by Fixed Income AllianceBernstein

Should you be concerned that high-yield bonds didn’t predict last year’s equity market selloff? We don’t think so. In fact, we think investors should consider adding high-yield exposure to reduce overall risk.

High-yield bonds have traditionally been a reliable early indicator of market trouble. Over the past 20 years, high-yield credit spreads—the extra yield investors earn for holding these assets instead of safer government debt—widened before every big equity market selloff, including the 1998 Russian default, the bursting of the dot.com bubble and the global financial crisis.

But some are wondering whether that streak ended last year when spreads narrowed in the months leading up to the S&P 500’s 7% October swoon—its worst monthly performance in more than seven years. The Wall Street Journal went so far as to suggest that investors’ favorite stock market crystal ball may have finally cracked. As a result, investors are worried about complacency in the high-yield market and questioning the historically tight correlation between high-yield bonds and stocks.

Want Lower Volatility? Consider High Yield.

The way we see it, this is no reason to rethink the relationship between high yield and stocks—or the logic behind using high yield to de-risk an equity allocation.

To start with, it’s hard to say that high-yield investors are asleep at the wheel. After bottoming at 303 basis points on October 3, spreads widened by more than 200 basis points over the next three months. Yes, the high-yield market was a bit slower to react this time. But that doesn’t make it less relevant as a risk signal.

As some of the market participants quoted in the Journal story noted, there are plausible reasons for the lag, including the fact that companies issued fewer bonds in 2018 despite high demand from investors. The result: a supply-demand mismatch that propped up valuations and caused spreads to narrow.

We think high yield may have been slower to react because the equity selloff, while abrupt and disorienting, looked more like a correction than the start of a prolonged bear market.

That could change, of course. We’re nearing the end of one of the longest credit cycles on record and the US yield curve has been getting flatter—historically a signal of slower growth or possibly a recession ahead.

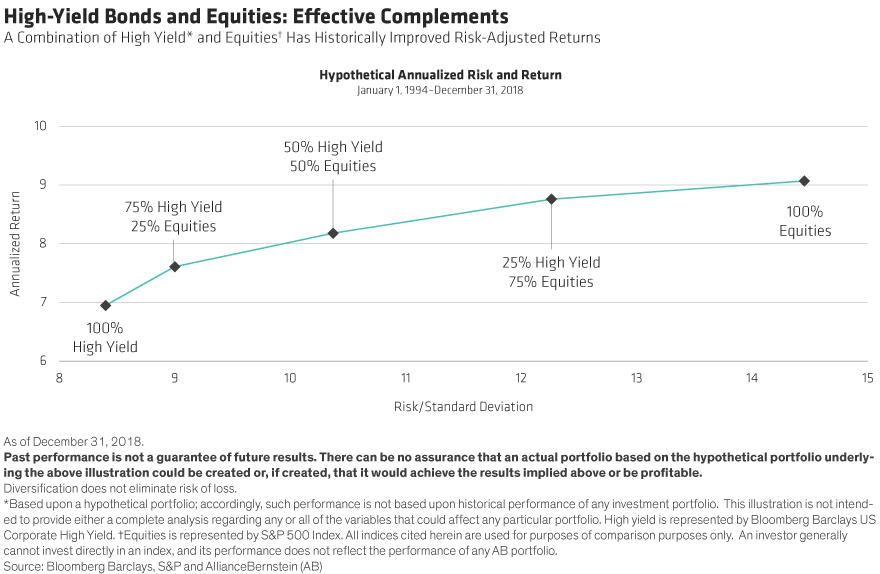

That’s why it’s a good time to remind investors that combining stocks and high yield can reduce overall risk when market conditions get rough without sacrificing much return (Display 1).

Income That’s High and Consistent

How is this possible?

First, high-yield bonds provide investors with a consistent income stream that few other assets can match. This income—distributed semiannually as coupon payments—is constant. It gets paid in bull markets and bear markets alike. After accounting for maturities, tenders and callable bonds, the high-yield market typically returns anywhere from 18% to 22% of its value every year in cash.

Along with these payments, high-yield bonds also have a known terminal value that investors can count on. As long as the issuer doesn’t go bankrupt, investors get their money back when the bond matures.

All of this helps to offset stocks’ higher level of volatility—and provide better downside protection in bear markets. Average calendar year returns for the S&P 500 Index and the Barclays US High-Yield Index between 1998 and 2018 were 8.2% and 7.4%, respectively. But the average drawdown for stocks over that period was 11.0%, nearly twice high-yield’s tally of 5.7%.

Taking Advantage of Wider Spreads

A more typical approach to moderating equity volatility is to reallocate assets to more stable options such as investment-grade bonds, or even cash. But this can exact a heavy cost in sacrificed return potential, especially as high-yield spreads widen.

When we measured 12-month rolling returns between 1994—the first year Barclays provided data on option-adjusted spreads—and 2018, we found that high yield outperformed equities when spreads were wide.

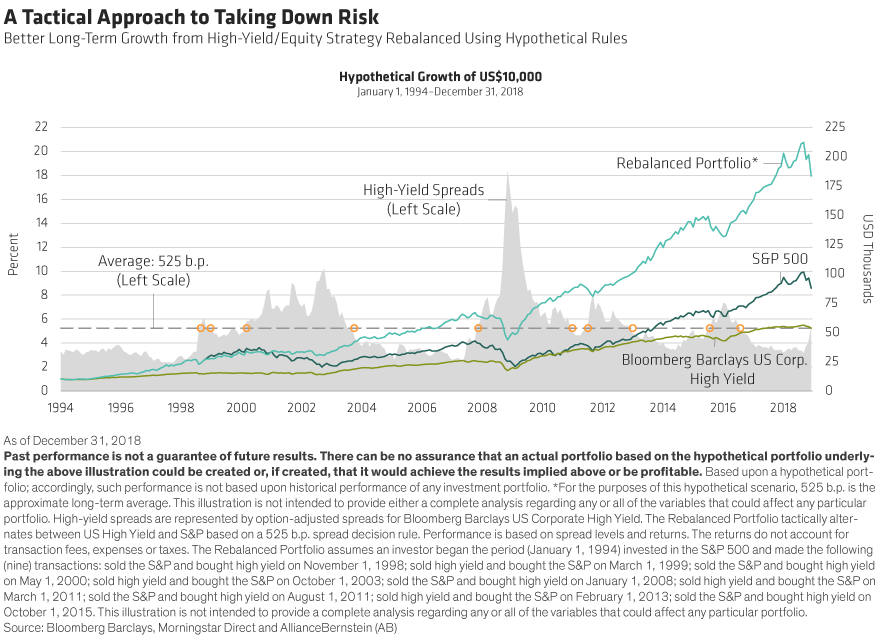

But how wide is wide enough to justify using high yield as a replacement for equity exposure? In our view, it can be helpful to establish a decision rule. We conducted a hypothetical exercise in which we set 525 basis points as the spread threshold—if average spreads moved above this level for two straight months, we sold equities and bought high yield.

For simplicity’s sake, we conducted the experiment as if we were shifting entirely out of equities and into high yield. In reality, investors would probably rotate a much smaller percentage of their equity exposure into high yield.

A hypothetical investor who put $10,000 in the S&P 500 on January 1, 1994, and stuck to this approach for the next 25 years would have made just 10 trades—the most recent of which would have been to sell high yield and buy stocks on October 1, 2016. Display 2 illustrates how the rebalanced portfolio would have stacked up against the respective indices. The hypothetical returns assume that the assets were fully invested over the entire period and do not include transaction costs or taxes.

Recovering Losses Quickly

Some of high yield’s advantage comes down to valuations. As spreads widen, high-yield bonds’ income-generating potential grows, and investors can reinvest their proceeds at higher yields. And if spreads continue to widen in 2019, causing short-term price declines, investors can take comfort in knowing that high yield tends to make up its losses more quickly than stocks do.

For instance, the high-yield market has suffered 10 peak-to-trough losses of greater than 5% over the last 20 years. On average, investors recovered their losses over the first nine of those drawdowns in less than six months—and sometimes as few as two (the market has already started to claw back some of the losses suffered during a 5.4% decline in late 2018).

Of course, it’s still critical to choose your exposures carefully. It’s late in the credit cycle and default rates will likely rise this year.

High-Yield Signals Are Still Important

Still worried about high yield’s ability to predict trouble? Don’t be. High-yield bonds—and credit markets in general—haven’t stopped playing canary in the coal mine for good. Companies with high debt levels are likely to remain highly sensitive to signs of slower growth.

Perhaps more importantly, we’re not convinced it really matters that much which market—high yield or equities—moves first. Over the long run, we’ve seen that adding a dash of high-yield debt to an equity portfolio when spreads are wide can tamp down volatility without sacrificing too much return potential. When markets are volatile, that’s a reassuring thought.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein

.png)