by Andre Bertolotti, CFA, Blackrock

Sustainable investing is no longer a niche area; it’s something investors should not ignore. Andre discusses three key themes driving transformation in this area.

Sustainable investing was once viewed as a niche area involving a trade-off between value and “values”. This is no longer the case. Sustainable investing is now going mainstream; it’s something investors cannot afford to ignore.

BlackRock defines “sustainable investing” as combining traditional investing with sustainability-related insights in an effort to reduce risk and enhance long-term returns. Assets in dedicated sustainable investing strategies around the world have grown at a rapid clip in recent years. We are seeing a surge in clients’ interest in incorporating sustainability-related insights into their investments.

This demand looks poised to accelerate amid societal and demographic changes and greater investment conviction. There’s growing awareness among investors that certain factors—often characterized as environmental, social and governance, or ESG—can be tied to a company’s long-term growth potential. Also contributing to this backdrop: Increased regulation and government focus; for instance, as the impact of climate change becomes more noticeable.

BlackRock is increasing its focus on sustainability across the board—from our investment processes to the investment solutions we offer. The field presents a largely untapped source of information that can potentially identify investment risks and generate excess returns. At the same time, the data are imperfect, scoring methodologies differ, and investors need to gain greater clarity on the risks of this emerging field.

We see three key themes driving transformation in sustainable investing, as we shared with leaders at the 2019 World Economic Forum last month in Davos, Switzerland. Here’s a look at these themes, which we cover in our new Global insights paper Sustainability: The future of investing.

Theme #1: The ability to create sustainable portfolios and strategies that do not compromise financial returns.

Enhanced data and insights make it possible to create sustainable portfolios without compromising financial goals. Our research, which relies on back-tested data, shows how ESG-focused indexes have matched or exceeded returns of their standard counterparts, with comparable volatility.

We find ESG has much in common with existing quality metrics such as strong balance sheets, suggesting ESG-friendly portfolios could be more resilient in downturns. These resilience properties deserve attention as market uncertainty increases. In other words: We have arrived at a ‘why not’ moment in sustainable investing.

Theme #2: The effort to use innovative research to go beyond headline ESG scores.

ESG is often used interchangeably with the term “sustainable investing.” We see sustainable investing as the umbrella and ESG as a data toolkit. ESG metrics measure decisions taken by company management that affect operational efficiency and future strategic directions.

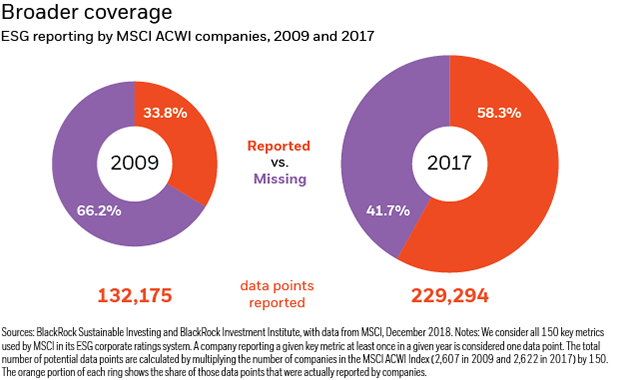

With the growing interest in sustainable investing, data providers have increased their efforts in gathering and reporting ESG indicators. MSCI, for example, has boosted the number of companies and key metrics it tracks. See the Broader coverage chart below.

Yet a lack of accepted data-reporting standards makes it hard to readily compare or combine insights across providers, and patchy past data make historical analysis challenging. ESG data may have evolved, but they are still incomplete. In response, we have created a customized database that combines data across many ESG sources and fills in the historical gaps.

It also helps us go deeper than headline scores to find the most meaningful investment insights. The top-line ESG score is an amalgamation of measures — think gender pay gap, pollution, board structure—that came together over time under the “ESG” label. A lot of granularity, and critical insight, can be hidden below. An example of some of the deep work being done to go beyond headline ESG scores is seen in our analysis of companies’ readiness to function in a low-carbon society. Our transition-ready investment approach focuses on directing capital to companies best positioned to navigate this global shift, with the aim of helping deliver competitive long-term financial returns relative to traditional benchmarks.

Theme #3: Integration of sustainability considerations into investment processes is on the rise–and for good reason.

Incorporating relevant sustainability insights can provide a more holistic view of the risks and opportunities associated with a given investment. There is no one-size-fits-all approach, but the opportunity to improve investment processes by integrating sustainability considerations is real and growing.

Our view is that material ESG insights have the potential to augment traditional investment processes, regardless of whether or not a strategy has a sustainable mandate. Our work fuels our conviction that the future of investing is sustainable. Read more in our full paper, Sustainability: The future of investing.

Andre Bertolotti, CFA, is Head of Research for BlackRock Sustainable Investing and a contributor to The Blog.

Copyright © Blackrock