by Blaine Rollins, CFA, 361 Capital

Who has it easier? This climber or a Federal Reserve Board Member? After last week’s member talks and interviews, it would seem that the Fed Board has backed their Chairman Powell and will hold firmly on rates for now. Not only has the broad macro data gotten worse, but several new bits of micro data have also come up short. And then there is the lengthening government shutdown and the missed paychecks for 800,000 federal workers, combined with the lack of economic activity and ripple effects from all of those office closings. Someone did realize on Friday that all future mortgage closings would dry up if the IRS could no longer verify income levels, so there was a late night phone call to the U.S. Treasury asking to pay a small group of employees to go back to work.

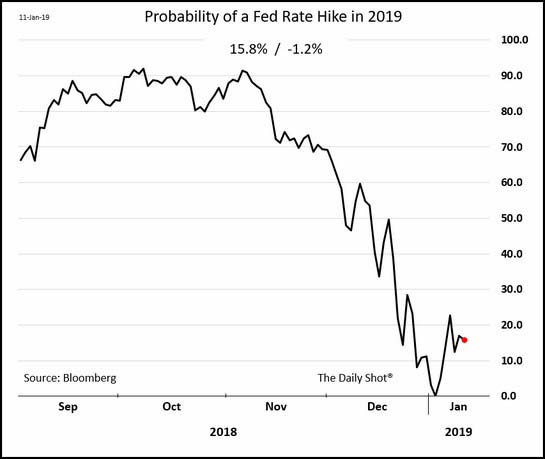

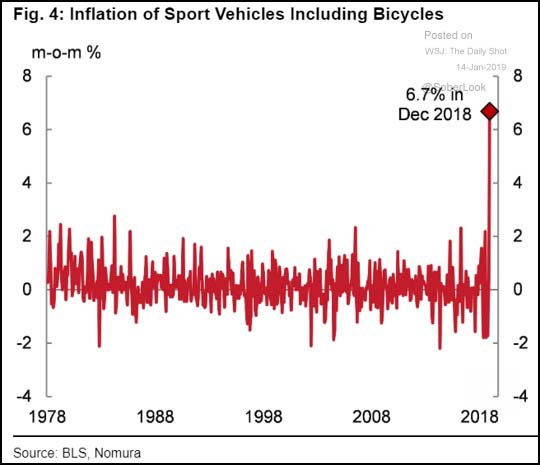

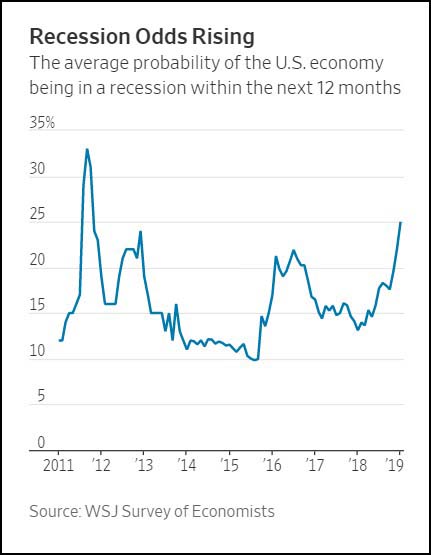

As recession odds continued to move higher, the Fed confirmed in many member talks last week that the most likely action on interest rates is hold. And, while there still is an active desire to shrink the balance sheet, this might also slow or pause if the economy loses its grip. So, we wait and watch while all new China data continues to show a major slowdown from which the rest of the world cannot escape. Sales updates from major retailers and airline companies are coming up shorter than they expected and the major California utility PG&E is going bankrupt which will only significantly increase power costs from anyone who buys from their production or grid.

So what comes next? Well, earnings season of course. Stocks are still lower going into the big 3-4 weeks of earnings reports but at least they are only 10% lower instead of 20% lower. Maybe still a good setup for those companies who can still crush it at the top and bottom line and give great forward guidance. But are there many of those companies in this current environment? I don’t think so. We will read the reports, listen to the calls and look for any good tidbits to follow up on so that we could add those stocks to our watch lists. The Government shutdown looks like it will last a while longer. The weekend polls shifted toward a Trump/GOP blame, but the numbers also show that a smaller crowd still supporting Trump have become more emboldened about wanting their Wall. This would imply that the main players in this game of tug of war will only dig in deeper. And if the shutdown cannot be solved, don’t expect anything else to get done either in the White House or Congress during the Q1.

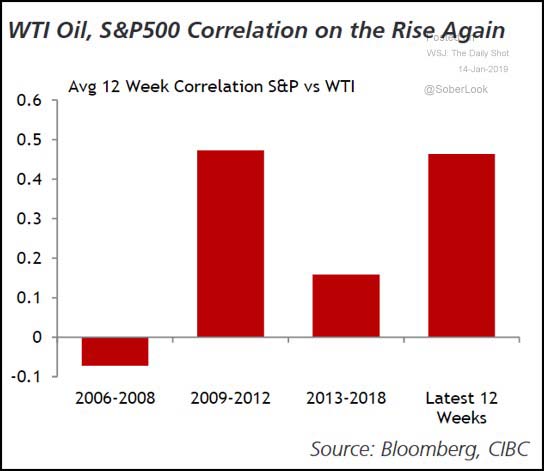

If you thought that Washington D.C. was paralyzed, you should see the year-to-date trading volumes in the financial markets. Sure the market has had a solid rip higher, but if it only happens on a fraction of its average volumes, does it still matter? Lots of good talk about this right now among the traders and investors. One thing that we know for certain is that the stock market is trading nearly one for one with the price of Oil. Go look at that correlation. Very high. So that is what I have for now; watching earnings, economic data and waiting for some better signs to get me to let go of these stacks of cash.

To receive this weekly briefing directly to your inbox, subscribe now.

China has caught an economic flu. The rest of the world is sure to be next…

(WSJ/DailyShot)

Sounds like the holiday shopping season was fine until the market melted, the government shutdown and the POTUS set a tweet record…

Macy’s Inc. and other mall-based retailers said sales petered out at the end of the year as they continued to lose customers to discounters and e-commerce, highlighting how not all chains are positioned to benefit from a strong U.S. economy.The year-end results—and a weak profit outlook from Macy’s—clouded what have been upbeat expectations for the holiday sales season with consumers showing a hearty willingness to spend.

The news Thursday spooked investors, who sent shares of Macy’s down nearly 18%, the department store’s worst one-day decline on record. Rival Kohl’s Corp. and mall stalwart L Brands Inc., the owner of Victoria’s Secret, also posted tepid holiday sales, triggering a broader selloff in retail stocks.

“The holiday season began strong—particularly during Black Friday and the following Cyber Week, but weakened in the mid-December period,” Macy’s Chief Executive Jeff Gennette said.

(WSJ)

Airline travel was also negatively impacted in December…

U.S. airlines are facing a darkened outlook as economic uncertainty threatens demand. American Airlines’ pared estimate for a key gauge of pricing power on Thursday followed a similar move by Delta Air Lines Inc. at the beginning of the year. And that was before accounting for a partial government shutdown in the country.

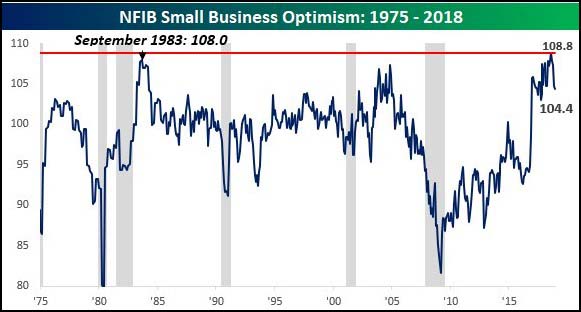

So it only makes sense that small business optimism went into a quick retreat…

@bespokeinvest: The NFIB’s 4-month decline through December was the largest since December 2012.

