e-commerce marketplaces and offline retail hubs, and more as a data-centric ecosystem that drives profits through digitisation and technology, while generating better customer experiences.

MercadoLibre: Building Warehouses to Stay on Top

MercadoLibre is investing in shipping logistics and consumer incentives to shore up its commanding lead over competitors like Amazon. Taking a page out of Amazon’s playbook, MercadoLibre is building new warehouses to serve as cross-docking locations.

Costs to build these fulfillment centers, plus free shipping incentives, have taken a noticeable bite out of profit margins in the past year. Nevertheless, our Global Growth team is confident these investments can pay off by improving the customer experience and by attracting more merchants.

The Retail Revolution is Accelerating

The reality of today’s digitised marketplace means that not only has shopping changed dramatically in just a decade, the rate of change also continues to accelerate.

It’s now easier for shoppers to get tailored items and access products more quickly and conveniently than ever before. Technology pioneers like Amazon, Alibaba and MercadoLibre are largely responsible for setting new standards in the world’s biggest markets—continually improving customer experiences by anticipating their preferences, lowering prices and delivering items faster.

Plowing vast amounts of capital into new innovations (sometimes to the detriment of near-term profits), these companies are raising the bar for everyone by reshaping customer expectations. We believe each company bears close watching to understand where the retail landscape is heading next.

You can read even more views from our investment teams in the latest edition of FT Thinks: “Three Technology Titans Reshaping Retail.”

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

Copyright © Franklin Templeton Investments