by James T. Tierney, Jr., Frank Caruso, Kurt Feuerman, Equities, AllianceBernstein

With US stocks facing multiple risks, it’s easy to lose sight of the positive trends that could help the market recover. In 2019, investors should search for select stocks with the right attributes to produce positive surprises in a potentially tricky market environment.

When 2018 began, investors were upbeat for good reason: GDP growth was expected to be the strongest since 2005. Corporate earnings were projected to grow by at least 20%. The president was bent on deregulation. Nobody worried about a recession. US stocks moved higher until the fourth quarter downturn dragged equity returns into negative territory for the year. It was the first time investors lost money in US stocks during a calendar year since 2008. And it was the first time in 70 years that a market rose by more than 10%, only to end the year in the red.

What Changed?

In the fourth quarter, real fears took center stage. Investors started worrying about the Federal Reserve tightening monetary policy, fallout from the escalating trade war with China, a partial government shutdown and maybe even a recession by late 2019. In 2019, US GDP growth and corporate earnings are likely to slow from robust levels in 2018. Memories of the bear market of 2008 suddenly seem vivid.

Caution is warranted and market conditions are complex. Yet we believe US equity markets could surprise skeptical investors in 2019. We’re not wearing rose-tinted glasses, but we are taking a cold look at the state of the US economy, expected corporate earnings growth, current valuations and history.

US Economy: Bright Spots amid Dangers

Let’s start with the economy. Much of the recent weakness has been caused by trade tensions. US efforts to renegotiate trade deals have caused weakness in developing countries, which Apple blamed for its historic earnings miss in early January. While there’s no guarantee that a US-China deal will be reached, there’s enough pain on both sides to suggest a deal is in the best interests of both countries. Positive resolution of the trade conflict would go a long way to firming up the growth outlook.

Beyond trade, the US economy looks resilient: Unemployment is under 4%, wages are growing at more than 3% annually and the workforce and workweek are expanding. Consumer spending advanced by 5.1% during the holiday season, according to MasterCard’s SpendingPulse. Since the US consumer drives about 70% of the economy, we think these promising trends provide important support for growth.

Earnings and Valuations

Corporate earnings are poised to slow after a spectacular 2018. US companies posted earnings growth of about 25% last year, according to S&P. Earnings growth is expected to drop significantly to below 10%. Yet with slower growth, we expect a wider dispersion of earnings, which provides fertile ground for investors to distinguish between winners and losers.

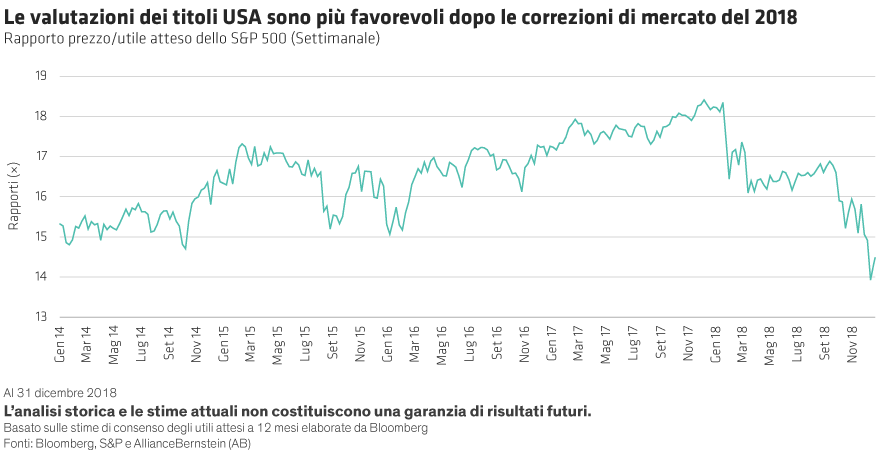

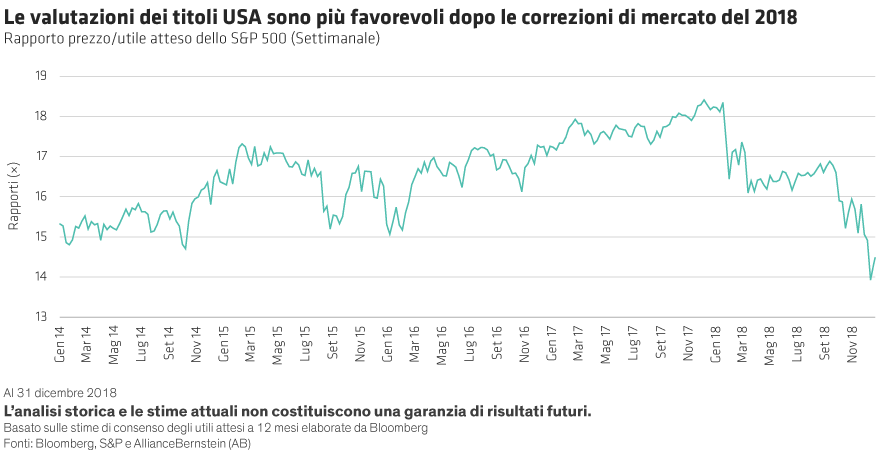

Stellar earnings growth combined with declining stock prices led to a severe contraction in the market’s price/forward earnings (P/FE) multiple. The S&P 500 traded at a relatively expensive 18 times expected earnings in early 2018 and started this year at about 14.5 times estimated 2019 earnings (Display). Stocks do look expensive based on other valuation metrics, such as price/sales and price/book value.

In historical perspective, the 2018 multiple contraction—the third worst since 1976—offers a ray of hope. Stocks have typically done well in the 12 months following a multiple contraction of at least 3 points. Of course, past performance doesn’t guarantee attractive returns this year. However, in our view, far more favorable valuations and continued earnings growth suggest that investors should be rewarded for 2019 earnings growth (and possibly even for strong earnings from 2018). This could be even more pronounced if the trade disputes are resolved and the Fed slows its rapid tightening pace, both of which are distinct possibilities.

In this complex environment, investors should sharpen their focus on several key attributes to find winning stocks in 2019, including:

- Pricing power—companies that are able to raise prices will have an advantage in maintaining earnings growth in this market. Companies that can’t raise prices will struggle to maintain earnings as wages rise.

- Low debt—corporate debt levels are near record highs and companies with stretched balance sheets may struggle to maintain earnings, especially if interest rates rise again. Companies with low leverage and high profitability are relatively resilient to the whims of market funding and should be able to reward shareholders with dividends or buybacks, even in a tougher market.

- Quality businesses—strong business franchises that generate free cash flow and top-line revenue growth are essential ingredients in a US equity portfolio today.

There’s a long list of challenges for US equity investors this year. Political risk and trade wars are a constant threat. Record high operating margins and low tax rates have flattered earnings, so a simple P/FE valuation is only a meaningful indicator if a company’s margins are firm. Efforts to impose a digital tax in the EU and rumblings of higher US corporate tax rates after 2020 require investors to take a critical look at the sustainability of record net margins.

Last year was frustrating for many investors as strong earnings growth was met with stock price declines and a significant P/FE multiple contraction. But we think this trend can’t continue indefinitely. Despite the risks, we think incremental earnings growth and relatively attractive valuations provide a solid backdrop for US equity investors in 2019, especially if some of the storm clouds driven by trade and Fed tightening dissipate. Selective investing in high-quality stocks seems to be the most prudent approach to prepare for the risks, while also positioning for a potential positive change in sentiment.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Copyright © AllianceBernstein