by Mark Phelps, Dev Chakrabarti, Concentrated Global Growth, AllianceBernstein

Equities declined around the world in 2018, and valuations fell sharply. The risks are clearly significant—but have stocks fallen too far? With earnings still expected to advance this year, we think selective investors can find attractive entry points.

Reality can be subjective. For many investors in stocks, last year’s pain was real, as returns fell sharply due to the escalating US-China trade war, growing concerns about monetary policy tightening and fears of a global economic slowdown, all of which weighed on the earnings outlook.

But the earnings outlook itself may not be as bad as widely perceived. It’s true that the pace of earnings growth is slowing—particularly in the US, as the boost from last year’s tax reform fades. Yet companies are generally still increasing profits, which is a positive environment for stocks.

But the earnings outlook itself may not be as bad as widely perceived. It’s true that the pace of earnings growth is slowing—particularly in the US, as the boost from last year’s tax reform fades. Yet companies are generally still increasing profits, which is a positive environment for stocks.

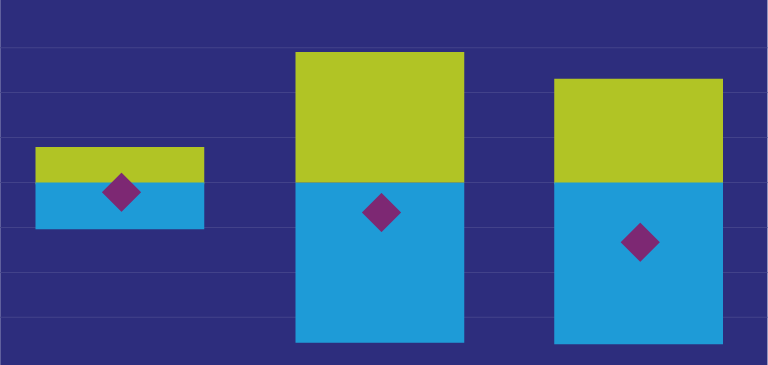

As the Display above shows, earnings are expected to advance across almost all sectors globally in 2019. At the same time, price/forward earnings valuations have compressed sharply since last year’s market declines.

So are markets divorced from reality? To some extent, yes. These days, when sentiment is so downbeat, good macroeconomic news isn’t given any credibility. Volatility is widely seen as a hazard even though it also provides active managers with opportunities to exploit mispriced securities. And while the pace of profit growth has moderated, earnings haven’t fallen off a cliff. Sectors such as healthcare, technology and consumer discretionary provide especially fertile ground for investors, in our view. By identifying high-quality companies with solid business dynamics, competitive advantages and pricing power, we believe investors can build a portfolio with long-term outperformance potential—even in today’s tough markets.

Source: Bloomberg, MSCI and AllianceBernstein (AB)

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Copyright © AllianceBernstein