by John Lin, Stuart Rae, Equities, AllianceBernstein

As MSCI considers boosting the allocation to Chinese onshore stocks in its emerging-market indices, global investors are pumping money into the market. But watch out for crowds. Flows into China are concentrated in a small group of large-cap stocks.

On February 28, index provider MSCI will decide whether to begin increasing the weight of onshore Chinese A-shares in its emerging-market and global indices in May after first opening the door last May. If approved, MSCI will quadruple the value of large-cap China A-shares in its benchmarks, forcing index funds to add to their positions. For example, in the MSCI Emerging Markets, A-shares will increase from 0.7% of the index to 2.8%. This will be done by raising the inclusion factor for A-shares from 5% to 20% of each stock’s free-float adjusted market capitalization by August. Mid-cap stocks may also be added.

Chinese stocks have been popular in early 2019. The MSCI China A Index surged by 27.1% in US-dollar terms this year through February 25. In January, foreign investors pumped a record US$14.5 billion into China A-shares through the Stock Connect channel, according to Bloomberg. Investors increasingly believe that the onshore market has bottomed out after sharp declines in 2018.

Flows Focus on a Few Large Names

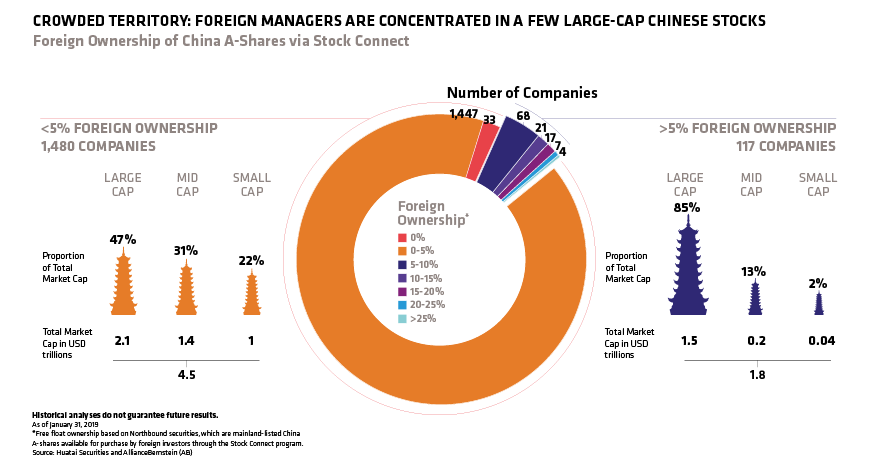

But where’s the money going? Our research suggests that foreign inflows through the Stock Connect channel are concentrated in a small number of Chinese stocks, mostly large caps (Display). In fact, only 117 Chinese A-shares have foreign ownership of more than 5%, while 1,480 stocks have foreign ownership of less than 5%. Those 1,480 stocks include many small- and mid-cap names that may be less familiar to foreign investors.

There are many good long-term investment opportunities in large-cap Chinese stocks. But naively following crowds can be risky, if sentiment and momentum toward popular positions reverse. We believe the Chinese market offers a world of opportunities in a diverse set of companies that are off the beaten path. International investors seeking to take advantage of China’s newly opened markets should make sure their asset managers have strong local knowledge of companies and industries as well as the capabilities and skill to capture the potential that’s being overlooked by the masses.

John Lin is Portfolio Manager—China Equities at AllianceBernstein (AB)

Stuart Rae is Chief Investment Officer—Asia Pacific Value Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein