by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

February 4, 2019

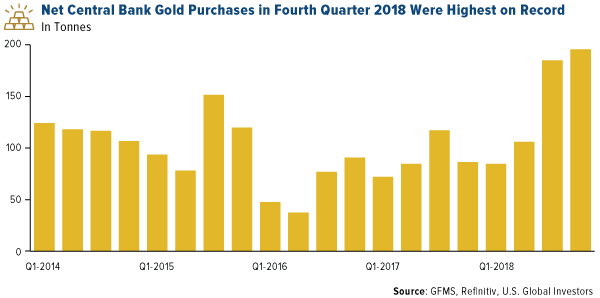

Something big is happening in the gold market right now, and nowhere is that more apparent than in central banks of emerging economies. Last year was a watershed in the size of official gold purchases, as banks added an incredible 651.5 tonnes (worth some $27.7 billion) to their holdings, according to the World Gold Council (WGC). Not only is this a remarkable 74 percent change from 2017, but it’s also the most on record going back to 1971, when President Richard Nixon brought a formal end to the gold standard. In the final quarter of 2018 alone, central banks purchased as much as 195 tonnes, the most for any quarter on record, according to leading precious metal research firm GFMS.

As I’ve shared with you before, central banks have been net buyers of the yellow metal since 2010 in an effort to diversify their reserves away from the U.S. dollar. Last week, I had the opportunity to discuss the issue with SmallCapPower’s Vasudha Sharma. You can watch the conversation by clicking here.

Most Western nations already have a comfortable weighting in gold relative to their total reserves, so the demand is almost strictly from emerging markets. Among the biggest purchasers last year were Russia, Turkey and Kazakhstan, and we also saw China add to its holdings for the first time since 2016. Meanwhile, Hungary, Poland, India and a number of other countries took deliveries for the first time this century.

Central Banks Recognize Gold as an Effective Diversifier and Store of Value

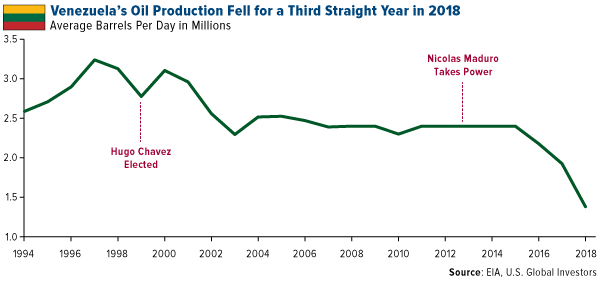

With gold representing a whopping 74 percent of U.S. reserves, the Federal Reserve has historically had the largest position among global central banks. (Venezuela’s weighting, at 76 percent, has lately roared past the U.S., but that’s thanks solely to hyperinflation and its rapidly deteriorating economy. I’ll have more to say on Venezuela later.)

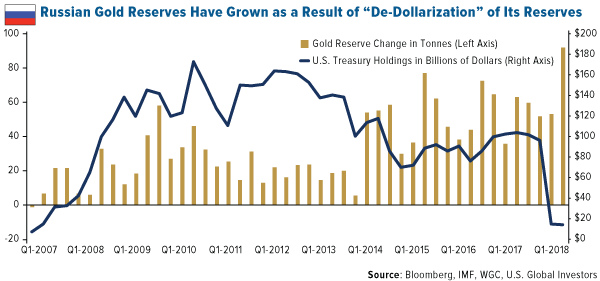

Other countries have a lot of catching up to do—i.e., gold buying—to get to the same level of diversification. Russia, for instance, has the fifth most gold in the world at 2,066.2 tonnes, but this amount represents only 17.6 percent of its total reserves. In sixth place is China, whose holdings (a reported 1,842.6 tonnes) represent a very small 2.3 percent of reserves.

Below you can see Russia’s ongoing strategy of “de-dollarization.” To date, the Eastern European country has liquidated nearly its entire position in U.S. Treasuries to fund its rotation into gold. According to the WGC, Russia bought 274.3 tonnes in 2018, its greatest amount on record, and the fourth consecutive year of purchases above 200 tonnes.

Gold Is the Only Thing Left of Value in Venezuela

Gold made even more headlines last week as it relates to Venezuela. The beleaguered South American country, as you probably know, is in the midst of a potential transfer of power, from current president and dictator Nicolas Maduro to the more centrist Juan Guaido, whom the U.S., European Union and other world governments have recognized as the de facto head of state.

Since the U.S. and other countries have imposed heavy sanctions on Venezuela and its oil industry, the cash-strapped country has had to rely on its gold holdings to make international bond payments, mostly to Russia and China. But the days of Maduro’s plundering of Venezuela’s hard currency might be numbered, and not just because he could be removed from power soon.

Last week Guaido sent a letter to U.K. Prime Minister Theresa May and the Bank of England (BoE), urging them not to send $1.2 billion from any sale of Venezuela’s gold reserves—held in the BoE’s vaults—to Maduro’s “illegitimate and kleptocratic regime,” according to the Financial Times. “Maduro has stolen a huge quantity of state assets,” including Venezuelan gold, a part of the letter reads. “There is no doubt that he will, if allowed, also steal the assets held by the Bank of England, which rightly ought to be saved to support the recovery of Venezuela.” The bank has honored Guaido’s request and is blocking Maduro’s efforts to sell the metal.

Later in the week, a Russian Boeing 777 allegedly landed in the capital city of Caracas and was loaded up with as much as 20 tonnes of Venezuelan gold, according to Bloomberg. It was later reported that the jet, for reasons unknown, left Caracas without the gold payment. There were additional reports, however, also by Bloomberg, that another aircraft, this one from the United Arab Emirates (UAE), had landed in the country and was awaiting delivery of the gold instead.

These incidents are certainly dramatic, and I’m eager to see how they play out, but I think the key takeaway is that gold is an exceptional store of value. It’s the only asset of any value to which a socialist autocrat like Maduro still has access. The bolivar is worthless, and the country’s once powerful and influential oil industry is fading fast. Without gold, Maduro is powerless.

Four Straight Months of Gains. What’s Gold’s Next Move?

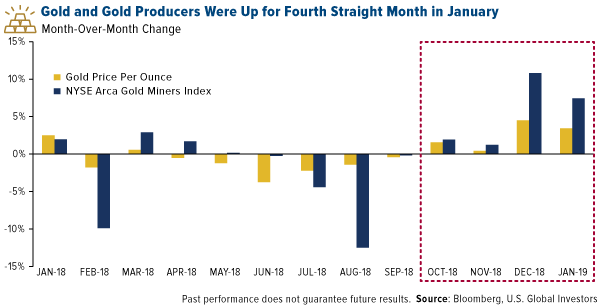

The gold rally that began late last year, when equities turned rocky, continued into the new year as the historic U.S. government shutdown gripped investors, and signs that Fed Chair Jerome Powell was set to pause monetary tightening intensified. For the fourth straight month in January, both the price of gold and gold mining stocks posted strong gains. Before then, the price of gold was down for six straight months, a losing streak we hadn’t seen in 40 years, when the yellow metal fell each month from December 1988 to May 1989.

The yellow metal ended last month at a nine-month high, and with the U.S. dollar expected to lose momentum on higher deficit spending, we could see prices surge to as high as $1,400 or even $1,500 an ounce this year.

I’m not alone in my bullishness. Billionaire Sam Zell, creator of the real estate investment trust (REIT), bought gold for the first time in his life, citing the fact that supply is shrinking.

And Mad Money’s Jim Cramer also came out strongly in favor of the yellow metal last week.

“We are big gold believers here,” Cramer commented. “Now gold is at $1,300, we think gold is going to $1,400, $1,500. We suggest that everybody have a little bit of gold in their portfolio.”

I second Cramer’s suggestion. My recommendation has always been a 10 percent weighting in gold, with 5 percent in bullion and jewelry, the other 5 percent in high-quality gold mining stocks and well managed gold mutual funds and ETFs.

Did you miss our updated Periodic Table of Emerging Markets? Read all about it by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Diversification does not protect an investor from market risks and does not assure a profit.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002.

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, ranging from office and apartment buildings to warehouses, hospitals, shopping centers, hotels and timberlands.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors