by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

February 21, 2019

Photo: Chris Tolworthy | Creative Commons Attribution 2.0 Generic (CC by 2.0)

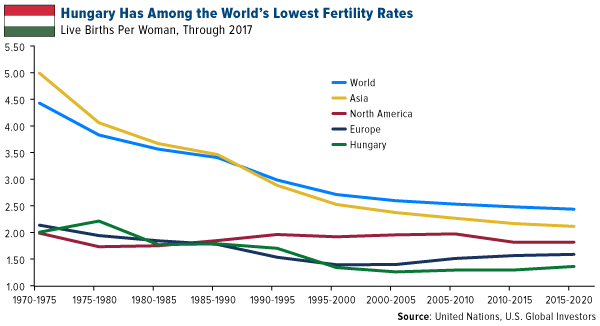

Hungary has a problem. Like many Eastern European and former Soviet countries, its population is shrinking thanks to a plunging birthrate and outmigration as young workers seek better opportunities and fatter salaries elsewhere in the European Union (EU). In 2017, the most recent year of data, Hungary had a low fertility rate of only around 1.4 live births per woman, significantly lower than what is considered the replacement rate. If nothing changes, the country’s population is projected to shrink 15 percent by 2050, from almost 10 million strong today to 8.28 million, according to the United Nations (UN).

This could have a number of negative economic and financial consequences. For one, the country could face serious demographic risk as its workforce is squeezed and the share of elderly, non-working citizens surges.

To be fair, Hungary isn’t alone. And it’s not even in the worst shape. According to UN data, the world’s top 10 countries with the fastest shrinking populations are disproportionately found in Eastern Europe. Bulgaria, the poorest EU member state, also has the ignoble distinction of ranking first in shrinkage velocity. By 2050, its population could contract as much as 23 percent—nearly a full quarter—followed closely by Latvia (22 percent) and Moldova (19 percent).

The reason why I’m focusing on Hungary is because I think policymakers there may have come up with an ingenious way to encourage young people to stay in the country, produce more children and grow the country’s labor workforce.

Interested in Paying No Income Taxes For Life? Start Making Babies

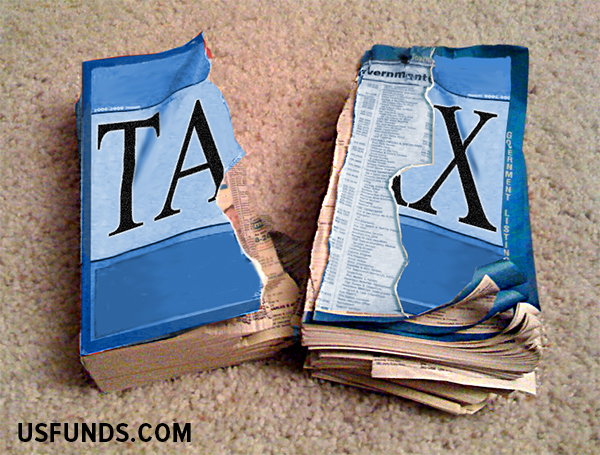

The plan I’m referring to, dubbed the “Family Protection Action Plan,” was unveiled last week by Hungarian Prime Minister Viktor Orbán. Among its incentives is a waiver on personal income taxes for life for married women who give birth to and raise four or more children.

This could be huge.

Let’s look at what some eligible women could stand to save. Since 2016, Hungary has had a flat income tax rate of 15 percent. Admittedly, that’s lower than the 22 percent a single American making between $38,700 and $82,500 is obligated to pay in federal taxes. But as recently as 2010, all Hungarians were on the hook for as much as 40.6 percent—and there’s always the possibility that they could return to that level (or higher) at some later point.

For many women, a guarantee that they’ll never again have to pay income taxes in Hungary, at any rate, could be incentive enough to have that fourth child.

Other parts of the action plan include subsidies for some families to buy larger cars (presumably to carry all those extra children), a new loan program to help families with two or more children to buy homes, and childcare payments for grandparents who offer to look after grandkids during work hours.

“There are fewer and fewer children born in Europe. For the West, the solution is immigration,” Orbán, a nationalist, was reported as saying. “For every missing child, there should be one coming in and then the numbers will be fine.”

“But we do not need ‘numbers,’” he added. “We need Hungarian children.”

Other European Nations Are Facing the Same Potential Crisis

You may disagree with Orbán’s solution to his country’s low birthrate—one Swedish minister has compared the policy to Nazi Germany—but he’s right in drawing attention to the fact that Europe, with few exceptions, is not producing enough children. In 2017, the EU had more deaths than births—5.3 million compared to 5.1 million, a deficit of around 200,000 people. The only reason the EU’s total population increased during the year, by 1.1 million people, was because of immigration.

Like Hungary, some EU members are looking at ways to encourage couples to start making more babies. In Italy—where only 464,000 births were registered in 2017, the lowest amount on record—policymakers are working on a plan to grant parcels of agricultural land to parents who have a third child between now and 2021. Poland’s government launched a multimedia campaign urging couples to “breed like rabbits.” And Spain appointed its own “sex tsar” to help give the country’s declining population a jolt.

Only time will tell whether these efforts can reverse the trend.

Finally, I invite you to take the quick poll below. Thanks in advance!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

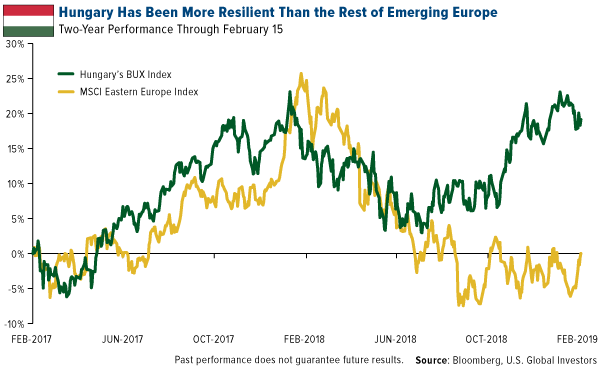

The Budapest Stock Exchange Index (BUX) is a capitalization-weighted index adjusted for free float. The index tracks the daily price only performance of large, actively traded shares on the Budapest Stock Exchange. The MSCI Emerging Markets Europe Index captures large and mid-cap representation across 6 Emerging Markets (EM) countries in Europe. With 73 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors