by Brooke Thackray, Alphamountain Investments, advisor to Horizons Seasonal Rotation ETF (HAC)

Market Update

We live in a world of instant gratification, with tweets and instant messages and updates. Investors react to every major economic announcement as soon as it is released, pushing the stock markets up or down. It is how we expect the world to operate.

Monetary and fiscal policy do not fit into our “instant” world. Any policy changes take time to effect the economy, particularly fiscal policy. There is typically a lag of a year or two before the effects are felt. When the Federal Reserve says that it is data dependent, it is, but it is using the trend of the current data to make decisions for the future. Whatever they do today, will affect the economy tomorrow. It is a difficult process.

Overall, the Federal Reserve has done poor job enacting policy (including Bernanke and Yellen). After the initial round of quantitative easing in the Great Recession of2008 and 2009, the Federal Reserve has been consistently behind the ball in getting the federal funds rate up to a neutral level. The stock market responded positively to the Federal Reserve’s consistent stimulus of low interest rates, which caused a misallocation of capital.

Powell, to his credit tried to get the federal funds rate back to neutral where the rate is neither stimulative nor restrictive and reduce the Federal Reserve balance sheet. Unfortunately, economic conditions around the world have continued to deteriorate and Powell was forced to shift the Federal Reserve’s policy stance abruptly. He should never have overstated the rising rate case, but that is another issue.

Despite the Federal Reserve’s recent strong dovish stance, it will take any opportunity it can to raise rates and decrease its balance sheet. Powell’s dovish statements in December and January did not erase its previous hawkish October stance, it only put it on “pause.”

At the last FOMC meeting, Powell hinted that the Federal Reserve may take a look at adjusting the current rate of its balance sheet reduction. Balance sheet adjustments are typically not made very often. Such an act would help solidify the Federal Reserve’s dovish shift.

Has the damage already been done?

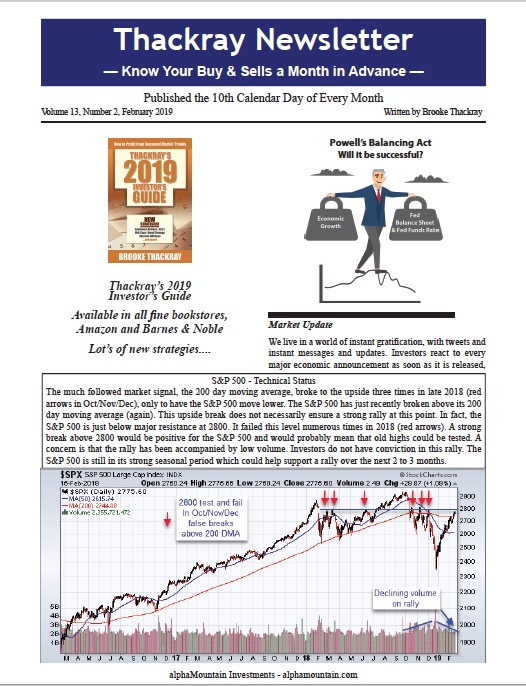

Powell is playing a balance act adjusting monetary policy to economic conditions. If the economy shows signs of strong growth, increase rates or become more hawkish. If the economy shows signs of slowing, hold rates. In effect, the Federal Reserve has indirectly “capped” the potential returns in the stock market. Economic growth is the background for increasing corporate profits which helps push the stock market higher.

It is possible that despite the Federal Reserve’s recent dovish shift, the tightening that occurred last year may be set to cause its damage this year. The effect of rising rates and decreasing the balance sheet does not occur right away and can take over a year or more to really have an impact. This is what makes the Federal Reserve’s job so tough. The momentum of the previous year’s data is not known until next year. Even then, it is not really known. The damage from the previous Federal Reserve’s tightening action could already have been done. The economy could roll over into a recession despite any policy action implemented by the Federal Reserve.

Is the stock market doomed?

Not necessarily. If the Federal Reserve is successful in continuing to “kick the can down the road” the stock market can continue to make gains. Probably not huge gains, but gains nevertheless.

We are in a totally different world today compared to a couple of years ago. It was not long ago that the Federal Reserve was making a decision on whether to pause or apply the brakes to quantitative easing programs. Today they are trying to decide whether to pause or apply the gas pedal on quantitative tightening. Sure, some investors think that the next move will be for the Federal Reserve to cut rates, or reverse its quantitative tightening program. It will be difficult for the Federal Reserve to take such action, without significant erosion to the economy and/or the stock market.

At this stage in the market cycle, investors would be wise not to expect a strong multi-year stock market rally. Any signs of a sustained market rally will probably be capped by the Federal Reserve becoming more hawkish and ramping up its runway of increasing rates. Investors would be wise to temper their expectations.

Bullish or Bearish?

Neither. I am neither bullish nor bearish. At the current time there is a lack of a catalyst to move the stock market higher. Of course Trump could sign a deal with China addressing some of the trade issues, which would probably push the stock market higher. It is doubtful that it would create a multi-month stock market rally.

The stock market could “climb a wall of worry.” In this circumstance the market continues to move higher despite investor bearishness. This tends to be a frustrating experience for “bearish investors” as the stock market seems to defy logic.

The bottom line is that in the short-term it is difficult to predict short-term market movement, despite the lower expectations for stock market gains over the next few years.

Seasonal value added

Investing based upon seasonal trends, helps reduce the anxiety of a bull-or-bear market perspective. Seasonal investing helps make investment decisions over a multi-month time period, in which it is often difficult to determine the direction of the stock market. Based upon seasonal probabilities, it helps to increase the odds of success investing in sectors of the stock market, or the broad stock market itself.

Where do we stand right now? Currently, we are in the second half of the six-month favorable period for stocks which runs from October 28th to May 5th. March and April tend to be two of the stronger months of the year. From a seasonal perspective, it is prudent to be invested in the stock market at this time as there is a higher likelihood of gains compared to any two month contiguous period over the following six months.

[Download the complete monthly letter]Copyright © Alphamountain Investments