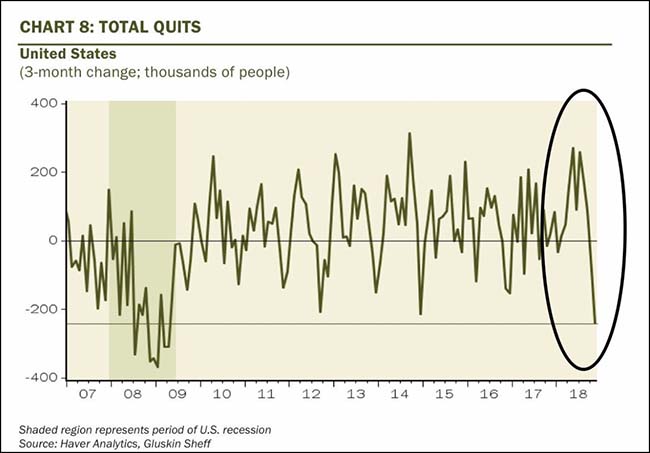

The shifting mood also affected the number of people quitting their jobs at year end…

More economists also had their models turn down…

On average, economists surveyed in the past week as part of The Wall Street Journal’s monthly poll said there was a 25% chance of a recession in the next year, the highest level since October 2011.

The probability was just 13% a year ago…Just over two-thirds of the economists said U.S. growth is somewhat or very exposed to a slowdown in other major economies such as China, Europe and Japan.

Forecasters are even more concerned about the outlook for 2020. More than half of the economists, 56.6%, said they expected a recession to start in 2020, a presidential election year, while another 26.4% of those surveyed expect a recession in 2021.

(WSJ)

Is the market leading the Fed now on rates?

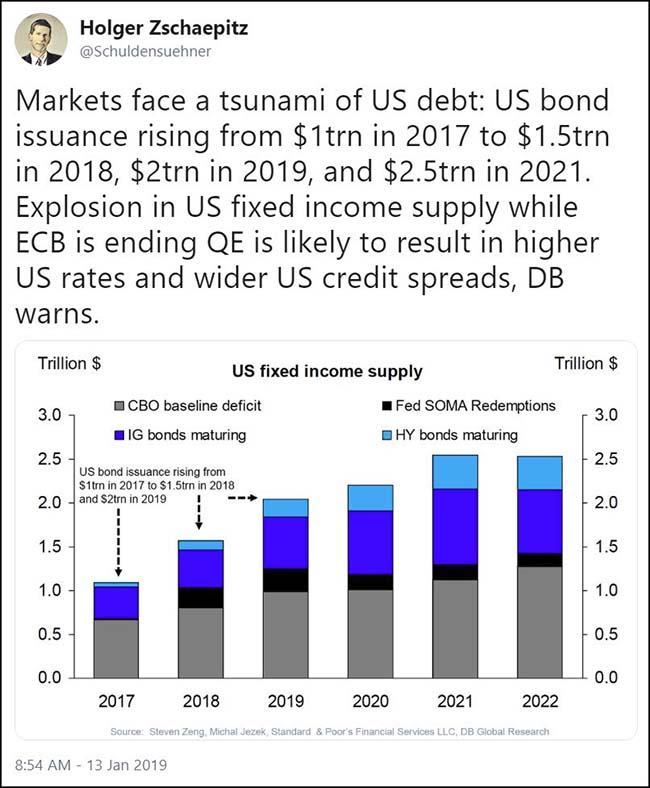

While the Fed may not raise the funds rate, here is how interest rates could still move higher in 2019-2020…

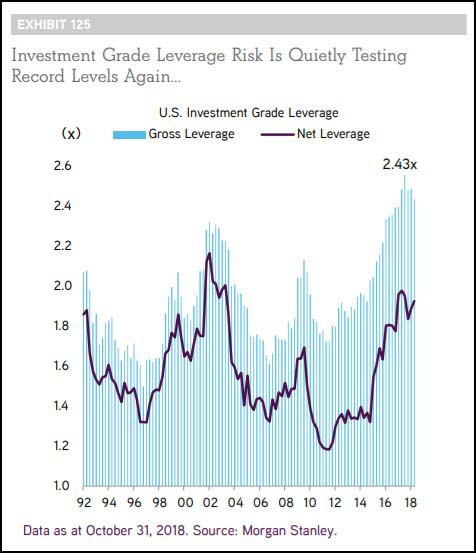

Jeffrey Gundlach had several good points on debt in the Barron’s roundtable…

The biggest risk is the corporate bond market. U.S. junk-bond issuance has been prolific, and the quality has been poor. Many issues have been floated with no covenants [legal agreements regarding issuer behavior]. The investment-grade corporate-bond market has also grown massive; it is much larger than it was going into the prior credit crisis. A Morgan Stanley research report suggests that, based on leverage ratios alone, 45% of investment-grade corporate bonds would be rated junk right now. The report further suggests that around 60% of corporate bonds currently rated BBB would be rated junk by the same leverage-ratio metric. That’s around $1 trillion of par value, or about 150% of the junk-bond market’s value.

There are problems with debt broadly. I keep hearing the president say that this is the strongest economy ever, which isn’t true. There was a bump up in second- and third-quarter gross domestic product, but the growth is debt-based. We have floated incremental debt when we should be doing the opposite if the economy is so strong. In fiscal 2018, we increased the national debt by $1.27 trillion. The deficit officially was nearly $800 billion. The difference is phony IOUs from the Social Security system and expenditures on purportedly one-off military operations and natural-disaster relief. U.S. GDP is $20.66 trillion, so a $1.3 trillion increase in the national debt is 6% of GDP.

In addition, the Federal Reserve has engaged in quantitative tightening, or shrinking its balance sheet, to the tune of $50 billion per month. We are talking about the creation of an ocean of debt, while the Fed has raised rates nine times in the current cycle, in addition to quantitative tightening, which, according to some studies, equates to about two more rate hikes. The Fed wants to raise rates two more times this year, based on its dot plot [individual rate projections by the members of its policy-setting committee]. This is a problem for the stock market. U.S. manufacturing data has deteriorated. Mortgage applications are near an 18-year low.

(Barrons)

Risk is bubbling among high grade corporate debt borrowers…

(KKR)

I agree with Morgan Stanley on this observation…

“From an equity perspective, we think a retest of the December lows driven by more earnings and economic data disappointments would seal the deal on our earnings recession call. We are equity strategists, not economists, and we’ve said all along that an earnings recession amounts to the same thing as an economic one for investors.”

(Morgan Stanley)

One thing that you won’t be able to spend Cash on this month: IPOs..

The partial closure of the Securities and Exchange Commission is forcing companies that were seeking to list shares in January to push back their plans, according to bankers and lawyers. They include biotechnology firms Gossamer Bio Inc., Alector Inc. and Blackstone Group LP’s Alight Solutions LLC.It now looks likely that no major company will tap the U.S. IPO market this month. Since 1995, there have been just three years that had a new-issue drought in January, according to Dealogic data. That happened as a result of choppy markets in 2003, 2009 and 2016, which went on to be some of the weakest years for initial public offerings on record, the data show.

As part of the shutdown, currently the second-longest on record, the SEC has furloughed thousands of employees and stopped reviewing and approving all new and pending corporate registration statements, including proposed IPO filings, according to the agency’s shutdown plan and other notices on its website. Dozens of SEC accountants and lawyers who review IPO paperwork are prohibited from reading email or calling deal lawyers seeking to discuss complex disclosure questions.

(WSJ)

Want to see volatility during a market crash?

Look at the below string of swings. Just crazy! By comparison, we have had a pullback of -19.9% followed by a pop of +10.8%.

