by John Lynch, Chief Investment Strategist, LPL Financial

KEY TAKEAWAYS

- The Fed’s signals on future policy in this week’s meeting will be especially telling.

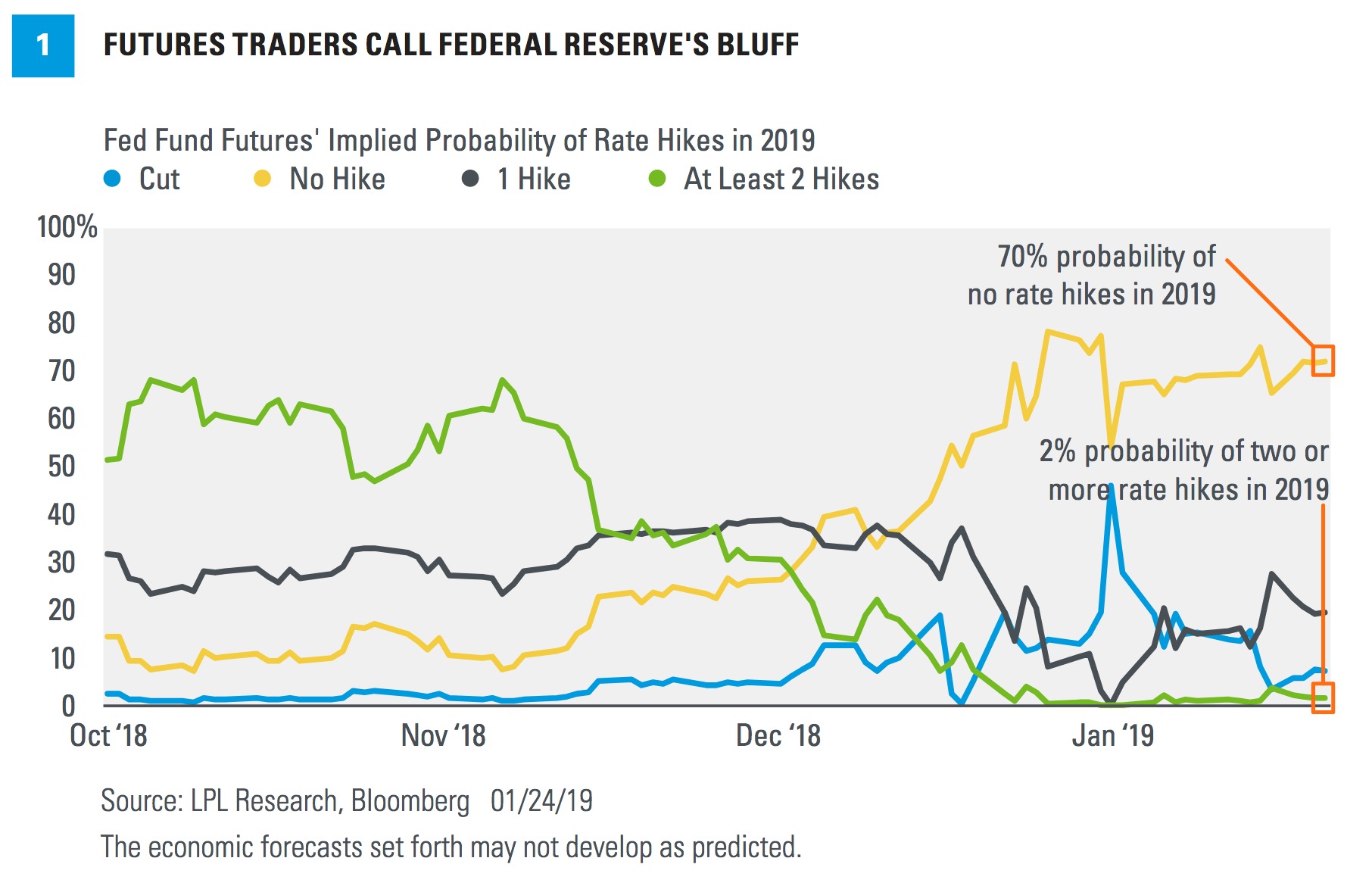

- The Fed’s dot plot implies two rate hikes in 2019, but futures traders are positioning for a pause.

- Powell’s comments on macroeconomic headwinds and balance sheet policy will also be focal points.

Tensions around U.S. monetary policy remain high as recession fears grow and markets seek further reassurance that the Federal Reserve (Fed) is prepared to slow or stop future rate hikes as needed. The Fed will meet this week and make a rate announcement on Wednesday, January 30. Policymakers’ last rate announcement rattled investors, who have watched global economic data deteriorate, but Fed Chair Jerome Powell’s comments on flexibility have calmed markets. Although the bulk of U.S. data remains solid, growing uncertainty over several issues leaves the Fed with a delicate balancing act as it decides its next policy steps.

Mixed Signals

The Fed’s signals on future policy at this week’s meeting will be especially telling. Fed policymakers raised rates December 19, 2018, but lowered their expectations in the “dot plot” (a summary of policymakers’ rate projections) to just two hikes this year. Still, U.S. stocks posted their worst performance on a rate announcement day since 2011 as investors interpreted the Fed’s messaging as detached from current economic reality. Since then, trade and political headwinds have intensified, and futures traders have increasingly positioned for a Fed pause this year. Fed fund futures are pricing in about a 70% probability that the Fed will keep rates unchanged for the rest of 2019 [Figure 1].

The Fed has acknowledged global risks but has maintained an optimistic stance on long-term economic growth, which is reflected in its updated dot plot. The median dot suggests the fed funds rate will rise to a range of 2.75–3% at the end of 2019 (or two hikes from the current level), then peak at 3–3.25% at the end of 2020 before declining to a “longer-term” rate of 2.75%. Based on the dot plot, the Fed is one hike away from this “longer-term” rate—or our best indication of the neutral rate, where policy is neither accommodative nor restrictive. Of course, the neutral rate is a moving target, and the economic factors the Fed watches are always shifting. But at this point, policymakers expect interest rates to settle around its forecasted levels, and they’re building in wiggle room to raise rates beyond neutral if inflation rises too quickly. The Fed updates its dot plot four times a year, so we’ll get more details on rate projections in March.

There’s broad consensus the Fed is unlikely to hike rates at this meeting, considering global weakness and signs of deterioration in pockets of the U.S. economy. Overall, though, we think the domestic economy is strong enough to digest continued gradual rate hikes once the trade and government shutdown headwinds subside.

Powell's Talking Points

Powell’s post-meeting press conference will be another focal point. Powell is scheduled to speak after Wednesday’s rate announcement, based on the Fed’s new schedule of holding press conferences after every, rather than every other, meeting. Given Powell’s track record, this schedule change could be problematic for U.S. stocks. The S&P 500 Index has declined on every Fed rate announcement day since Powell took over as Fed chair in February 2018, although we do expect the tone in messaging to improve.

The latter part of the economic cycle has been challenging for every Fed chair, and despite Powell’s pragmatic approach to policy, the new chair has not yet found the right tone to persuade markets that the Fed will be responsive to circumstances even as it tries to contain risks of late-cycle inflation. Following the last meeting on December 19, the S&P 500 slid nearly 2% from the beginning of Powell’s press conference through the end of the day as he weighed in on softening inflation, deteriorating global growth, trade tensions, and the Fed’s political independence. Powell has tended to talk about the balance of upside and downside risks, and emphasized that the Fed remains flexible but data dependent. Even though Powell’s messaging hasn’t always soothed markets, we think his pragmatic approach is appropriate given the complicated nature of the domestic and global economy, and we don’t expect him to deviate from it.

Still, investors will be very focused on Powell’s tone as he discusses the economy and policy, especially in the absence of economic data during the government shutdown. Fewer data points mean less context for everyone to gauge economic health, so investors will likely be looking to the Fed for direction. Sentiment is especially fragile right now, so Wednesday’s market action could be volatile.

Balance Sheet Unwind

The Fed’s balance-sheet normalization, as it unloads years of bond purchases made during quantitative easing, has recently come under scrutiny after Powell said in the December press conference that the unwind is on “automatic pilot.” The Fed’s unwind has typically taken a backseat to investor speculation on interest rates, so we were surprised that Powell’s comments spooked investors. The Fed has telegraphed plans to reduce its $4.5 trillion balance sheet since the summer of 2017, and the program has now been in place for over a year.

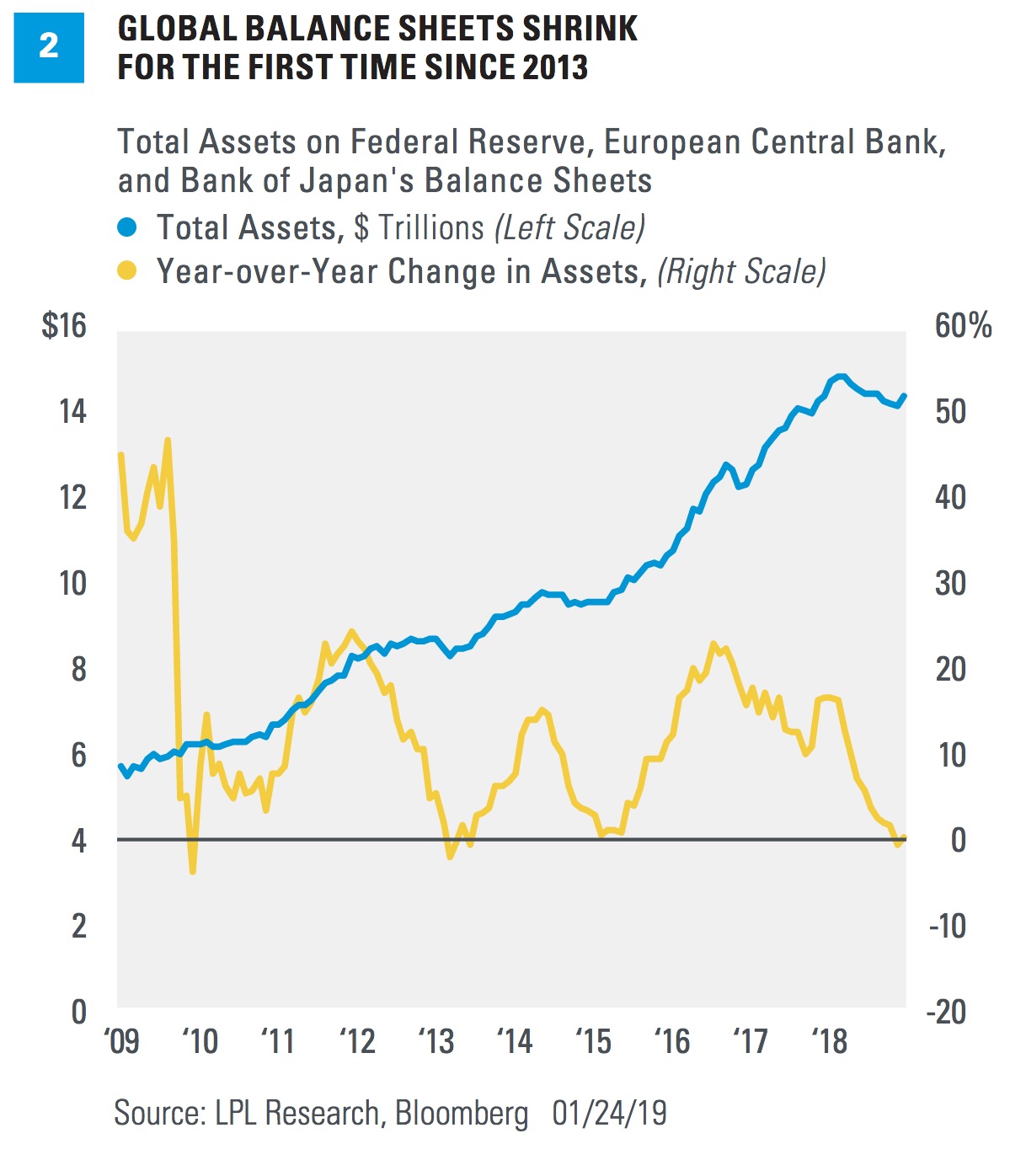

Investors’ nervousness around the balance sheet is largely driven by sentiment, in our view. There has been a sizeable shift in global liquidity as the Fed continues to unload assets and the European Central Bank tapers its bond purchases [Figure 2]. Still, global liquidity remains healthy. While financial conditions have tightened in the United States, rates across fixed income sectors remain relatively low.

However, the impact of balance-sheet normalization has been tough to quantify, and markets have sold off at any sign of destabilization recently. Analysis we’ve reviewed has suggested that the impact of current balance sheet runoff is equal to a little less than one to as many as three rate hikes per year. While there’s considerable uncertainty about the exact ramifications, investors’ recent psychological reaction has been clear. On January 4, Powell effectively walked back his “autopilot” comment by saying the Fed will be flexible with all of its policy tools, including the balance sheet. The S&P 500 jumped 3.4% that day in one of its biggest daily rallies of the bull market. Since then, there has been speculation that the Fed will slow, pause, or even end its balance sheet reduction. We will be monitoring the Fed’s policy statement and Powell’s press conference for any new details.

Conclusion

As discussed in our Outlook 2019, we believe solid U.S. economic trends will produce gross domestic product growth of 2.5–2.75% in 2019, which would justify further tightening. However, given the interconnected nature of the global economy these days, the Fed is also monitoring decaying international growth. Some downside risks in the U.S. also continue to raise concerns, with major trade issues still unresolved, business investment slowing, and dysfunctional partisan politics in Washington. We believe the Fed is likely to show the flexibility markets are seeking at its upcoming meeting, as it balances still solid domestic economic growth against slower global growth and less significant, but persistent, domestic risks.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

Any economic forecasts set forth in the presentation may not develop as predicted.

Investing involves risk including loss of principal.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Copyright © LPL Research