by Johann Schneider, Russell Investments

For over 20 years, Russell Investments has partnered with thousands of financial advisors to help them evolve and deepen client relationships. I’ve found that when advisors hear about our data-driven business solutions capabilities, advisors are generally most curious about two things:

- Which firm metrics matter most?

- What can I do to improve those metrics?

We can draw some data-driven insights—rather than just hunches and gut instincts—about the answers to these common questions based on information we’ve collected from over 1,000 advisors between 2015 and 2017. The data comes from conducting a Custom Business Analysis, which forms the basis of our coaching engagements.

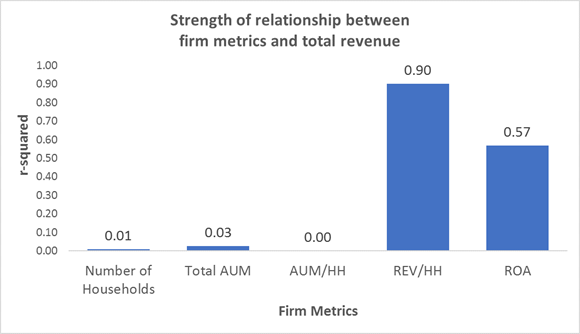

Which firm metrics matter most to revenue production?

It turns out that the list of key metrics is pretty short—and the winners might surprise you.

For firms with revenues ranging between $50k to over $5 million, we have found that the most important firm metrics that explain total firm revenue production are:

- Revenue per household (REV/HH)

- Return on assets (ROA)

Said another way, what matters most is having productive client relationships (ROA) with appropriate level of revenue (REV/HH).

In contrast, the least important metrics include:

- Total number of households

- Total assets under management (AUM)

- AUM per household

These metrics have virtually zero relationship with revenue production. In other words, getting more clients doesn’t impact firm revenue! And the AUM with each client doesn’t really matter either!

Relationship between firm metrics and total revenue

Source: Russell Investments. Data from 1,123 advisors who submitted books for analysis 2015-1017. The measurement statistic is r-squared, also known as the coefficient of determination. A high number suggests a strong relationship. Recall, however, that correlation analysis does not imply causation; it measures the strength of the relationship. In this instance, the r-squared measures how closely the changes in firm metrics relate to changes in total revenue. The results show that changes in advisory firms’ revenue per household explain 90% of the variation in total firm revenue production. In other words, advisors with more revenue per household were more likely to have a higher level of total revenue production.

Revenue per household (REV/HH) and how to help grow it

Revenue per household is the single metric that best differentiates high revenue firms from low revenue firms. Why? Because it is more efficient to work with a smaller number of large households, attracting high revenue clients is an effective way to create scale in your advisory firm.

Based on our data, for firms that generated between $500k and $1 million in total revenue, the average REV/HH was $1,654. The number ranged between $692 (bottom quartile) and $2,218 (top quartile).

Here are a few strategies to consider for increasing revenue per household—and hence potentially positively impact the health of your business:

- Formalize a target client demographic and enforce client minimums

Identify which clients you enjoy working with or who appreciate your value the most and help refocus your business on serving your best and biggest clients. The more your business is aligned with serving the needs of your “ideal” or target client, the more likely you will be to attract more of that type of client.

By elevating your service, you can improve client satisfaction and increase the probability of generating referrals in your target client demographic. Implement a proactive service model to deliver personalized planning and client service attention to this group of clients.

- Review the bottom 50% of your book

In the typical advisor’s book, the bottom 50% of households by revenue generate about 5% of the total firm production. These are most likely unprofitable accounts. The fastest way to increase your firm’s REV/HH is by reducing the number of households that are not in your target client demographic. This is a delicate topic, as you must balance your fiduciary responsibility to clients with your objectives to run a profitable business.

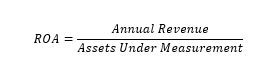

Return on assets (ROA)

ROA is hands-down my favorite single firm characteristic for judging the overall business health of an advisory practice.

![]() It conveys the productivity of an advisor’s AUM and it also signals the effective overall fee the advisor is charging to clients. You often hear about advisors charging a fee of 1%. Based on our data, though, it turns out that it is quite rare to come across a book with total ROA above 1%. For firms that generated between $500K and $1M in total revenue, the average ROA was 0.60%. The number ranged between 0.44% (bottom quartile) and 0.72% (top quartile).

It conveys the productivity of an advisor’s AUM and it also signals the effective overall fee the advisor is charging to clients. You often hear about advisors charging a fee of 1%. Based on our data, though, it turns out that it is quite rare to come across a book with total ROA above 1%. For firms that generated between $500K and $1M in total revenue, the average ROA was 0.60%. The number ranged between 0.44% (bottom quartile) and 0.72% (top quartile).

Below average ROA may indicate low fees, or it may signal a sizable percentage of legacy brokerage assets that are no longer earning commissions. Low ROA may be a warning sign, but it can also indicate an opportunity to identify unprofitable client relationships and turn them profitable. The fact is that many advisors don’t curate their client base nor do they analyze it to identify imbalances in their service model.

Consider these strategies for increasing ROA—and potentially also the health of your business:

- Transition legacy commission-based accounts to advisory accounts Many advisors have a segment of client accounts that are no longer producing revenue, which can be a burden on your client service model. Transitioning some of these clients to an advisory relationship may be the best way to optimize your firm’s ROA.

- Raise fees, articulate your value as an advisorRather than focusing on discounting your price, try to focus on the value you can provide and articulate that value to clients. Take every opportunity to educate your clients on the services you provide and value you have added to their financial lives.

- Elevate your Client Discovery

Many investor clients with low ROA and low AUM are considered legacy clients that could have additional hidden assets being held away from the advisor or are expecting windfall assets from something like a qualified retirement plan rollover or inheritance. By having a (re)discovery conversation with these clients, you could identify additional assets for management which could lead to higher revenues.

The bottom line

Tending to client and staff needs, keeping up with the markets and overseeing investment portfolios, it can be hard to also focus on the health of your business. Our data on thousands of advisor books reveals that assessing the health of advisory businesses may be more straightforward than expected: firm revenue production it’s driven primarily by two metrics: Revenue per Household and Return on Assets.

The best thing about these two metrics is that they are easy to measure. And by focusing on just these two metrics, you can begin to develop strategies designed to help grow your firm’s revenue and run a more efficient practice. You can also monitor your progress over time.

Of course, we recognize that it can be challenging to make meaningful change in your business with everything else that’s already on your plate. That’s one of the reasons why many advisors choose to partner with Russell Investments. We can help you better understand the specific needs of your business—and help hold you accountable to executing on your goals, no matter what stage of the advisory lifecycle you are in. Whether you’re looking to optimize your book, evolve your practice or revolutionize your business, we can offer data-driven insights to help elevate your business and help you and your clients maximize your potential.

Let us know how we can help.

Copyright © Russell Investments