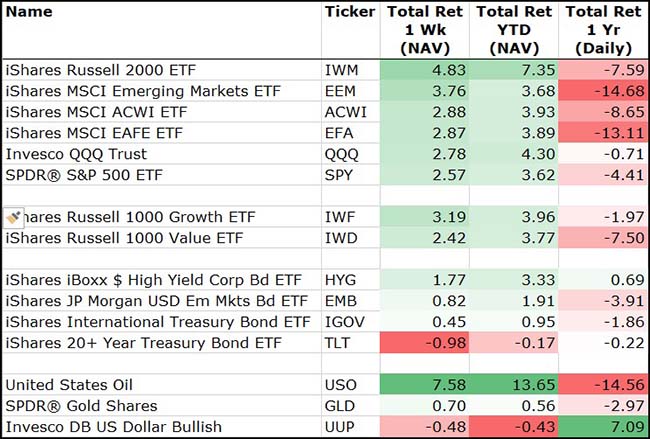

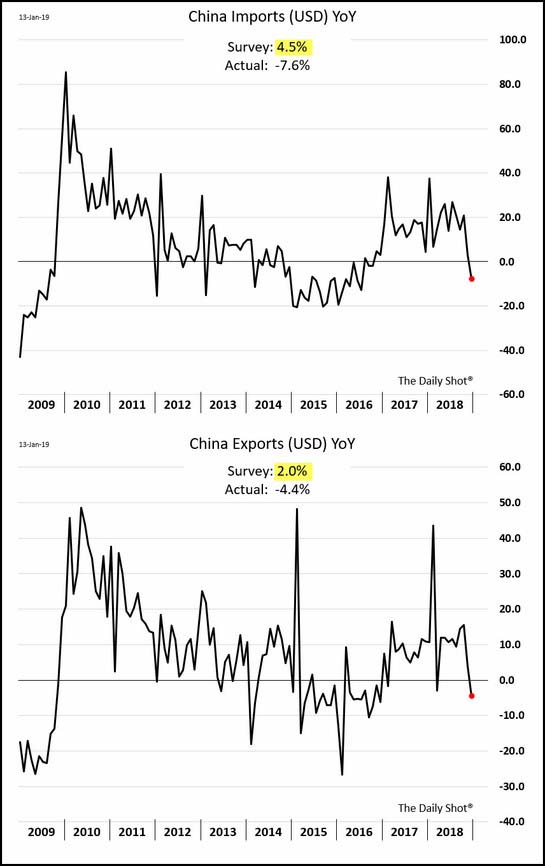

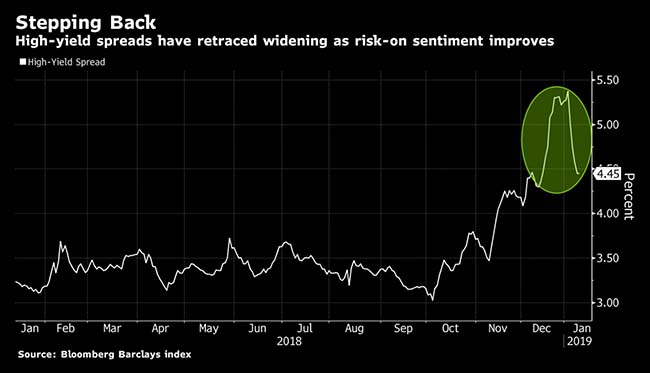

It was a great week among risky assets for the week…

Small Caps and Emerging Market stocks led gainers. Junk Bonds continued to bounce. And Oil led the way all week.

To receive this weekly briefing directly to your inbox, subscribe now.

The markets have recently been trading turn for turn with oil…

This chart shows only the 3-month correlation but since Christmas Eve, the figure is closer to 0.8.

(WSJ)

And finally, a new Junk Bond deal!

Targa Resources Corp. on Thursday ended the drought in the high-yield market in stunning fashion, drawing in enough demand to double the size of its offering to $1.5 billion. Anheuser-Busch InBev NV drew in orders quadruple the amount it initially sought to borrow, allowing the world’s largest beer brewer to up the size of its offering to $15.5 billion. Leveraged loan prices have rebounded and returns have soared, giving way to a $4.5 billion week of new supply.That’s a stark contrast to as recently as last week, when units of companies like Ford Motor Co. and Duke Energy Corp. had to pay higher risk premiums and received little demand for their offerings. Better sentiment this week allowed investment-grade companies to borrow $45 billion, and the good vibes are already shaping up to flow into next week, when a unit of Twenty-First Century Fox Inc. is expected to bring a multi-billion dollar deal related to its acquisition by Walt Disney Co.

Among stock sectors, Biotech led the surge last week due to some M&A and a busy J.P. Morgan Healthcare conference…

Utility stocks will have a rough week due to the PG&E Corp bankruptcy…

Hopefully no one you know has some legacy shares of the old Utility sitting in their conservative income producing account.

Even the meltdown in the bonds is amazing for a leading major Utility…

@lisaabramowicz1: The magnitude of the move in PG&E bonds is striking. The Californian utility is a special case on many fronts, but I wonder how many other special cases will emerge after a decade of loose lending conditions.

And let the earnings season begin!

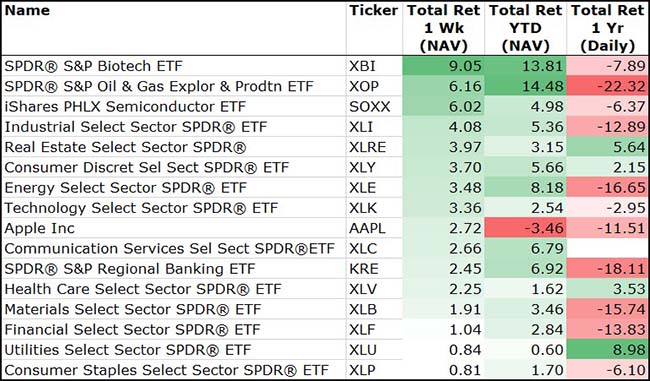

Watch global trade tariffs hurt bike shops…

Your local bike store doesn’t make much margin selling bikes but they do well selling the accessories for your newly bought bike as well as clothing and helmets. So if the cost of new bikes is not getting people into the store, then your local bike shop is going to get hurt. Go get your bike serviced this week and help out your local store because they do not have a high priced lobbyist in Washington D.C.

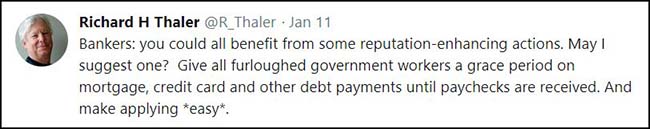

Banks were given gift by the U.S. Treasury over the weekend…

So maybe they should pay it forward and help out those Government workers missing paychecks…

I think the U.K. has found it’s new leader…

If only the Remainers would have found her before the Brexit vote, they wouldn’t now be fighting over how to return to the Dark Age.

Golf courses are now a liability to homeowners as the ancient Scottish past time fails to attract younger players…

Forty years after developers started blanketing the Sunbelt with housing developments built around golf, many courses are closing amid a decline in golf participation, leaving homeowners to grapple with the consequences. People often believe a course will bolster their property values. But many are discovering the opposite can now be true—and legal disputes are erupting as communities fight over how to handle the struggling courses…

More than 200 golf courses closed in 2017 across the country, while only about 15 new ones opened, according to the National Golf Foundation, a golf market-research provider. Florida-based development consultant Blake Plumley said he gets about seven phone calls every week seeking advice about struggling courses, from course owners or homeowners’ associations. He said most of those matters end up in court, and predicted that the U.S. is only about halfway through the number of golf-course closures that will eventually occur.

When a course closes, prices for nearby homes typically fall about 25%, Mr. Plumley said. Prices can plummet 40% or 50% if a contentious legal battle arises, as potential home buyers balk at the uncertainty accompanying litigation.

(WSJ)

Copyright © 361 Capital