While big market swings can be unsettling to many investors, there are a number of alternative investment strategies that aim to turn volatility into opportunity, according to K2 Advisors’ Brooks Ritchey and Robert Christian. They outline some of the market challenges they see ahead, and why they believe certain hedge strategies could find fertile ground.

Today’s “risk uncertain” markets present an evolution of challenges for investors. The post-2008 massive expansion of central bank balance sheets around the developed world—one of the most dominant market-shaping forces over the last decade—is beginning to reverse. We see this in the United States and in other developed economies as well.

Markets have seen increased volatility and threat of increased inflation. Earnings growth looks like it may be slowing somewhat. In addition, macroeconomic concerns—including geopolitical hot spots, growing political uncertainty in Europe and the threat of trade wars—all pose legitimate concerns for market stability.

In particular, the recent drawdowns in equity markets may be especially concerning. These declines are happening in the face of rising interest rates. Historically, if investors sought to manage equity volatility, they could do so by using core fixed income. Now, overweight in core fixed income carries its own risk, because of heightened sensitivity to rising rates.

Bottom line—investors have expressed concerns about what to do with their equity allocations, especially given current valuations and rising volatility. They are also concerned about fixed income allocations due to rising rates. These are risks they are seeking to mitigate. We will examine some hedge strategies to illustrate why increased allocations to alternatives may be a viable approach to addressing today’s uncertainties.

When are They in Favour?

Opportunity set is key to alternatives. What we mean is that when there are more possible trades or investments, there is more chance of capturing alpha. Looking back over the last 25 years, there have been six periods of rising interest rates.1 We found that both the performance and standard deviation2 of long/short hedge strategies have compared favourably with stocks and bonds, and long/short hedge strategies’ volatility was comparable to bonds and nearly half that of equities.3 Additionally, we have found a significant amount of performance has come from a different source than equity beta.4 In sum, we found the risk-and-return experience was better, and the ride a smoother one.

Why do we see a beneficial relationship with long/short hedge strategies, particularly in a rising interest-rate environment?

As central bank rates move higher, often we will see a wider variation of the specific interest rates that are applied to certain sectors, companies, or sovereign debt. For the vast majority of the past 10 years, as interest rates globally have been artificially suppressed, less economically sound companies or countries have been able to survive on a very low cost of financing. This was part of the central bankers’ intent as they sought to stabilise equity and bond markets.

This dynamic started to change in mid-December 2015 when the US Federal Reserve began hiking rates and, subsequently, other central banks like the Bank of Canada followed its lead. The result: a wider gap between companies that have a higher debt-to-equity ratio and, say, technology firms that have a lot of cash and don’t mind if rates rise.

As a result, we have seen a higher dispersion in the performance of winning sectors versus others, such as utilities and other high debt-to-equity industries. So, the separation of performance influenced by the impact of higher interest rates creates an alpha opportunity—alpha being defined as a measure a manager’s value added relative to a passive strategy, independent of the market movement.

In addition to the impact from rates on equity and fixed income, higher volatility in the major currency markets of the world also has an impact on sectors in terms of revenue growth, and whether they are importers or exporters.

Hedge Strategies with Widening Opportunity Sets

Currently, we have seen notable expanded opportunity sets for three hedge strategies: Global Macro, Event Driven and Relative Value. We provide our reasoning on the latter two categories.

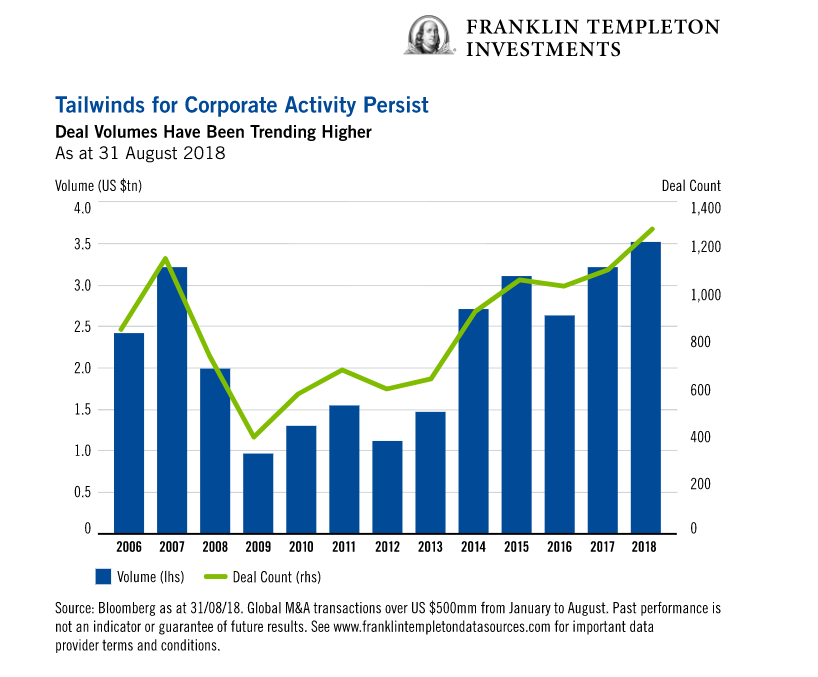

Event Driven—Merger Arbitrage. We think it’s a ripe environment for mergers in the media industry, as well as a broadly more favourable outlook on vertical mergers. Tailwinds for corporate activity also persist, including corporate tax cuts, cash repatriation, high CEO confidence, and strong credit markets. We see the most significant headwind as the potential for a trade war between the United States and China. We also view technology as a significant factor influencing deal flow. In particular, changes in the semiconductor space, where companies seek to get ahead of the technology curve via acquisition of smaller start-ups versus developing innovation in-house, may drive activity.

So-called “industrial policy” is a potential headwind to future merger and acquisition (M&A) activity. This refers to the political considerations that are increasingly coming to the fore as business and commerce evolves globally. Governments around the world—in the interest of national security—have been increasingly sensitive to businesses sharing critical technologies. This is not just the United States and China, but includes Canada, Germany, Australia and the United Kingdom as well. Still, the added risk associated with industrial policy is not necessarily all bad for hedge fund strategies. The increased uncertainty may widen spreads significantly, creating a more attractive risk/reward opportunity set.

With interest rates starting to rise we see duration5 risk coming into focus for fixed income investors. We view relative value fixed income strategies, such as long/short credit, being well-positioned (given their shorter duration portfolios) to capture alpha form rising sector dispersion.

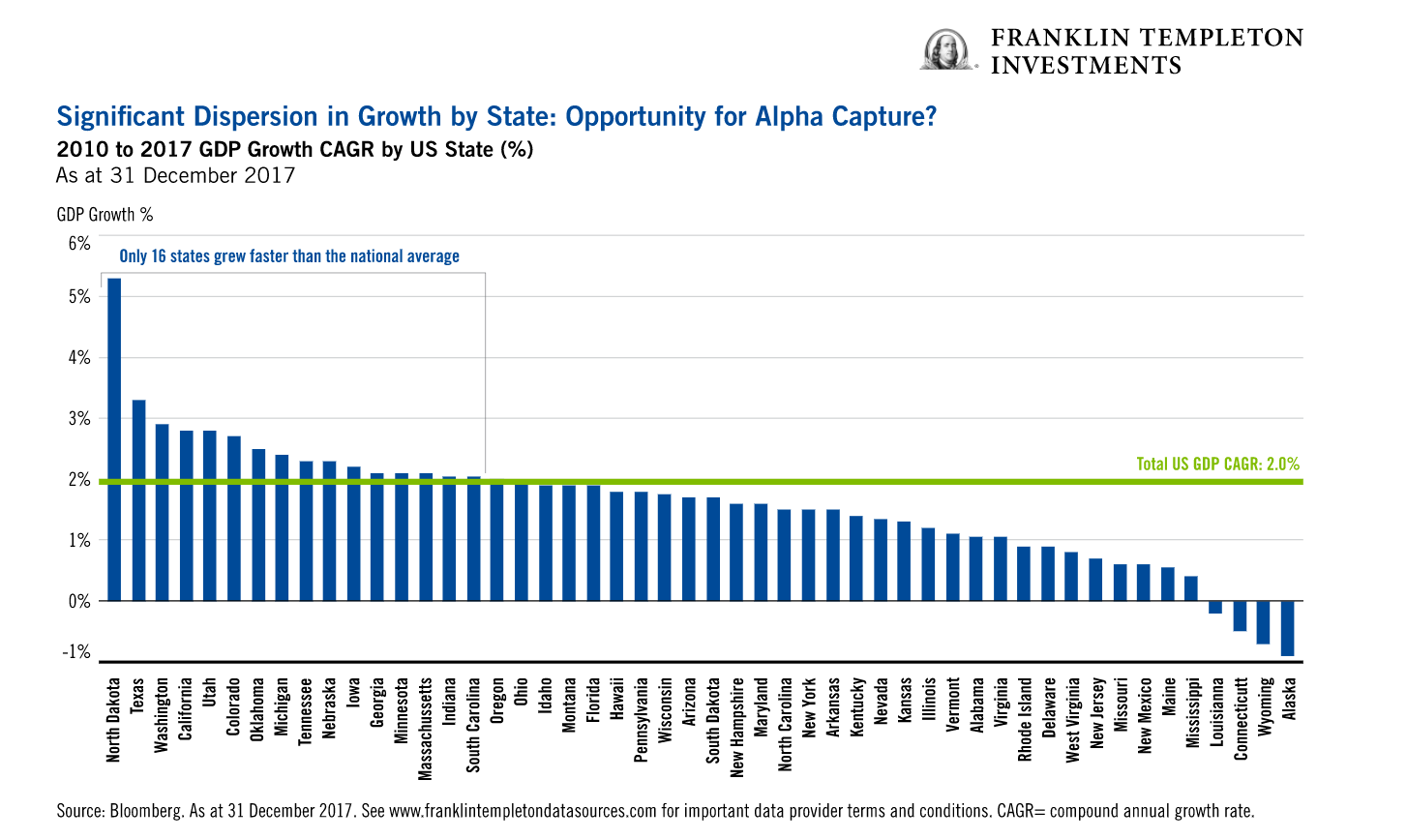

Since the Global Financial Crisis (GFC) a decade ago, gross-domestic product (GDP) growth in the United States has progressed at a steady, albeit unremarkable, rate of about 2%. But this growth is not uniform; there is tremendous variation if you deconstruct its components at the state level. Viewing the data from this perspective in the chart below, we see that only 16 US states have either met or exceeded the national average of GDP growth since the crisis. Four have had negative growth for the entirety of the recovery.

So, the US economy is not homogeneous, and in fact GDP growth is rather dispersed. Tax changes probably amplify this dispersion.

Our takeaway is that when hedge managers look at fixed income investments in the United States, they consider where those issuers do business. Not in terms of where they are headquartered, but where the underlying commerce takes place. The disparity in state growth rates may impact these companies very differently, which we believe ultimately can create opportunity for relative value fixed income hedge managers to capture alpha or seek different returns.

Finding a Smoother Road

There are three main allocations in portfolios: equity, fixed income and alternatives. How much and when to shift allocations is a key component of risk management. There is significant uncertainty going forward: Can global growth sustain? Will there be a de-coupling between the United States and the world? How will trade tensions between the United States and China resolve?

Whatever the results, in this type of evolving environment, we think understanding the types of investments that can act differently can potentially be a powerful tool to manage to your desired outcome.

We also believe that an increased allocation to alternatives may help buffer a portfolio for risks. Depending upon an investor’s objective, alternatives can potentially benefit from things like volatility, sector rotation, asset class dispersion, and de-coupled global growth. In the case of hedge strategies, their potential for a widening opportunity set helps signal when to expect them to be particularly useful.

*****

Comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Products, services and information may not be available in all jurisdictions and are offered by FTI affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton has not independently verified, validated or audited such data. Franklin Templeton and its third party sources accept no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. K2 does not represent that such information is accurate or complete. Certain of the information contained in this document represents or is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. K2 believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, too much reliance should not be placed on such forward-looking statements and information. Important data provider notices and terms available at www.franklintempletondatasources.com.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.